Trending Assets

Top investors this month

Trending Assets

Top investors this month

In 1972 Thomas Phelps wrote "100 To 1 In The Stock Market" where he wrote:

"Dividends are an expensive luxury for investors seeking maximum growth."

If you are looking for stocks that can 100x here is what you MUST understand about dividends and retained earnings.

--

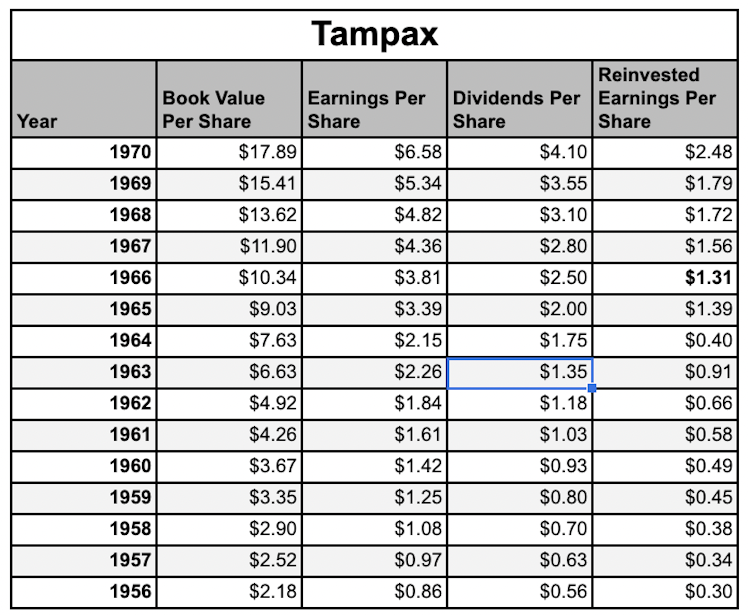

Critical assumptions we are making:

