Trending Assets

Top investors this month

Trending Assets

Top investors this month

5 Ways Buffet Looks for Moats

Interest rates. Inflation. Recession.

Moats matter more now than ever.

If you invest, you MUST know how to identify them.

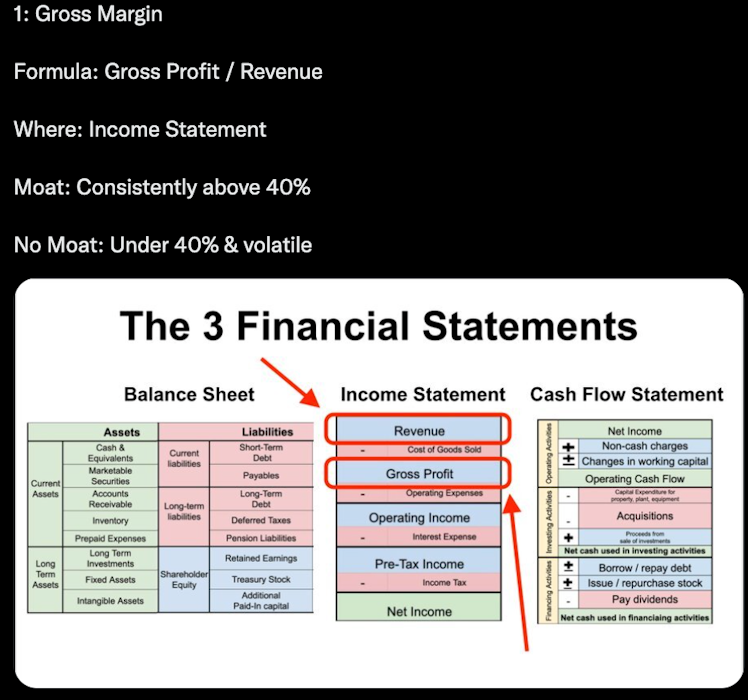

Here are 5 financial “rules of thumb” that Warren Buffett uses to tell if a company has one

Buffett’s logic:

A consistently high gross margin signals that the company isn’t competing exclusively on price.

A high gross margin also provides ample gross profit to pay all expenses and still leaves money for shareholders.

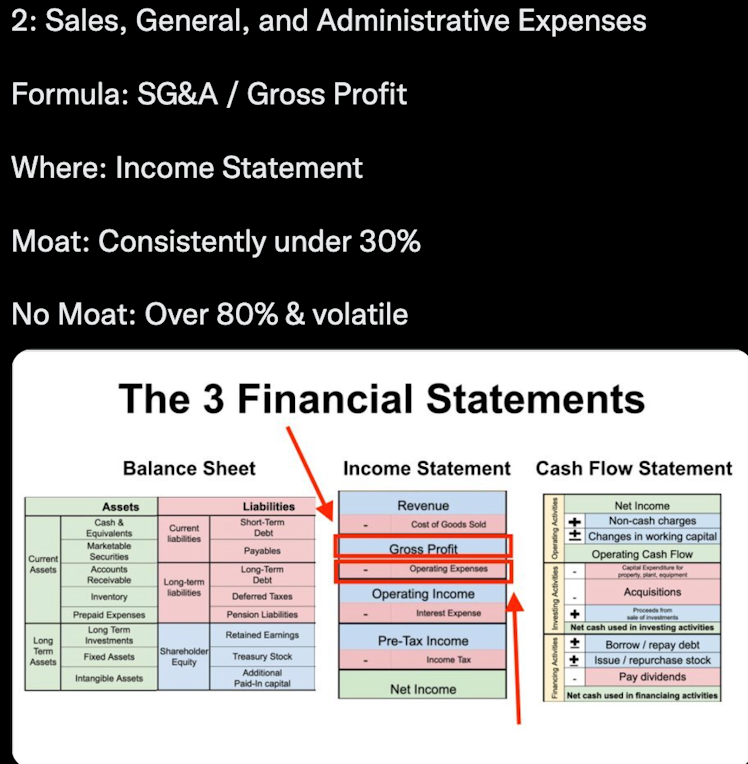

Buffett’s logic:

Wide moat companies don’t need to spend big on overhead to operate. Businesses without moats do.

Buffett looks for companies that consistently spend under 30% of their gross profit on SG&A.

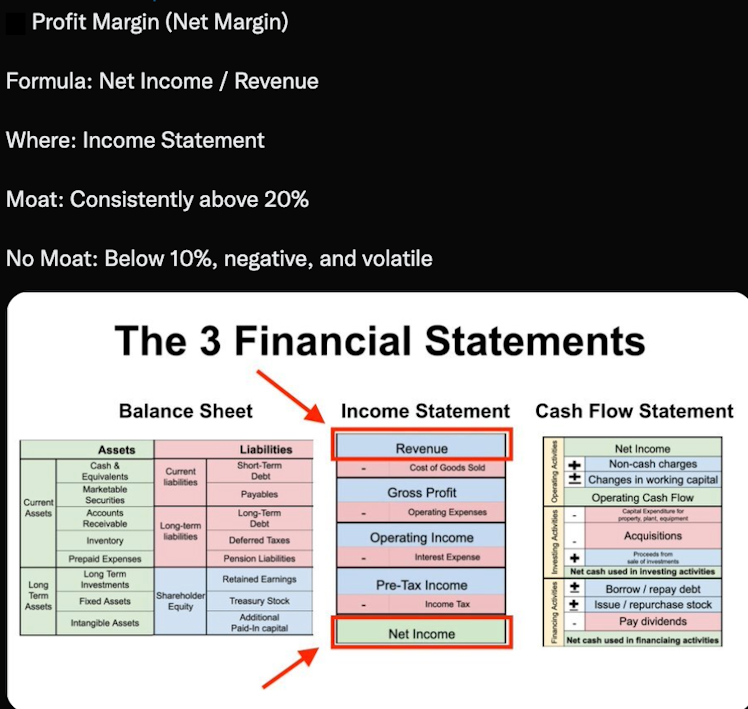

Buffett’s logic:

