I’m not much for short term action but I do watch daily just to see if I can add anything on bigger dips. Funny to see how the market acts to whatever catalysts it may be driving any particular action. My retail holdings all went like this today:

$SCVL +7% (my buy the dip candidate, up 20.6% since purchase)

$LULU was flat, held in kids’ custodial account (I’m a value investor)

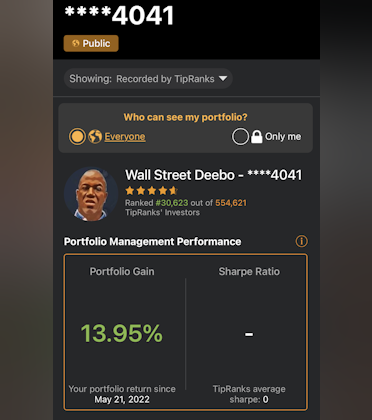

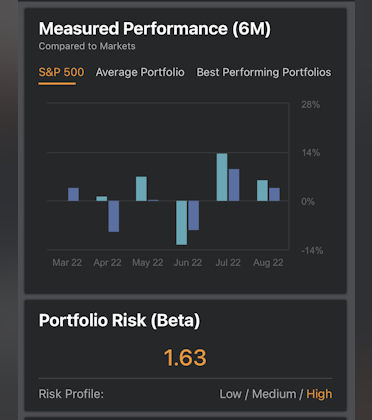

My picks are value positions and mostly for the swing trade/shorter-term part of my portfolio; not one of my core holdings like Google or Microsoft. Positions I buy to hold, not forever, but until they reach a price closer to fair value and providing a sufficient ROI. I figure after tax Buffet numbers are a nice goal to shoot for. I always intend to hold for 1-3 years, until market sees the value, but sometimes it happens a little quicker than I expect. These positions are all up 20%-28% since purchase in May, June, and July, however,

$WSM is the only retail I intend to hold long term currently, the rest I will be watching closely to sell the position at a nice gain. I’d rather be early than late, that’s usually one of the weaknesses of value investors. But I always remembered the quote I read early on that ends with “pigs get slaughtered”. I’d rather take a 28% gain in 40 days than wait on 40% or some other arbitrary number that I thought I should see.

Keeping this journal after the Covid rebound and subsequent correction will be a great tool for the future me. Knowing what I was thinking and when will be priceless.

It is fun to be a spectator and watch the market swing prices wildly up & down every quarter based on fears of recession, the joy of no recession after all, inflation, wars, etc.; all problems the market has faced before and things I don’t let affect my investment decisions. Watching entire industries swing almost 10% in a day shows the irrationality of the market; whether there are legitimate macro fears or not. History has proven problems are short term for excellent businesses. This is what makes it easier, IMO, to take advantage of. It seems the algorithmic bot trading and rise of day trading EVERYwhere, has made it easier for broad (longer-term) swing trading, driving the price irrationally high or low, creating a feedback loop of retail investors and bots chasing each other up or down.

I’ll continue to spectate most days rather than participate in the folly. I said my goal was Buffet returns; Buffet gained ~20% annually, I assume 28%-40% pre-tax gains should be sufficient to come close to that. I look at each position to meet that goal; if it happens in 2 months, it just gives me time to find another under valued position to compound my returns.

As for

$WSM they will be in the Berkshire Hathaway wing of my portfolio. Excellent businesses I collect with impressive track records and long histories of execution, that I just occasionally check in on.