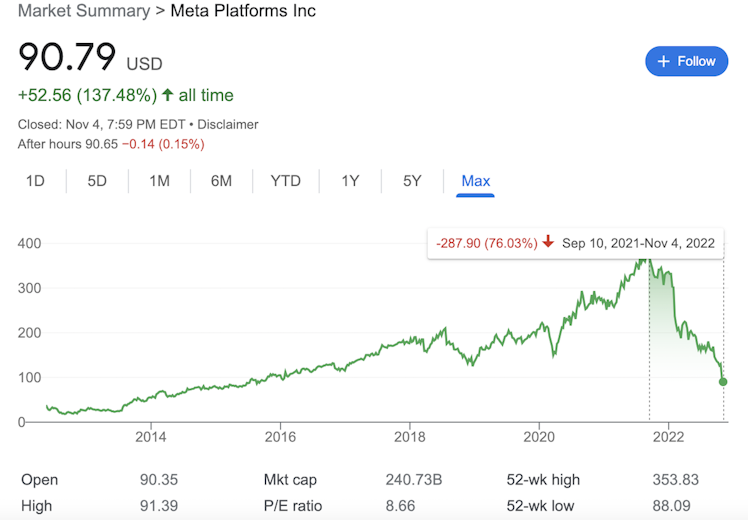

$META is down to 2015 levels. 7 Years of returns lost for long-term shareholders.

Since 2015:

- Revenue ⬆6.7x

- Earnings ⬆9.2x

- Free Cash Flows ⬆6x

- Book value ⬆2.92x

A return to fall 2021 highs from today's prices for $META would be a 4-bagger. That's absolutely nothing to sneeze at. But today's Meta isn't 2015 Meta and that--yes, impressive and admirable--growth in earnings, FCF, book value is in the rearview mirror. At this point in Meta's transformation, this looks to me more like a speculative investment. I'm not against speculative investments. I ask myself, anchoring to the recent 2021 highs for the sake of this thought exercise: is a 4-bagger a good-enough return for a speculative investment? Finally, when I'm looking at speculative investments with major upside potential, I'm often fishing in the sub-$1B market cap range. Yet after a fall of more than 75% from that fall 2021 high, this is STILL a $241B company.