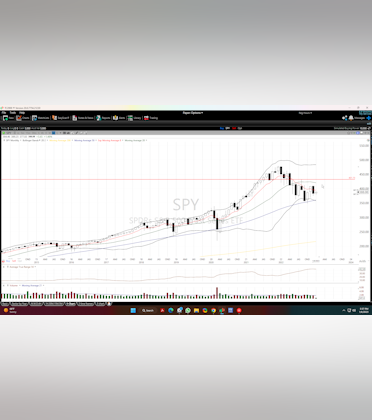

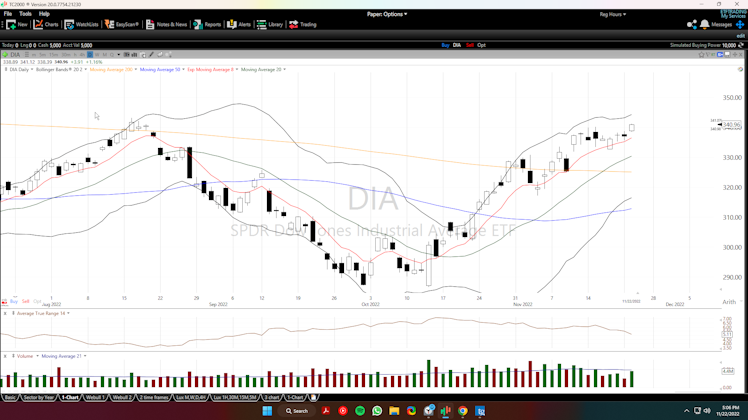

There's a nice short-term uptrend with the S&P 500 index now trading strongly above the 50-Day simple moving average.

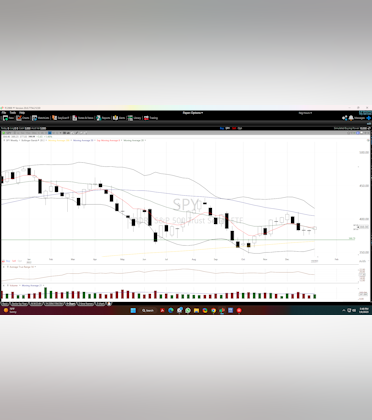

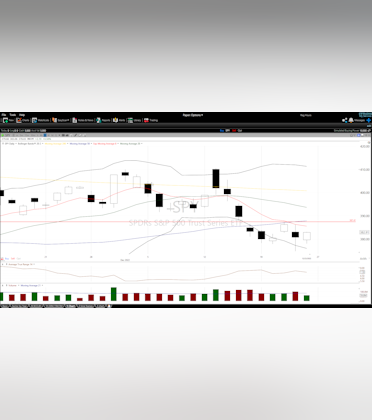

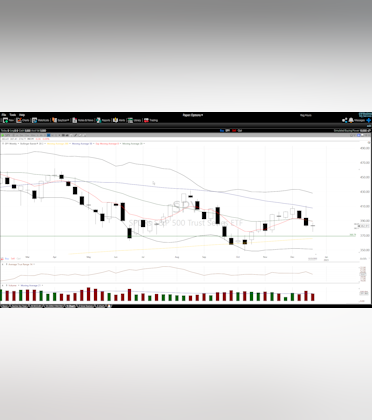

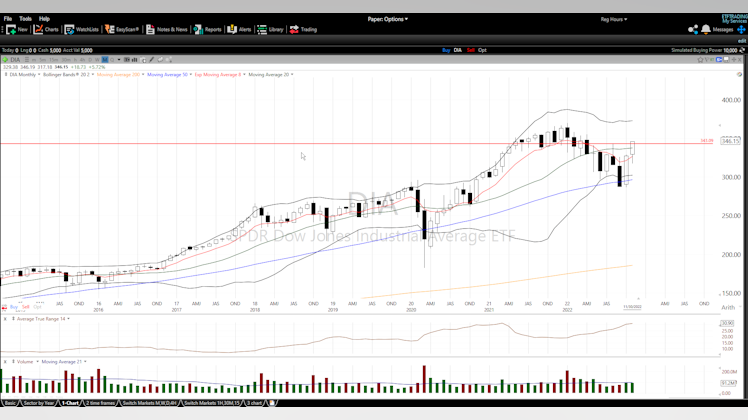

They way I interpret the daily chart as a trend follower is that the market has been making short-term higher highs, but we're still in an overall downtrend. So I think I'm seeing it similar to you when you look at the monthly chart.

I'd like to see this recent uptrend sustained, and I need to see it break the declining 200-Day SMA which has been a definitive line of resistance twice in the past. Then I'd like to see the market break above the 4,305 level (previous significant high) before I can be convinced a recovery is well underway.

The next few trading days are going to be key to see if this recent strong move can be sustained, or if buying pressure gets exhausted and we just fall into a funk again and fill in that gap.