Accounting Series part 1: The Balance Sheet

Been meaning to do this for a while, but I just honestly haven't had the time. I'm hoping to knock one of these out each week, but between school and other things, I'm not gonna make any promises.

Anyway, I think accounting is an essential skill to have (at least a basic understanding of it) in order to be a good investor. While it's inherently backward-looking, and you ideally want to be forward-looking as an investor, understanding basic financial statements go a long way towards understanding what makes a company tick and can help you determine what sort of assumptions make sense for a company in the future.

I wanted to start with the balance sheet. In my opinion, it's the easiest financial statement to understand and it's pretty straightforward. I'm not going to get too in-depth with debits/credits/t-charts/etc, the whole purpose is to help people understand at a high level, what it is they're looking at when they read a financial report.

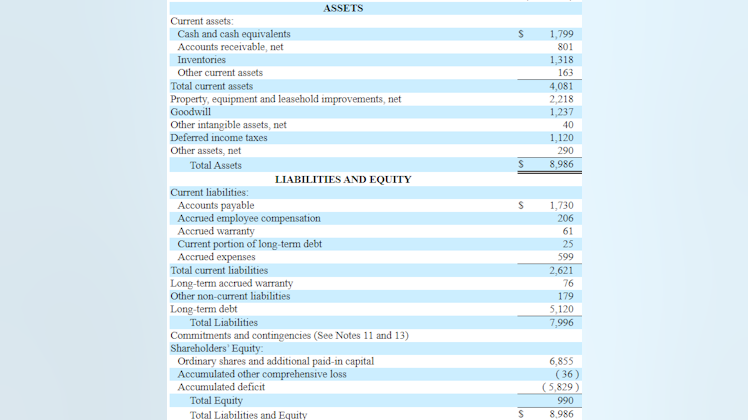

I've chosen Seagate Technology as the company I'm going to be writing about, mostly because it's pretty easy to understand, but also because I'm looking at it right now so I'm a little more familiar with it. I'm just pulling all this data from their most recent 10-Q for simplicity accessed through Capital IQ, but this info is also easily available on the SEC website

So what are we looking at here? Assets are pretty straightforward, just what the company owns. I like to think of Liabilities and Equity as a lump "Claims" section however because that's what it is. Liability owners, as well as Equity owners, have a claim to certain assets that the company owns.

The important thing to remember is that Assets = Claims, or Assets = Liabilities + Equity. Viewing the balance sheet through the lens of Assets vs Claims makes it pretty easy to see why I think. Someone always has a claim on a given asset of the company, so this equation can't ever be imbalanced.

Most of these accounts are pretty self-explanatory, so I won't be talking about what cash is, for instance, because I think everybody on here can figure that out. That being said, if I skip over something and it's confusing, I'm happy to answer questions in the comments. For investing purposes, there are different ways to forecast these accounts. I won't get into that here, but I may talk about it down the road.

So, Accounts Receivable, basically just what the company is owed. If I sold some item and gave my customer 30 days to pay, that revenue would show up in this account until I actually receive the money, at which point A/R would decrease, and Cash would increase, keeping the accounting equation constant. The net takes into account that some customers won't actually pay us back ever. There are a few different ways that companies can net A/R, but the simplest way is to look at how often a failure to pay happened in the past, and just use that same percentage in the current period.

Other Current Assets are pretty broad, and they obviously will differ based on the company, but this gives me a good opportunity to talk about current vs non-current. Essentially, the rule of thumb is that if the account will become due/realized in 1 year or less, it's current. Otherwise, it's non-current. This makes a little more sense viewed through liabilities, but in terms of assets, you would expect to be able to use cash tomorrow if you needed to, and recover your net A/R within a few months most likely. On the other hand, you'll likely be using your buildings for a really long time, even if you absolutely had to sell them, it could easily take a year or more to liquidate, compared to inventories which could probably be moved in a week or so.

Net plant, property, and leasehold improvements are pretty much exactly what it sounds like. Just the value of those assets minus any accumulated depreciation. Leasehold improvements are a little tricky in terms of accounting, but as long as you understand that it's just an improvement on an asset being leased, that's really all you need to know.

Moving on to non-current assets with Goodwill, which is just a premium paid over fair book value when acquiring a company. For example, if I acquire company X for $100, and the companies assets are solely $50 in cash, I'd have an imbalance in my financial statements, so we add $50 in Goodwill as a plug to make the accounting equation hold true. This sounds a little funky, but things like customer loyalty, brand recognition, etc, are difficult to value and don't always appear accurately on a balance sheet (if they do at all), so the idea behind Goodwill is that it accounts for those items. This number doesn't usually change except in an M&A transaction, but Goodwill impairment can sometimes happen, however it's usually not worth worrying about.

Deferred Income Taxes are what you would think just caused by different accounting treatments for a company's books vs tax. Deferred Tax Assets and Liabilities are really interesting, but it's a little complicated. Depreciation is a good way to give you an idea of how it works. Basically, most companies depreciate equipment on a straight-line basis, but you're allowed to depreciate using an accelerated method for tax purposes. When you do this, you'll pay less in tax than what's on your books, so you'll owe more in the future, creating a deferred tax liability. Obviously, this would go under liabilities, rather than assets, but you can imagine a scenario where it might go under assets.

Accounts Payable are just the opposite of A/R, so payments that the business expects to make in the future. Ideally, you'd like to make all of your payments, so this isn't really netted.

The accrued expenses are self-explanatory, accrued just means that you haven't actually paid them yet. The important thing to remember is that they're just estimates, so the actual number can change over time.

The current portion of long-term debt is just the portion of long-term debt that's due within a year. Commitments are just legal promises, usually disclosed in notes. Contingencies are a little complicated however because they involve uncertainty and depending on the likelihood of different outcomes, they get accounted for in different ways. I'm just not going to go super in-depth here.

Lastly looking at the equity section:

Common Stock or ordinary shares is just the par value of each stock (usually like $.001 or something really small like that) times the number of shares sold at that par value. Additional paid-in capital is just the amount of money that the company receives above that par value amount. I think it's usually confusing that this doesn't really change that often necessarily, but when we buy and sell shares on an exchange, that doesn't affect the company's books since they aren't gaining or losing any money.

Accumulated other comprehensive loss isn't too important. It's basically an accumulation of unrealized gains or losses (loss in this case) related to pension plans, Forex exchanges, or available for sale securities.

Just to touch on securities: companies can classify their investments as Available for Sale, Trading, or Held to Maturity. In AFS, you report unrealized gain or loss in Other comprehensive income, in Trading, the unrealized gain or loss goes with the other line items on the income statement, so it wouldn't be accumulated in the manner above. Held to maturity wouldn't show unrealized gains or losses at all on the income statement. I guess that's kind of a quick preview of how earnings can begin to be manipulated by clever accountants.

Lastly, the accumulated portion of net income that remains after paying dividends goes into an account called retained earnings (you might also see retained earnings as this line item name, but it's the same basic thing), which is what the Equity holders have a claim to. In this case, the account is negative, which means that accumulated expenses + dividends have exceeded accumulated profits. Retained earnings = Previous Retained Earnings + Net Income - Dividends.

I think I covered just about everything, but if I made a mistake somewhere or you could use some clarification, feel free to let me know. Also, there are a ton of line items not appearing on this balance sheet, this is just a primer. Often, I have to google what different line items are, but understanding the basics makes it a lot easier to put the puzzle pieces together, even if you don't have them all at first.

Next time: The Income Statement

This is incredible, seriously thank you for the time you are putting into this. It will help

many