Trending Assets

Top investors this month

Trending Assets

Top investors this month

6 Reasons Warren Buffett Bought Apple In 2016

Warren Buffet's Apple investment has made Berkshire shareholders $90 billion since 2016.

Learn the 6 reasons behind his decision and how you can apply them to find your next winning investment.

Brand

"Apple has an extraordinary consumer franchise. It's probably the best consumer franchise in the world." - Warren Buffett

Buffett learned about the strength of a brand See's Candy and Coca-Cola.

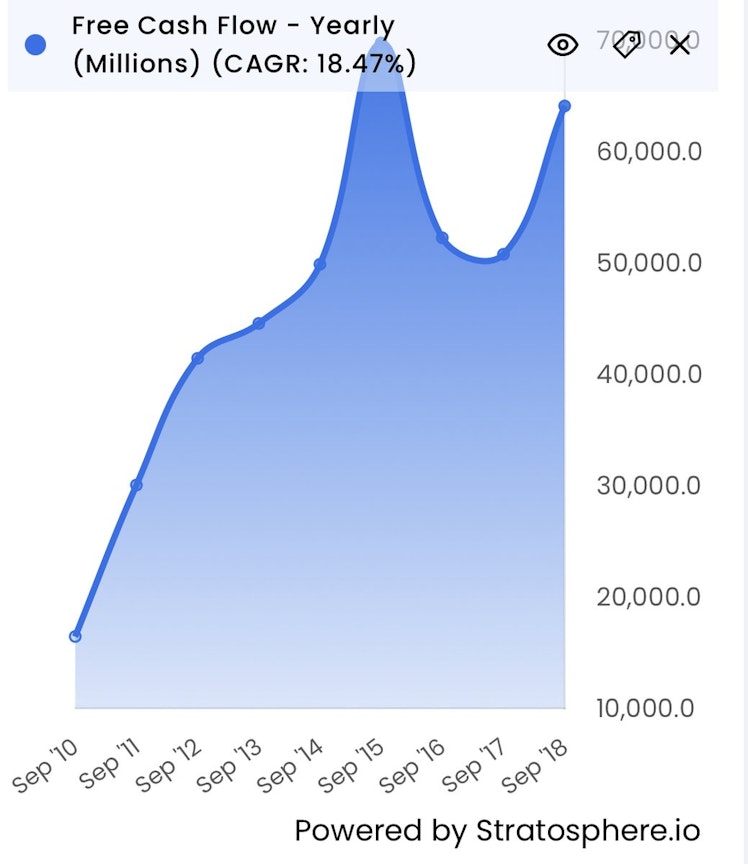

Free Cash Flow Generative

Warren loves businesses that are gushing cash.

Apple fit the bill to a T.

