Trending Assets

Top investors this month

Trending Assets

Top investors this month

Mobileye ($MBLY) Investment Thesis (& Kudos to Commonstock)

It has been a few months since my last post, so I'd be remiss to not say congrats to @mcd and the rest of the @commonstock team for the acquisition by Yahoo Finance! The team, community, and @nathanworden especially have made me feel welcome on this platform since literally day one, when I asked, "Question as someone who created their account today, why do some people on here not share their portfolio?"

I've been so impressed with the growth of Commonstock since that fateful day when my silly question made it to the top of the daily news feeed, and I can't wait to see what's in store next.

With that out of the way, let's get down to brass tacks. I recently initiated and scaled into a significant Mobileye position, totaling 13.7% of my portfolio as shown below.

After reviewing and writing about Mobileye's S-1 Filing (Prospectus) before the company's IPO in November of 2022, I've been patiently monitoring the company's execution and share price, waiting for the right moment to strike.

Much to my disappointment, shares never truly dipped below its debut price despite a challenging market for non-mega cap technology companies from IPO in late 2022 to the present day.

Despite my frustrations, at the very least, the movement of Mobileye's share price made sense to me. The company executed well and built up an impressive record pipeline.

When the price dipped from an ATH of $48.11 to around $34, and after extensive due diligence, I decided to pull the trigger. Let me share with you my investment thesis, starting with the company's background.

Company Background

For those who didn't read my S-1 post last year, I'll re-hash the basic info for you.

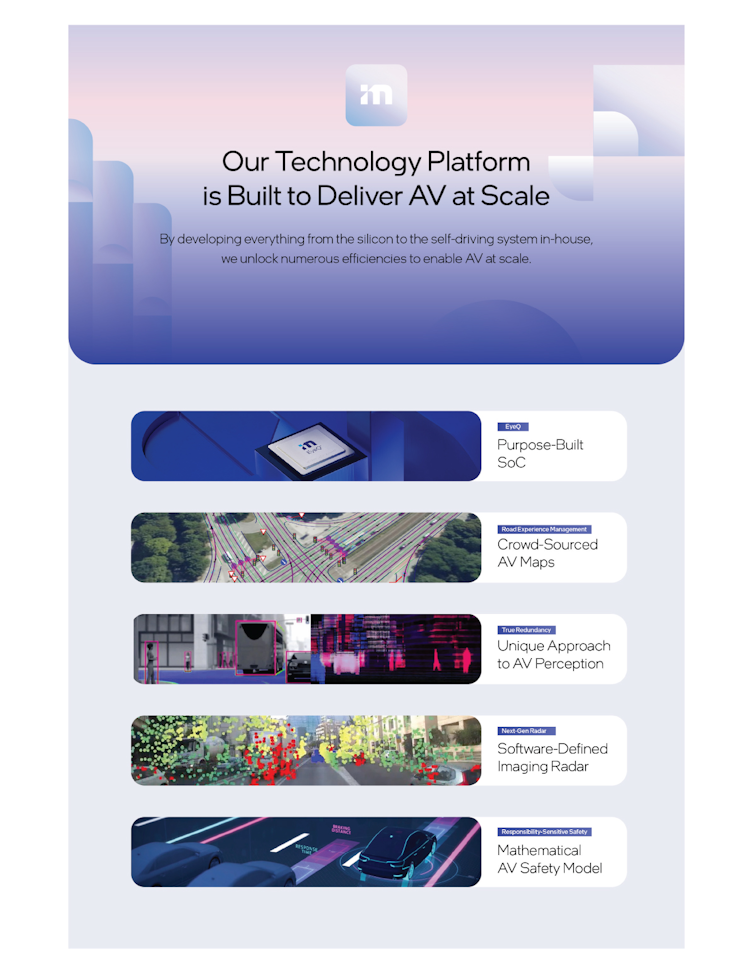

Mobileye’s technology platform, which is built to enable the full-stack of autonomous solutions, is based on five pillars:

- EyeQ family of System-on-a-Chip (SoCs)

- Road Experience Management (REM) that generates crowd-sourced AV maps from the Advanced Driver Assistance System (ADAS) enabled solutions deployed on the road today

- True Redundancy from the independent perception subsystems of cameras and radar/LiDAR

- Design of next-gen imaging radars, limiting the LiDAR need to a single sensor and driving down cost

- Mobileye’s Responsibility-Sensitive Safety (RSS) framework, published in 2017, constantly optimized, and used by international governing bodies to design AV safety standards

