Trending Assets

Top investors this month

Trending Assets

Top investors this month

2022 - A Year in Review

2022 has been a very challenging year as an investor. I was hit with the double whammy of a tumultuous market and inability to maintain regular contributions. Life happened - continuing to adjust to a new house, new job(s), new city as well as a rising inflationary environment affected our ability to contribute.

Although I did not achieve some of my goals for 2022, there are many takeaways from this year:

- If I can manage this level of volatility and be unaffected, I will be set up to be a long term buy and hold investor

- Maintaining a process to guide through difficult times is essential

- Setting less-specific goals to help with mental blocks when goals aren's being reached

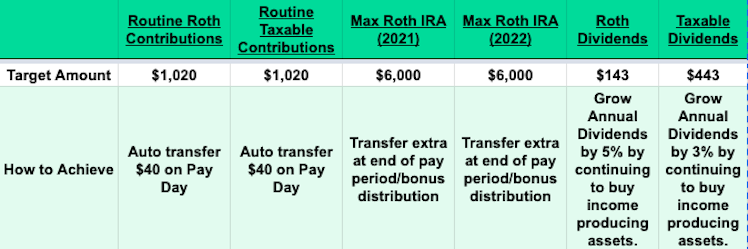

Now for the investing-specific goals I set for myself in 2022:

Progress:

Routine Roth Contributions: 2/26 ❌

Routine Taxable Contributions: 2/26 ❌

2021 Max: $2,180 ❌

2022 Max: $50 ❌

Roth Dividends: $157.54 (through November) ✅

Taxable Dividends: $389.85 (through November). Will reach target with confirmed December dividends ✅

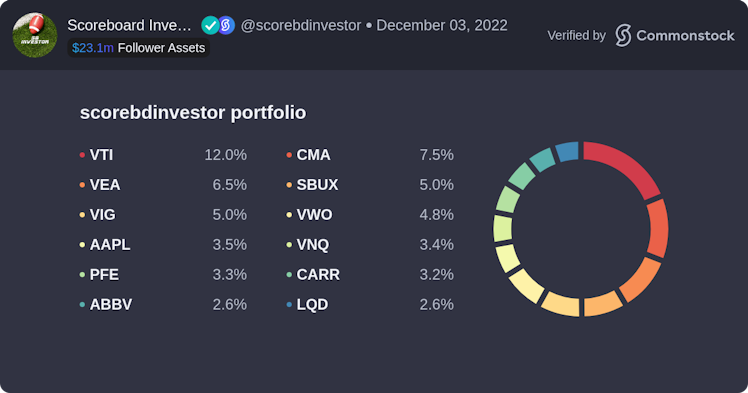

Portfolio Changes:

Below is my current verified portfolio mix and a comparison to my portfolio allocation compared to my January Portfolio Reviews:

Taxable Top 5

December 2022

Roth IRA Top 5

December 2022:

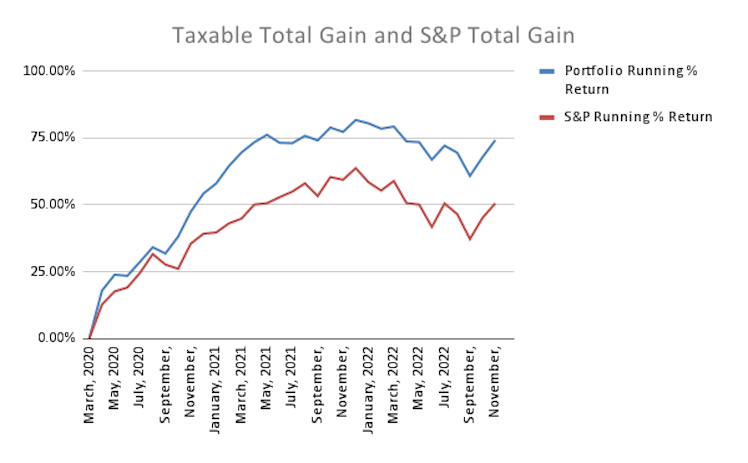

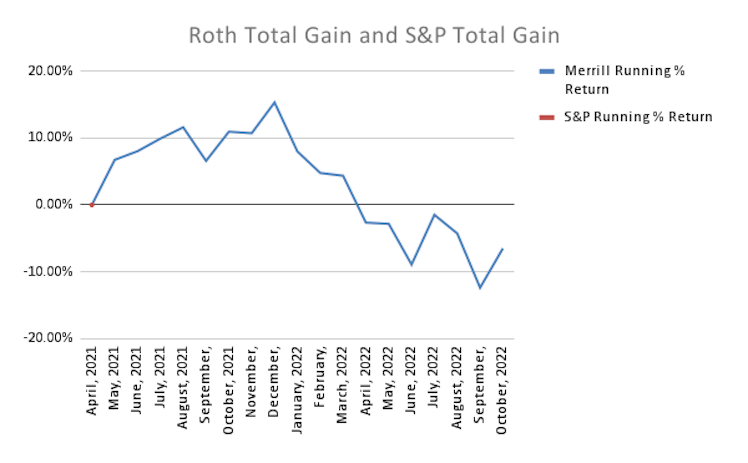

Finally, I want to review my portfolio performance vs my benchmark of the S&P 500:

Taxable (YTD): -7.5% ✅

S&P 500 (YTD): -18.6%

Roth IRA (YTD): -13.7% ✅

S&P 500 (YTD): -18.6% (Had issues getting my S&P trend to plot)

Overall, this has definitely been a challenging year. My portfolios are down and the markets are down. However, I am down less than the market. I am thankful to have my dividend income that has allowed me to continue to add to positions, even when I am unable to contribute new funds.

Looking forward to 2023, I want to continue to follow my Scorecard process, collect dividends, and contribute as I can to continue to grow these two portfolios.

As always, would love to see your thoughts, comments and questions below!

Already have an account?