Between 2010-2018 Apple compounded free cash flow at 18.5%

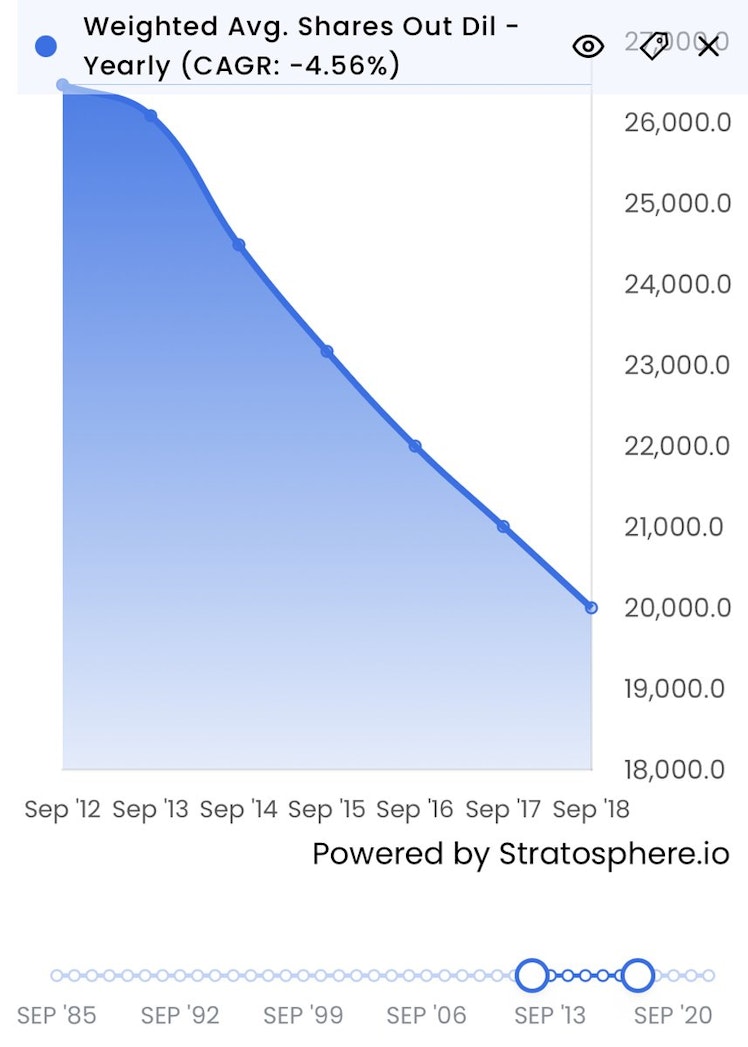

Intelligent Share Repurchases

"I think buybacks are great when you're buying at a price that's well below intrinsic value."

He saw that Apple was buying back a meaningful amount of shares at good prices.

He knew that this would continue and increase the value of his shares.

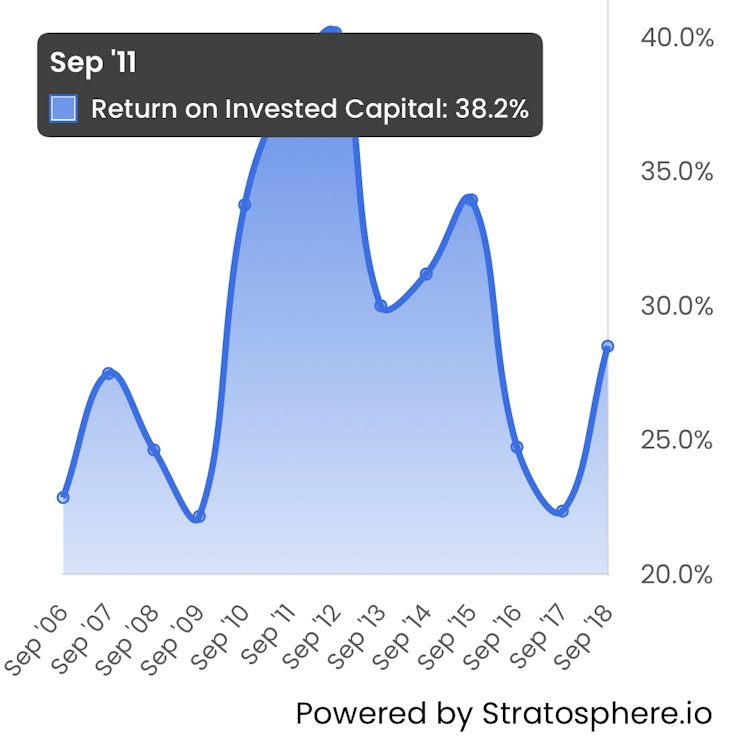

Great Management

Buffett knew that Tim Cook was

• A wonderful manager

• Highly talented

• Full of integrity

He could see all this was creating shareholder value, as returns on capital were consistently very high.

He also could see that these high levels were sustainable.

