The Millennial Wealth Conundrum: Exploring the Stark Contrast Between the Top 10% and the Average

The gap between the rich and poor is growing in the United States. This topic mostly concerns the wealth gap between the Baby Boomer and Millennial generations. However, this gap looks different when you compare the baby boomer generation to the millennial generation. The wealthiest baby boomers are richer than the average baby boomer. But the gap is even bigger for millennials - the richest millennials are way wealthier than the typical millennial. This essay will explore why the wealth gap is so much larger within the millennial generation compared to the baby boomers.

When you compare the millennials vs baby boomers discourse, you’ll find the discourse to center around issues with translating their income into home ownership, having to worry less about retirement due to access to pensions, not having student debt, and being able to buy investments at a time when valuations were lower.

The issue with valuations is a bigger deal than many think. When someone invests in an asset, the valuation metrics determine whether someone is getting a great deal on their purchase. As many will say, riches are made when people are buying assets for cheap, and that usually happens in recessionary times. For the Boomers, they got to buy assets for cheap during the 1970s and early 1980s when the US economy was in turmoil. For Gen Xers, they had the opportunity to buy assets for cheap during the 2008 financial crisis. Millennials were supposed to have the COVID crisis be their opportunity to buy assets for cheap, but the actions of both the federal government and the Federal Reserve made the dip buying opportunity small, and asset prices went from being less expensive to super expensive.

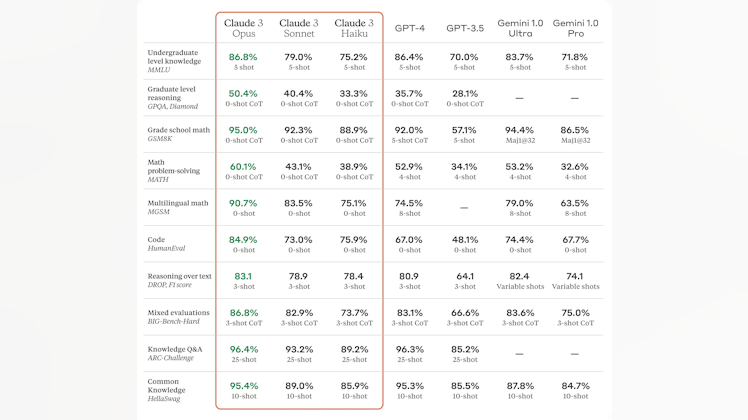

With millennials being stuck with a lack of opportunity to buy assets for cheap, it’s understandable why millennials have a harder time translating their incomes into homeownership and have more anxiety about retirement. Looking at the chart below by the Financial Times, we can understand why people are concerned with the wealth gap between the average boomer and the average millennial. But when you compare the top 10% of millennials and the top 10% of boomers and compare the gap between their average peers, we will find that the wealth gap is larger among the millennial generation.

Learn more about the wealth gap conundrum between the top 10% of millennials and the average millennial in this article: https://dissectingthemarkets.substack.com/p/the-millennial-wealth-conundrum-exploring

But the wealth gap is even bigger for Millennials - the richest Millennials are much wealthier than the typical Millennial age of war