Mobileye’s Solutions & Roadmap:

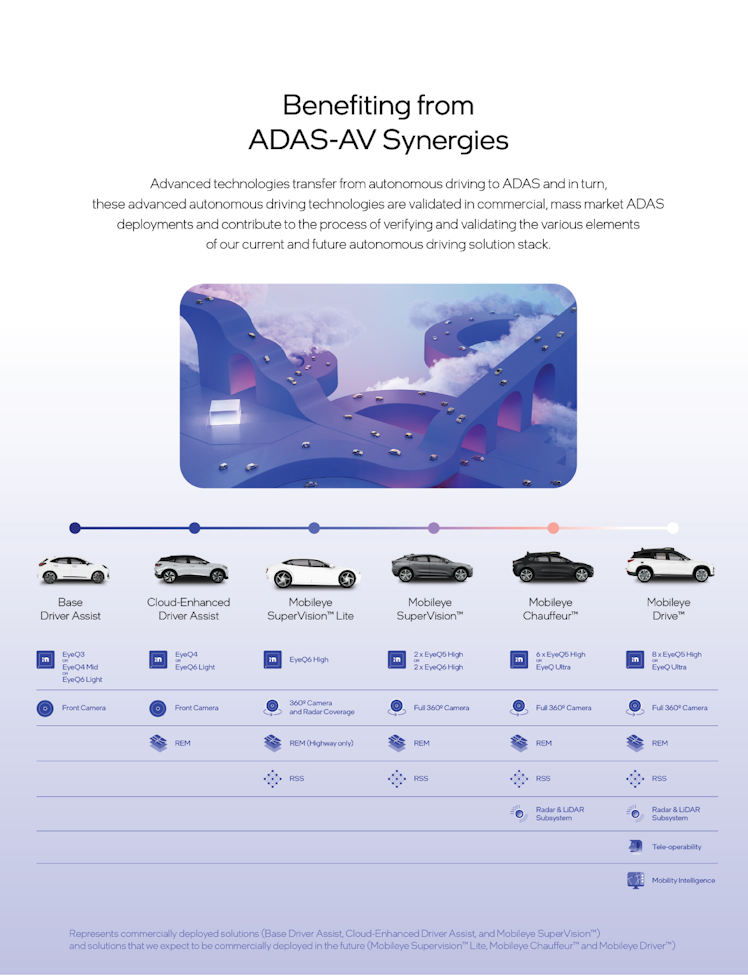

- Driver Assist: Base Driver Assist functions such as real-time detection of road users and markings to provide safety alerts and emergency intervention

- Cloud-Enhanced Driver Assist: High-accuracy interpretations of scenes in real time using the REM mapping system

- Mobileye Supervision Lite: Premium Driver Assist which will provide eyes-on/hands-free high navigation, assisted driving, and autonomous marking with over-the-air (OTA) updates

- Mobileye Supervision: Highest functioning Premium Driver Assist with fully operational point-to-point assisted driving navigation and OTA updates

- Mobileye Chaffeur: 360 degrees of coverage with True Redundancy, along with REM AV maps and RSS, for increased scalability and safety

- Mobileye Drive: Expands on Mobileye Chaffeur to deliver driver functions without any in-vehicle human intervention. Mobileye Drive may be offered across two vertically integrated product sets: (1) B2B channels to a range of transportation network operators and vehicle OEMs, which would operate services such as Autonomous-Mobility-as-a-Service (AMaaS), transportation on demand, and delivery of goods (2) AMaaS to interface with Moovit’s platform, which provides a service layer and ready-made user base.

Investment Thesis

Mobileye is the undisputed leader in ADAS today, with a 69% market share reported in January 2023. ADAS, also known as Level 2 (L2) autonomy, consists of the features considered as standard safety features in cars coming out today; blind spot monitoring, adaptive cruise control, front collision warning, etc. These features, if not already mandated by governing bodies across the world, soon will be required by new cars across the board.

These mandates are an obvious tailwind for Mobileye, backed up by design wins announced earlier this year, totaling $17B+ in just ADAS pipeline. In a noted down-cycle for the business, the company is at or around GAAP breakeven (-.04 EPS in Q2) with a 49% gross margin. For the next twelve months (NTM), $MBLY at $34.26 (28.31B market cap) has a forward PE of 41.97.