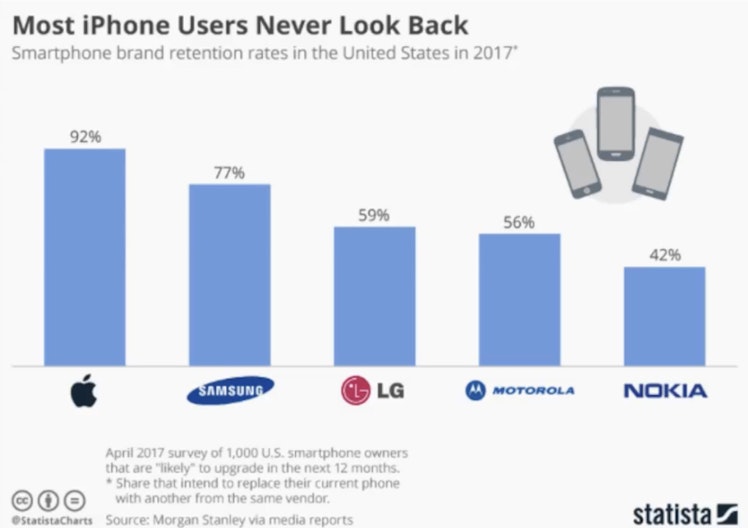

An Attractive Services Segment

Buffett knew that iPhone users didn't leave the Apple ecosystem once they entered.

Apple could leverage this by offering an increasing amount of paid services to its loyal customer base.

This was a segment that still carried a long runway.

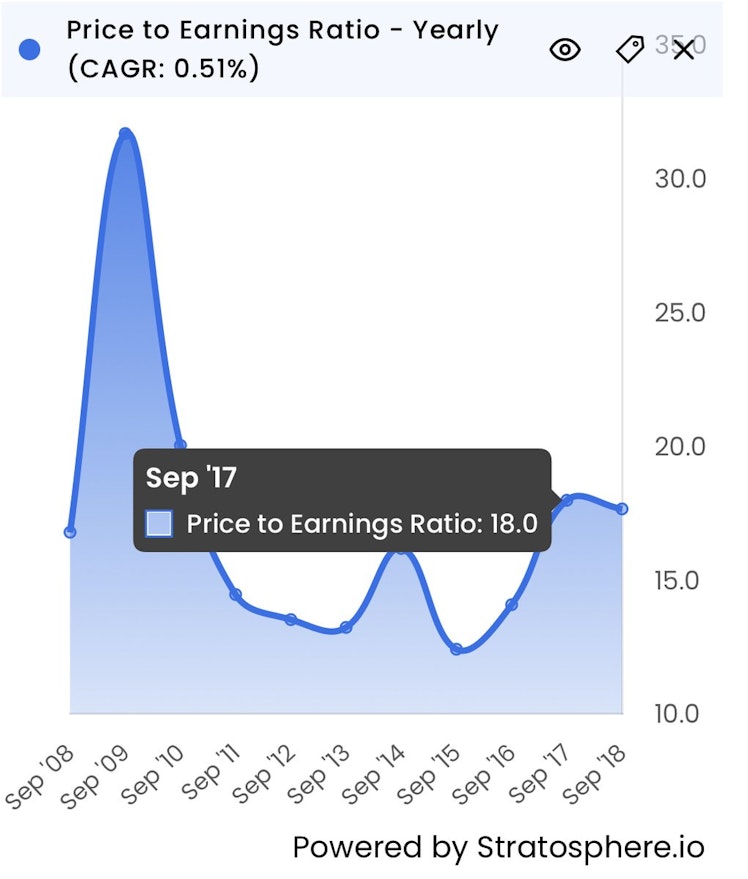

A Fair Price

Buffett tries his best never to overpay for a business.

In Apple's case, he paid ~16-18 times earnings.

Not cheap, but given the quality of the business, he had high certainty, he'd be able to generate a solid return.

Want to stay ahead of the game and discover hidden gems in the stock market?

Join my Substack for an in-depth analysis of:

• Under-followed stocks

• The power of long-term thinking

• Detailed analysis of wonderful businesses.

Already have an account?