Trending Assets

Top investors this month

Trending Assets

Top investors this month

@uberkikz11

Rod Alzmann

$3.1M follower assets

117 following150 followers

Netflix 4Q22 Earnings

X (formerly Twitter)

Wook Capital (@WookCapital) on X

Join us as we kick off Wook Capital’s earnings call series with $NFLX tomorrow. We’ll launch Spaces 10 mins before the company’s scheduled call time & after the ~hour of remarks + Q&A will dive into the analysis/takeaways. All are welcome to participate: https://t.co/6QpQXb1C6l

+ 3 comments

What return target do you have in mind when investing?

X (formerly Twitter)

Rod Alzmann (@RodAlzmann) on X

What annualized return are you aiming for in your investment portfolio?

+ 4 comments

$R what is Supply Chain Solutions worth now?

X (formerly Twitter)

Rod Alzmann (@RodAlzmann) on X

What is Ryder's Supply Chain Solutions business worth?

If $R comes out of the next freight recession & there's still such a massive chasm between $GXO's valuation and the implied value of SCS within Ryder, expect a spin/sale in ~2024. WholeCo rejected $86/sh offer in June. 1/3

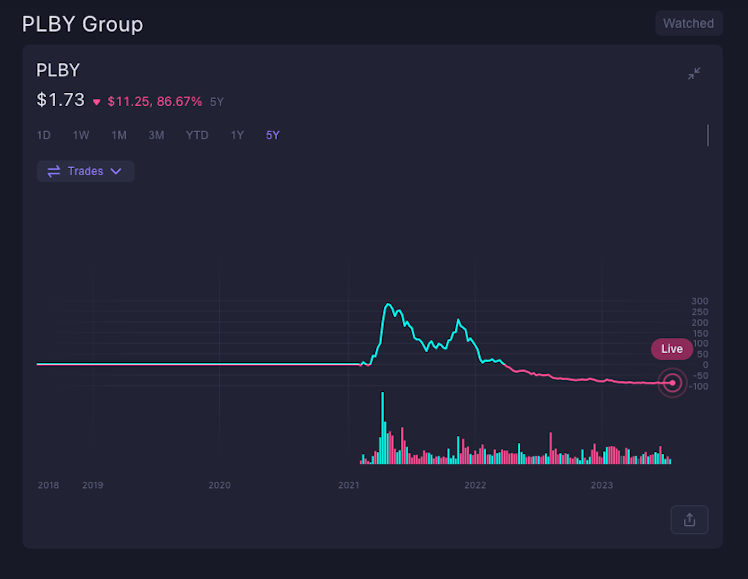

$PLBY I am calling for the CEO's resignation

X (formerly Twitter)

Rod Alzmann (@RodAlzmann) on X

Incredibly @plbygroupceo is on the record saying this.

The market is screaming at you to resign. Do it, and lockup your shares. Bring in a charismatic, gritty, entrepreneurial female operator to head up the business.

Do the right thing for all $PLBY investors.

Watchlist

Something went wrong while loading your statistics.

Please try again later.

Please try again later.

Already have an account?