Companies that consistently convert 20% of their revenue into net income likely have a moat.

If this number is under 10%, negative, or volatile, the competition is likely fierce.

(There’s tons of nuance between 10% and 20%)

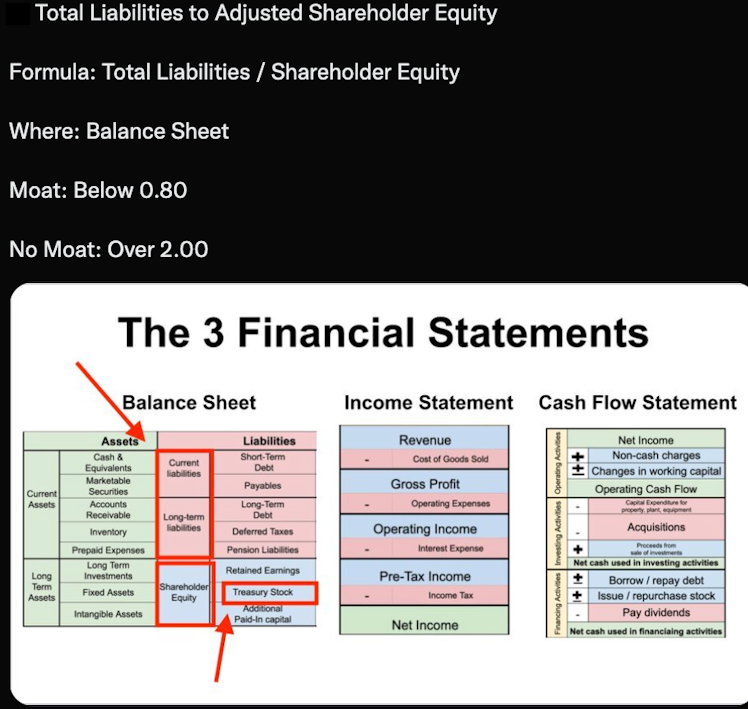

Buffett’s logic:

Wide moat businesses finance themselves with profits, not debt.

However, stock buybacks can throw off this equation. Adjust for this by adding back any treasury stock to the shareholder equity number.

Buffett’s logic:

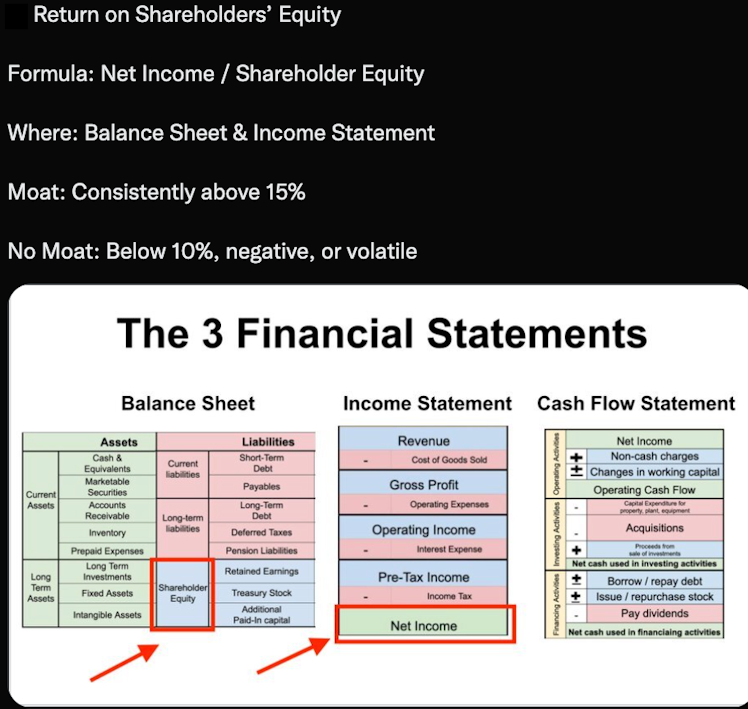

Return on equity shows how effectively management is reinvesting its profits. A number consistently over 15% indicates that the business has a moat.

Under 10%, negative, or volatile indicates that the business is struggling with the competition.

There are important caveats too ALL of these

Learning to read financial statements is an INCREDIBLY important skill for investors, managers, and business owners to master

Want help? @brianferoldi and I teach a live course that gets rookies up to speed, FAST

Interested? DM me for a coupon code for the BIGGEST discount we have left between now and the course: https://maven.com/brian-feroldi/financials

maven.com

Financial Statements Explained Simply by Brian Feroldi and Brian Stoffel on Maven

From Rookie to Pro in 6 Lessons.

Already have an account?