Trending Assets

Top investors this month

Trending Assets

Top investors this month

A Better Dividend ETF

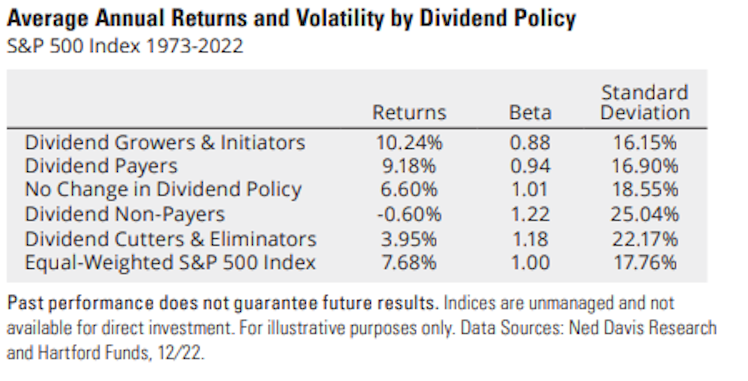

Check this out, stocks that begin and grow their dividends have had better returns and less volatility than the equal weight S&P 500 ($RSP) for nearly 50 years.

This fact has made me consider moving my ETF positions around a little bit. I have about $1k in $XYLG that I have wanted to cut and put somewhere else for a while now, and I made a move on that yesterday.

I came across a potential dividend growth ETF to replace it. It is $LEAD. It’s a small Siren ETF with a somewhat high expense ratio, but I love their strategy.

Their strategy is designed to capitalize on this theory that consistent dividend growers outperform. They’ve developed a criteria that gives them a selection of companies with the highest probability of a dividend increase in the following 12 months. These picks are determined using a proprietary dividend health scoring system and weighting methodology that ranks the largest 500 US companies using 7 quantitative factors that correlate with dividend growth likelihood.

Those factors are weighted on effectiveness and summed together to provide a “DIVCON” score of 1-5, with 1 being most likely to decrease the dividend and 5 being the most likely to increase the dividend. The ETF selects all the stocks that scored the highest and weights them according to the score. They rebalance the ETF on the first Friday of every December.

Weighting the holdings based on likelihood of an increase seems like a better system than weighting by market-cap, or dividend dollars, or dividend history, like what $DGRO and $VIG use. Using the DIVCON score cuts some fat out of the portfolio compared to other larger ETFs that hold onto poor performing positions like $BAC, $TGT, $NKE, $DG, $MMM, $FIS, $SWK, $VZ.

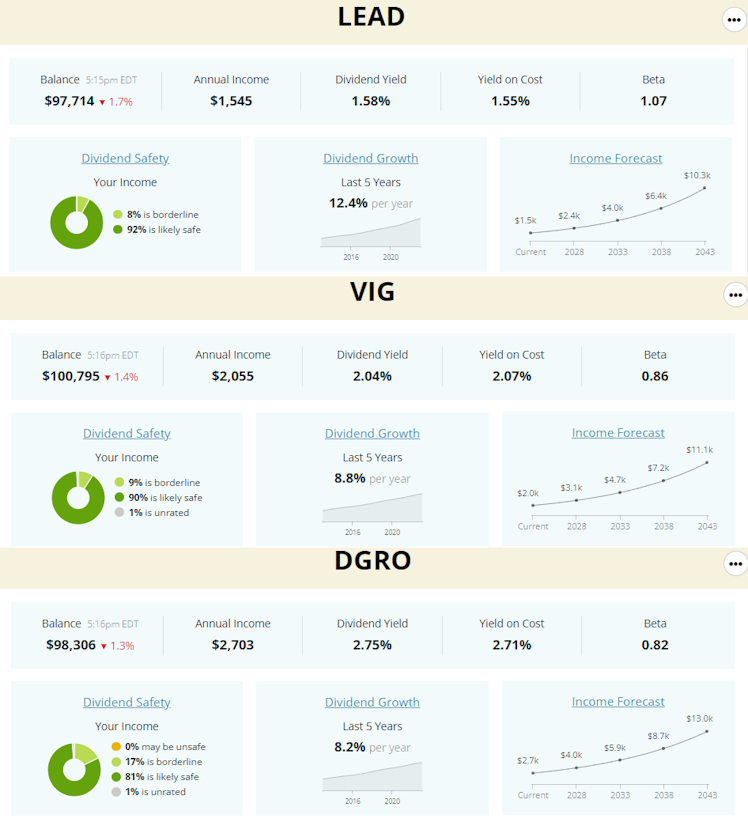

$LEAD holdings averaged a 71% gain over the last 3 years, only 1 out 57 holdings were negative. For $DGRO, 56 out of the current 432 holdings lost money in 3 years and had an average return of 56%. $VIG has 34 holdings in the current 318 positions that last money the last three years and had an average return of 53%. I also created mock $100,000 portfolios for $LEAD, $VIG, and $DGRO using their current weightings and the results were interesting. $LEAD has a lower overall yield, scored higher on dividend safety, and has higher dividend growth over the last five years which also is represented in the steeper income forecast.

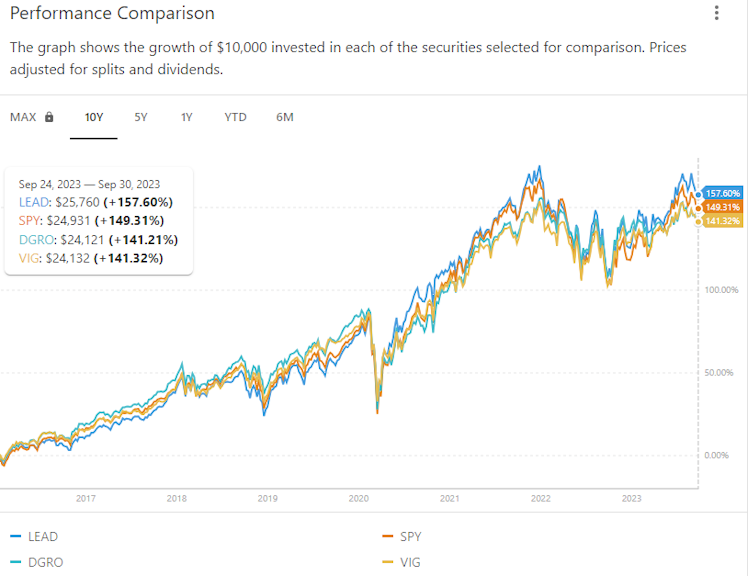

It seems that $LEAD will beat its dividend growth ETF competitors over time. It also beat $SPY with a little margin over the last 7 years since its inception, a feat that few dividend growth ETFs can claim. Overall, $LEAD appears to have better capital appreciation potential, better dividend growth potential, and a more concise and intelligently selected portfolio (picture 4).

This seems worth the steeper expense ratio. The only downside in my opinion is the fact that it is such a small ETF, they only have $47M in assets. This leads to low volume, wider spreads when trading shares, and increased risk that the management company closes the fund.

Already have an account?