While these historical and NTM metrics are valuable to know, I believe that to understand the step change in business that Mobileye is about to undergo, it is also necessary to understand the current and future pricing model of the company's products.

For each ADAS system, making up the vast majority of trailing revenue, Mobileye makes ~$50 per unit. Very economical, which is a likely reason why Mobileye systems have been installed in 125 million vehicles since the company's inception 20 years ago.

The SuperVision system, currently in production and starting to ramp, generates anywhere from $1300-1500 per unit depending on the configuration. The fully autonomous systems, including Mobileye Chauffer and Drive, can go into the thousands of dollars per unit.

Mobileye is at a critical inflection point in pricing, so the billion dollar question is, do the company's autonomous driving products have the market demand to scale the company to the next level?

Unequivocally, yes.

With Tesla taking most of the self-driving news cycle in the United States, it's easy for Mobileye to fly (drive) under the radar.

In 2022 the company sold 90,000 units of the Zeekr 101 equipped with SuperVision technology (the $1300-1500 system), generating positive press across the board in China, where the car is rolling out first. And starting in Q1 2024, there will be 5 cars with SuperVision in production.

This includes 2 Zeekrs, the Polestar 4 (recently announced), a vehicle from Smart, and a yet to be announced brand. Low volume from Vinfast could also happen in 2024, and then the company has a design win with Porsche that launches in mid-2025.

Looking towards future design wins, CEO Amnon Shashua said in the Q2 earnings call that Mobileye "...can now count nine large established OEMs prospects in what we consider advanced stages for products like SuperVision and Chauffeur. In most cases we are not competing against anyone."

In the Q&A, Shashua expanded on the notion by defining these prospects as engagements in which "...engineers are fully aligned with Mobileye, that Mobileye is the right path forward in terms of technology, performance and cost, where we already are in production, executing an official product program or in a funded physical concept phase."

He also noted that "we still see high likelihood of significant design win announcements in the second half."

So far, we've established that Mobileye has (1) a sustainable ADAS business providing the company with consistent, predictable cash flow (2) an upcoming inflection point in pricing that will drastically boost margins and revenue prospects (3) an expanding pipeline for the future self-driving products, with catalysts all but guaranteed for the second half of this year.

But what about the competition? Surprisingly, I've only mentioned Tesla once so far in a post related to self-driving, so let's take some time to address the competitive landscape.

In a recent Goldman Sachs conference, Analyst Mark Delaney asked Mobileye Chief Communications Officer Dan Galves the following "...Tesla aspires to be a competitor, and they said they're open to licensing their FSD technology to other OEMs. Have you seen that impact your discussions at all with OEMs? And are you seeing them as a competitor in the marketplace?"

Galves responded with "...we haven't seen any impact from that... it's not the first time that Tesla has said that they'd be willing to kind of license or sell their self-driving technology to other automakers. I think that it's funny because this sense of urgency that's been created in the industry, we feel like is more related to Chinese automakers than Tesla."

Outside of Tesla, Nvidia and Qualcomm are Mobileye's other two potential competitors as providers of high-powered, open compute platforms.

To paraphrase Galves' commentary on the dynamics with Nvidia and Qualcomm, automakers evaluating those platforms realize that internal development efforts to write software on top of Nvidia/Qualcomm hardware end up being significantly more costly than going with Mobileye, with teams designing and developing the full software and hardware stack exclusively for automotive.

Additionally, Intel's acquisition and subsequent incubation had the benefit of enabling open compute for Mobileye, which used to be the advantage of going with Nvidia or Qualcomm. Mobileye now has something called EyeQ Kit, which consists of tools, libraries, and software development kits (SDKs) for automakers to deploy their own code.

The EyeQ kit allows automakers to fine tune their system's driving experience using 500-600 virtual knobs, from making lane changes more passive to giving the car a more aggressive feel.

Conclusion

As investors, we have a rare line-of-sight to both not only where the automotive industry is heading (ADAS and self-driving), but also where Mobileye is going with their rapidly expanding pipeline of opportunities to capitalize on.

I think that the next few months are a rare opportunity to accumulate shares before design wins start rolling in, and the broader market recognizes the growth prospects that I've laid out in this post.

I will continue to update everyone on my position, and as always, please let me know if you have questions about anything that comes to mind after reading this post. I'm here to help!

Mobileye

Polestar selects Mobileye to bring autonomous technology to Polestar 4

Mobileye Chauffeur™ technology platform to be integrated into Polestar 4

Already have an account?