Making 1,000% on a stock in 10 years is no small feat.

And yet, Dede Eyesan identified 446 of them in his 2012-2022 study.

Here are 4 surprising lessons you can instantly use to find your next 10-bagger

--

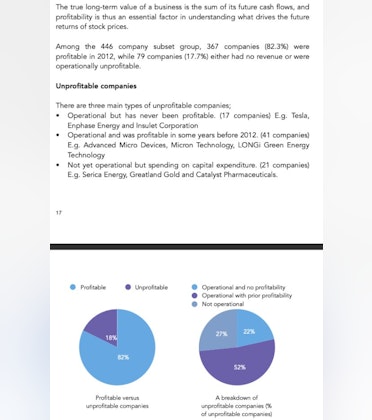

Between 2012-2022 the study showed that 82% of companies that went 10x were profitable in 2012.

You can look at this in two different ways:

- You can still profit greatly by buying unprofitable businesses

- You just stick with what you know works best

I personally like option 2.

As I've discussed before I want businesses in that I have a high degree of certainty.

Part of this certainty comes when I know the business has solved the profitability puzzle.

If that puzzle is fuzzy, it's an instant pass.

I'm not smart enough to forecast when an unprofitable business will turn positive.

So I stick with what I think is easier to understand.

Now that we understand how profitability plays into value, let's attack a different angle, multiple expansion.

--

"50% of the outperformers had an EV/Revenue <1x and 49% had an EV/EBIT <10x in 2012."

This means that half of these companies were dirt cheap at the beginning of the study.

Then through a mixture of earnings growth and multiple expansion, they outperformed.

This is an important fact for all to remember next time you're thinking of pulling the trigger on some high-revenue multiple businesses.

I personally have never evaluated a business by revenue multiples.

If the business is expensive, how would we get a 10-bagger?

Growth!

--

"31% of the 446 companies compounded their earnings by 27% over the 10 yrs. All their 1000% may have come from earning growth alone."

This is insane to me.

A business growing at 27% for 10 years can have a constant valuation and still get you a 1,000% return!

I wonder how many MBAs factored in 10 years of 27% returns into their DCA models?

Probably "0"

High earnings growth for 10 years may enable you to pay a high price and still make great returns.

But what size of business are we looking for in order to get a 1,000% upside?

--

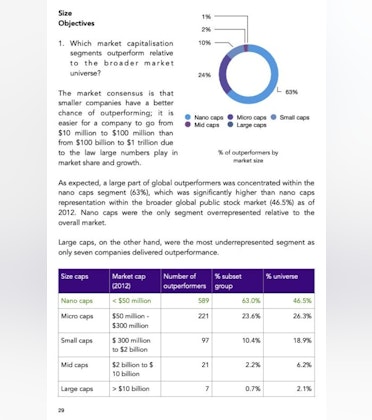

As you might have guessed, smaller companies occupy a massive majority of the 10x club.

Businesses with a 2012 market cap of under $300 million made up 86.6%of these quick 10-baggers.

Nano caps, which are stocks under $50 million in the market cap made up 63%.

So if you are going for large multi-baggers you should mostly skip the large caps (>$10 billion market caps) that made up .07% of the subset group.

When businesses grow, growth generally becomes harder.

I don't think going for 1,000% returns should be a goal. It can be an outcome that you accept, but not something sought after. Will lead to unwise decisions