Trending Assets

Top investors this month

Trending Assets

Top investors this month

A deep fundamental dive on $ZTS (Hold)

I recently finished a deep fundamental dive on Zoetis. For those of you who don't know, Zoetis is a spin-off from Pfizer focusing on animal pharmaceutical products. What makes Zoetis unique in that space is its focus on companion animals (pets). Whereas many competitors earn a disproportionate amount of revenue from livestock, Zoetis has about a 50/50 split between pets and livestock.

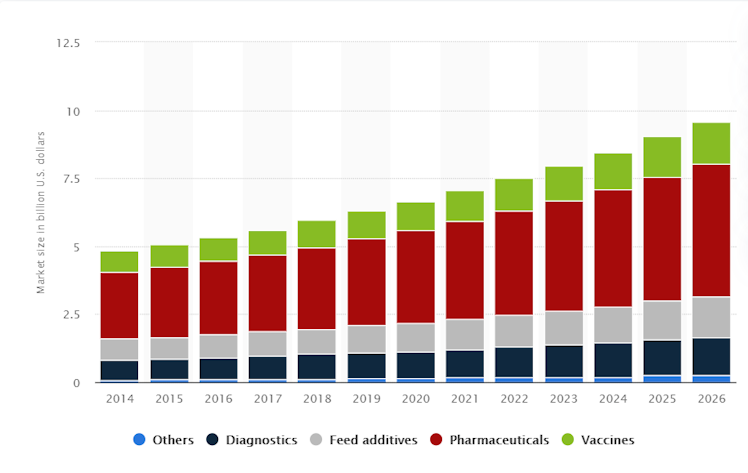

Why does this matter? Because meat production is forecast to decline worldwide. On the other hand, the pet space is forecast to grow to roughly 10 billion dollars by 2026. Clearly, Zoetis has been making smart plays by focusing its efforts on pets, as revenue has grown more than twice as fast over the past 5 years as its competitors.. Additionally, with 13 blockbuster drugs, Zoetis is only dependent on its top ten products for 40% of revenue, demonstrating product diversification which I find to be incredibly important. This means that as many competitors begin to really struggle with meat trends shifting, Zoetis can continue to thrive in the pharmaceutical space.

Source: Statista

With that being said, why do I recommend holding this company, and not buying? To understand my reasoning, we need to talk about Pumpkin Insurance.

This is a new venture that Zoetis is undergoing in order to have a foothold in the $1.5 billion pet insurance market. This number should continue to rise 1) as pet ownership continues to increase in the United States, and 2) as the increasing humanization of pets encourages consumers to only want "the best", including when it comes to pharmaceuticals. If Pumpkin Insurance catches on, I believe that not only will Zoetis have increased revenue from existing customers, they will also attract new customers who are seeking an affordable way to buy the best medication for their pets. By offering Zoetis products at an affordable rate with Pumpkin, they can lock pet owners into the Zoetis ecosystem, and further expand on their market share in the pet space.

However, this is a very new venture, only around since April, so I don't think it's possible to predict with any certainty if this will catch on and begin to chip away from existing offerings. Thus, I didn't incorporate it into my financial projections

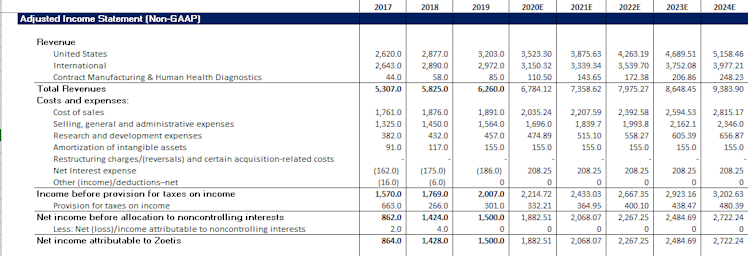

Since $ZTS revenue is about a 50/50 split between US and International, I divided up those projections accordingly. I forecast 10% annual growth in the US and 6% worldwide, both aggressive, yet in line with previous years. Even in COVID, people are buying more pets, so regardless of vaccine roll-out time, I feel confident in these projections. With a projected net profit margin of ~30%, well above competitors, this results in almost 3 billion dollars of revenue in the final year of my projections.

