Trending Assets

Top investors this month

Trending Assets

Top investors this month

@finiche

FiNiche

$998.1k follower assets

163 following581 followers

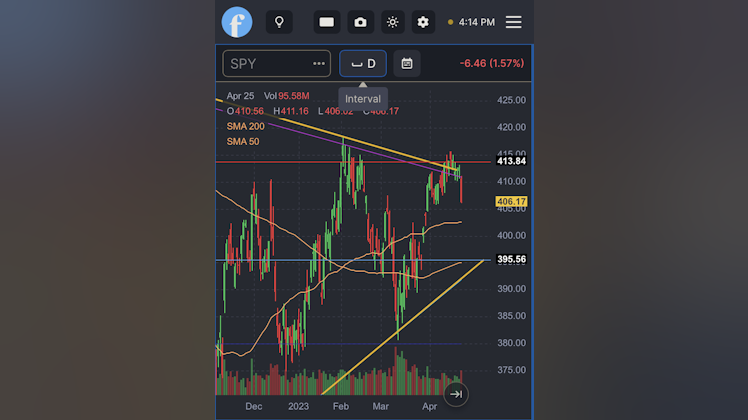

$SPY slips on Fed speak

finiche.substack.com

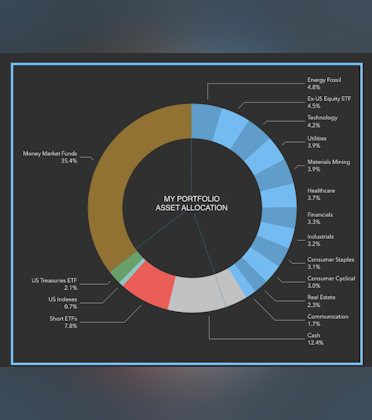

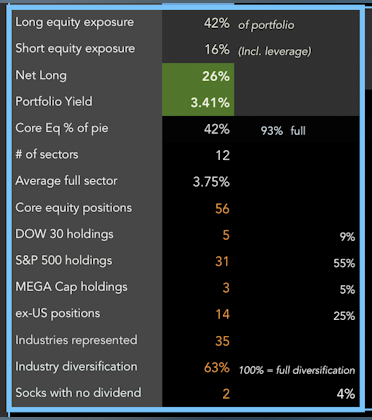

The Big Portfolio Refresh, May 2023

Updating my portfolio holdings, market outlook

From today's Big Portfolio Refresh

finiche.substack.com

The Big Portfolio Refresh, May 2023

Updating my portfolio holdings, market outlook

Portfolio Holdings and Market Outlook

substack.com

The Big Portfolio Refresh, May 2023

Updating my portfolio holdings, market outlook

$SPY and FOMC

finiche.substack.com

FiNiche Investments | Substack

For the DIY investor, a guide to stock portfolio construction and active portfolio management. I openly share my portfolio details and stock market outlook. Subscribe for FREE. Click to read FiNiche Investments, a Substack publication with hundreds of subscribers.

Watchlist

Something went wrong while loading your statistics.

Please try again later.

Please try again later.

Already have an account?