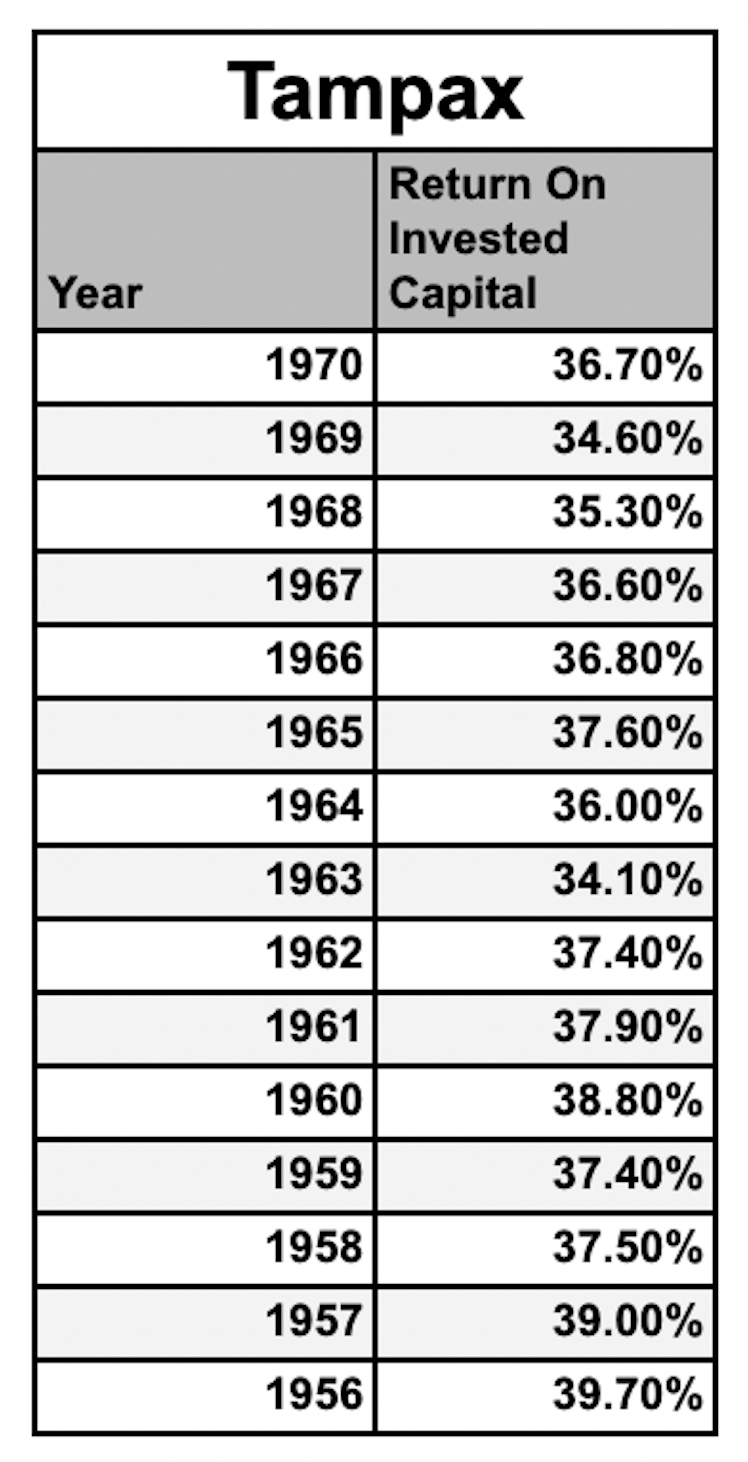

- Returns on Invested Capital (ROIC) remain above 34.1%

- The business had a place to allocate this money at these high ROIC rates

- Dividend payout ratio of 65%

Here are the numbers it generated IRL.

Very impressive book value and earnings growth.

In 1956 Tampax traded between 11-13.5x earnings

By 1970 this business was trading at a high of 50x earnings

This means you could have compounded your investment at 27.7% CAGR for the entire holding period!

Incredible results.

But...

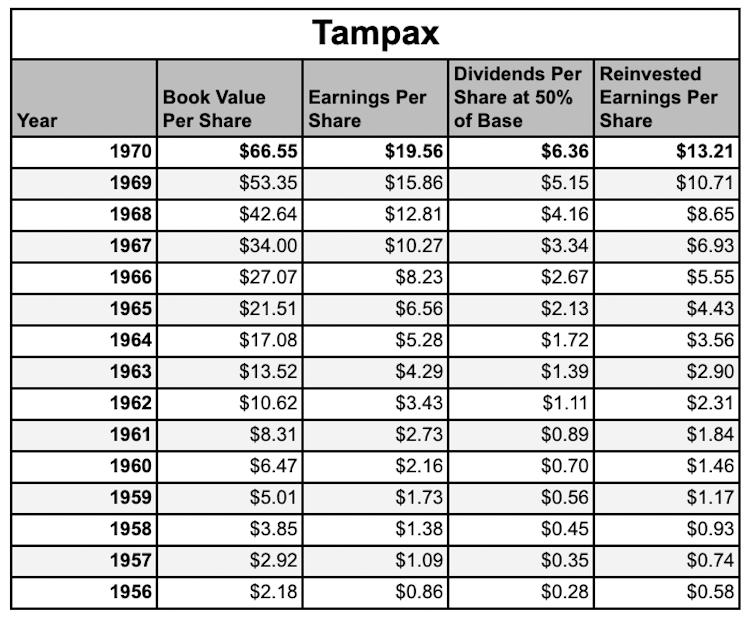

What if the business could have reduced dividends in half and increased its retained earnings?

We assume they could keep their returns on invested capital at the same rates, their dividend ratio is cut in half, and the money then goes into retained earnings. In that case, you see a monster increase in book value and earnings per share in 1970.

The crazy part is, even when you reduce the payout ratio in scenario B, because earnings rise so much quicker, you end up with higher dividends than in scenario A.

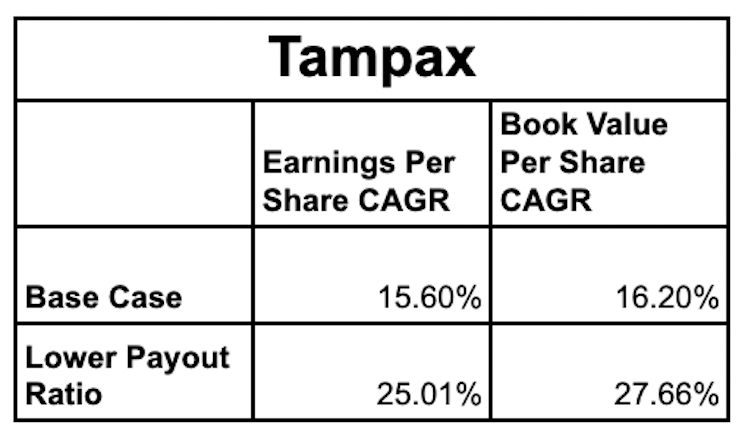

Here are the different results for EPS and Book Value Per Share Growth for each scenario.

Stark difference.

If the business decided to reduce its payout ratio in half and divert that money to retained earnings it would have had an EPS in 1970 of $19.56.

If we apply the same 50x multiple the market was willing to pay at the time, you would get $1,009.27. This gives you a 37.6% CAGR. Simply cutting the dividend would've provided 2.8x value!

When you are looking at a business's capital allocation skills, have a look at the opportunity cost of paying a dividend.

It may be costing you more than you think!

Already have an account?