I next created projected financial statements out to 2024. I won't post them here for simplicity's sake, but I'm happy to let others review them, just ask!

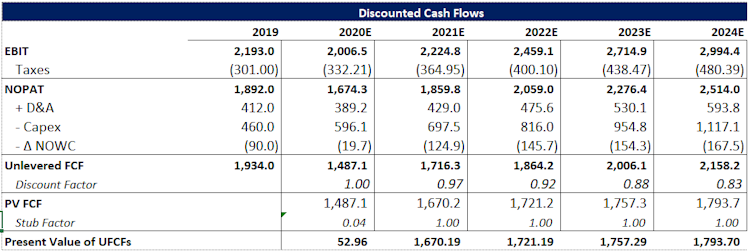

By projecting out future cash flows into the future, I attempted to determine a fair value for Zoetis's stock.

My WACC of 5.4% was based on a COD based on the current bond rating for Zoetis, a COE based on CAPM, market values for equity, and book values for debt, with that number being used to discount my cash flows.

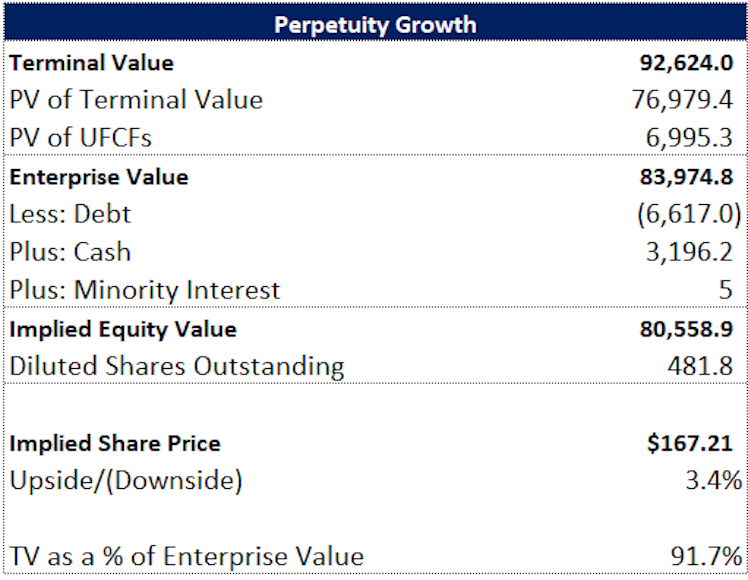

As you can see, I determined a fair target price to be 167.21, with 3.4% upside from current levels. Thus, I don't think it's time to be buying more or starting to sell.

I'm looking at pet ownership trends over the next year to see if I can spot any signs that benefit or hurt Zoetis with the upcoming vaccine. While I think that Zoetis can continue to be successful even if new pet adoption reverts to pre-covid levels, that doesn't raise my projected intrinsic valuation. More importantly, I'm looking to see how Pumpkin Insurance does. I think it could be a real game-changer and be very beneficial to all shareholders. At this point, however, it's too new a venture to project out, and I think that incorporating that revenue would be irresponsible. Thus, I'll be maintaining my position in Zoetis, and looking to see how trends impact Zoetis' current offerings. If more people adopt pets still, even if Pumpkin is a flop, Zoetis could be a stock worth buying in my opinion. For me though, the key is Pumpkin Insurance, if that catches on, I'll be slowly adding more over time, as I believe that would make it the undisputed leader in the companion animal space.

Feel free to reach out if you want to see more of my work on Zoetis, and also feel free to follow me on Twitter @theaustincox. I'd love to get any questions or feedback as well, definitely helps make me a better investor!

Already have an account?