$TSM: Fueling the Future of Computing

Taiwan Semiconductor Mfg. Co. (TSMC) has become the leading manufacturer (fab) of semiconductor chips by capitalizing on a series of egregious missteps at

$INTCThis is not a buy rec, but rather info for when it's actionable

A thread👇

1/ The Basics

The first "pure-play" foundry -> enabled the rise of the "fabless" (i.e. design-only) industry

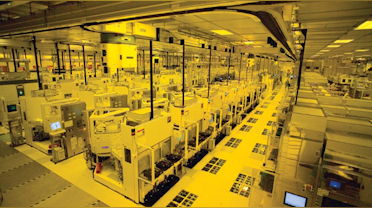

A foundry ("Fab") manufactures microchips (integrated circuits "IC") for customers such as fabless chip companies.

Fab only = sole focus on better process technologies

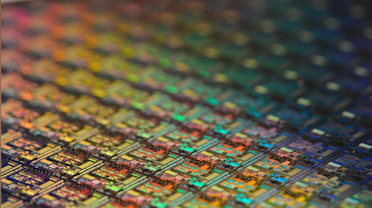

Image

2/ First Mover

The leader in chip mfg. is the fab that can get to the next “process node” first

Process Node (“Tech”): Used to indicate feature size of transistor - > now marketing tool for chip generation

As @gavinsbaker wrote in Jan '19, TSMC passed INTC at the 7nm node

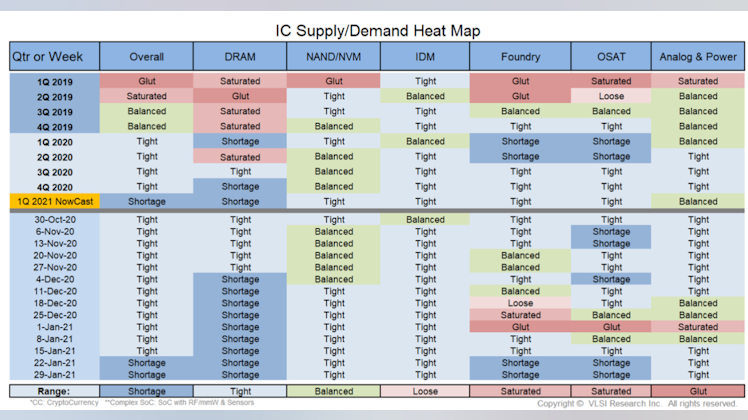

3/ Market Overview

All electronics = powered by semis

3 Types of Companies:

Integrated Device Mfgs. (“IDM”):

$INTC, KOSE: A005930,

$TXN,

$MUMarket Size: Semis power all electronics…

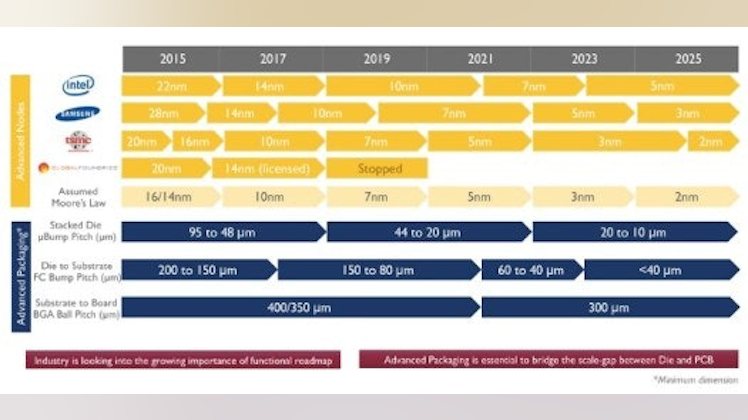

4/ Technology Advantage

Tech dominance while other foundries can’t keep up (GF dropped out at 7nm)

Tech advantage -> customer additions (

$AMD from GF)

1) 5nm already in production

2) Specialty tech (5G)

3) Advanced Packaging

TSM: 52% market share

Manu leader + Ecosystem

5/ Technology Platforms

Automotive Electronics: IP ecosystem & RF tech driven by autonomous & EV

High Performance Computing: Cloud datacenters and communication infrastructures

IoT: Fueled by wearables, smart homes / cities / industries

Smartphone: Mobile proliferation

6/ Q4 2020 Financial Results

Accelerating Rev growth YoY: 16%, 22%, 24.2%

Expanding EBIT %: 35%, 37.7%, 40%, 41.3%

2x FCF YoY

Accelerating EPS Growth YoY: 24.2%, 43.5%, 49.2%

ROA: 10.7%, 12.1%, 13.1%, 14%

ROE: 20.9%, 23.4%, 27.8%, 29.1%

7/ Capital Expenditures

2021 Guidance: $25B-$28B vs. 7B in 2020 (47% - 65% YoY Increase)

LT Capital Intensity: mid-30%

Accelerates CapEx spend to prep for higher growth

2021 Capital Intensity est.: ~48.5%

On conf. call: to support expected higher Revenue CAGR next 5 years

8/ Revenue Composition

5nm shipments accelerated in Q4 – now 20% of Rev

Advanced Tech (< 16nm tech) = 62% vs. 56% Q4 2019

Smartphone continues to dominate

Main HPB growth areas: CPU, networking & AI accelerator

- Could CPU growth be from $INTC?

HPC - main growth driver

9/ Next Step: N3

2021 Rev Driver = HPC & Auto

HPC: “We see a stronger innovation is coming our way on N3 as well as on N5.”

N3: Volume production 2H 2022

N3: 70% logic density gain, up to 15% performance gain & up to 30% power reduction vs. N5 (175MM transistors / mm^2)

10/ Future R&D Leadership

3nm logic tech platform & apps (2021): 6th gen 3D platform

Beyond 3nm by 2023 – 2nm in pipeline

Projects: Beyond-2nm node, 3D transistors, new memory, etc.

Focus: novel materials, processes, devices, nanowires & memories (+8-10 yrs away)

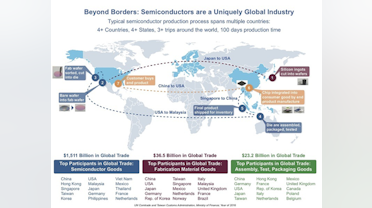

11/ Conclusion

$TSM is fueling the world of ubiquitous computing and interconnected devices

Has overtaken

$INTC in mfg. leadership -> economic benefits

Positioned to benefit and capitalize on hyper-growth trends: AI / autonomous driving, 5G, IoT

12/ Resources

Anything written by @foolallthetime (Twitter)

TSMC 2020 Q4 Quarterly Results -