Trending Assets

Top investors this month

Trending Assets

Top investors this month

December & January Portfolio Catch-Up

If I'm consistently inconsistent with posting my monthly portfolio updates, that makes me consistent, right?

I'll make up for my supreme tardiness this time with a bonus; a screenshot of my Tastyworks options account that unfortunately doesn't link properly to Commonstock.

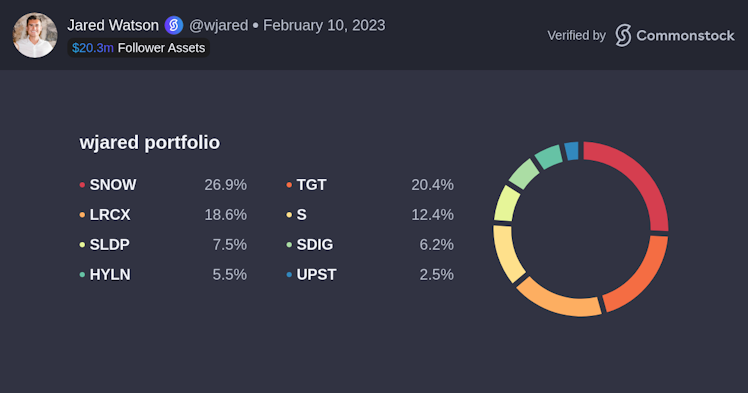

But first, let's cover the equities portfolio. Minor moves the last two months, primarily reflected in my shared trades. I sold out of $RIVN for the time being, which I'm comfortable with since despite being confident in the company's long-term outlook, I also recognize that they are burning cash and have catalysts that are likely years out.

I also trimmed $SNOW, freeing up a decent amount of capital.

I utilized this free capital to double down on $SLDP, a company that I've covered extensively in previous posts. I believe that Solid Power is criminally underrated at this valuation - with recent positive news like an expanded partnership with BMW and winning a DOE grant, and catalysts in the horizon such as a new CEO and positive A-sample feedback.

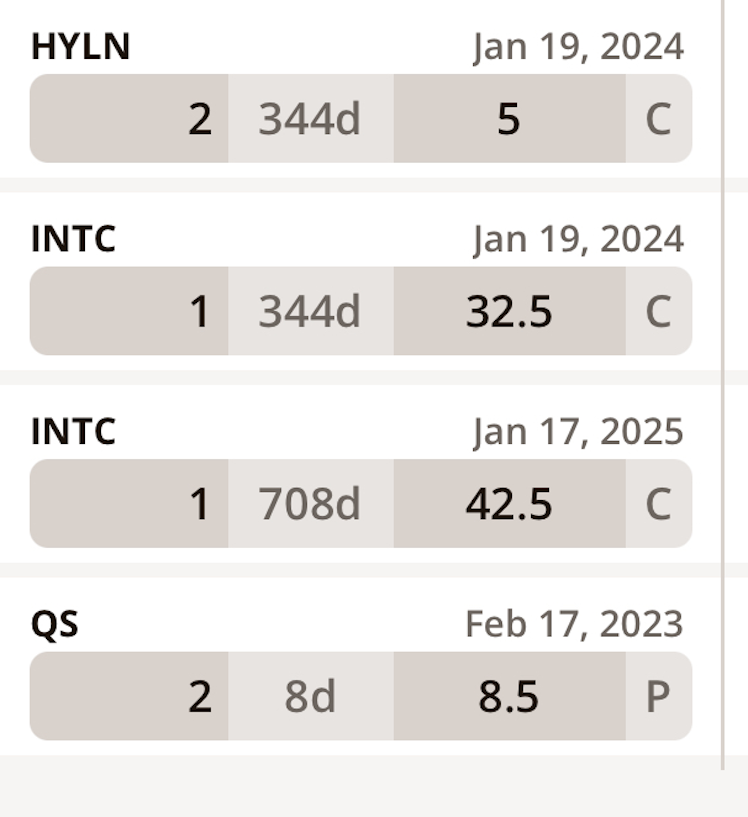

Now we can get to my options positions, all of which I have opened in the last two weeks. It's been a while since I've actively traded options. Circa 2018 I was doing a lot of vertical spreads, iron condors, and covered calls (i.e. defined risk positions). I guess I'm feeling frisky.

I'm long $HYLN with almost 365 DTE on the two contracts in the portfolio. I've held $HYLN for a while, and this is the year of catalysts for the company, the upside of which I don't think the market is recognizing. Hyliion will complete fleet trials, and then start delivering and recognizing revenue for their product that I believe to be game-changing, the Hypertruck ERX.

I'm also long $INTC with expirations in 2024 and 2025. I intimately follow most of the semiconductor industry, and with my current knowledge I believe that (1) sentiment around Intel has bottomed after a negative, but entirely expected earnings report (2) inventories will start to clear out around the end of the CY, enabling a more robust consumer environment for compute (3) the company has an opportunity to reach server CPU performance parity in 2024 with Sierra Forest and Granite Rapids (4) there are ample opportunities for unforeseen catalysts with IDM 2.0 as Intel continues to build out their foundry customer pipeline.

Last, and probably least, I'm short $QS again. I had some extra money in the account and since I'm notoriously a QuantumScape bear, I thought it would be a good opportunity to hedge my delta a bit in the short-term.

Long post, but thanks for reading! Let me know if you have questions about my approach, positions, or anything else that catches your eye.

Already have an account?