Trending Assets

Top investors this month

Trending Assets

Top investors this month

Mobileye ($MBLY) S-1 Prospectus Notes & Takeaways

Offering Summary:

- $21.00 per share

- Class A: one vote

- Class B: 10 votes

- Intel will own all of the class B shares equating to 99.4% of voting power, making Mobileye a “controlled company”

- CEO Amnon Shashua intends to purchase $10 million in stock but is not required to

- Part of the offering is a private placement to General Atlantic for $100 million in stock

CEO Amnon Shashua's Letter to Shareholders:

- In the 15 years since shipping their first product, more than 125 million vehicles have been equipped with Mobileye technology.

- Actively working with 50 automakers and Advanced Driver Assistance System (ADAS) technology has been installed in approximately 800 vehicle models worldwide.

- Expect Mobileye ADAS systems to be deployed in another 270 million vehicles based on design wins through October 1, 2022 alone.

- “Many founders leave when their companies are acquired, but I was not - am not - about to walk away from my life’s work. Mobileye’s goals - my goals - are incomplete, and I am as committed as ever to a safer future.”

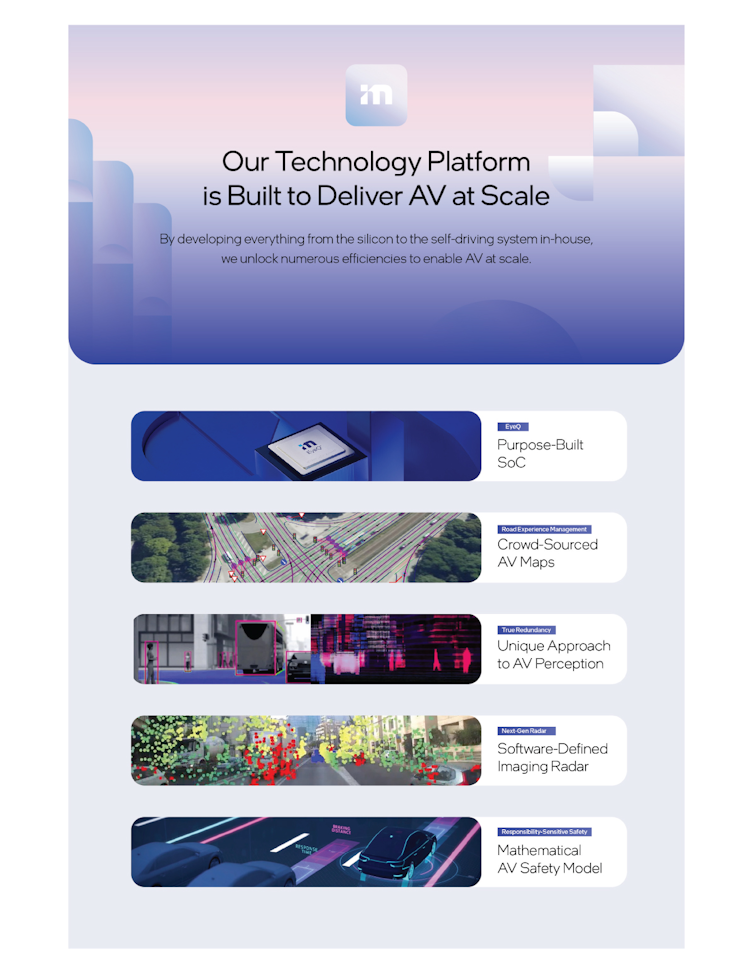

Mobileye’s technology platform, which is built to enable the full-stack of autonomous solutions, is based on five pillars:

- EyeQ family of System-on-a-Chip (SoCs)

- Road Experience Management (REM) that generates crowd-sourced AV maps from the ADAS enabled solutions deployed on the road today

- True Redundancy from the independent perception subsystems of cameras and radar/LiDAR

- Design of next-gen imaging radars, limiting the LiDAR need to a single sensor and driving down cost

- Mobileye’s Responsibility-Sensitive Safety (RSS) framework, published in 2017, constantly optimized, and used by international governing bodies to design AV safety standards

Core Challenges to Making AVs Ubiquitous:

- Regulatory Endorsement

- Geographic Scale

- Cost

Mobileye’s Solutions & Roadmap:

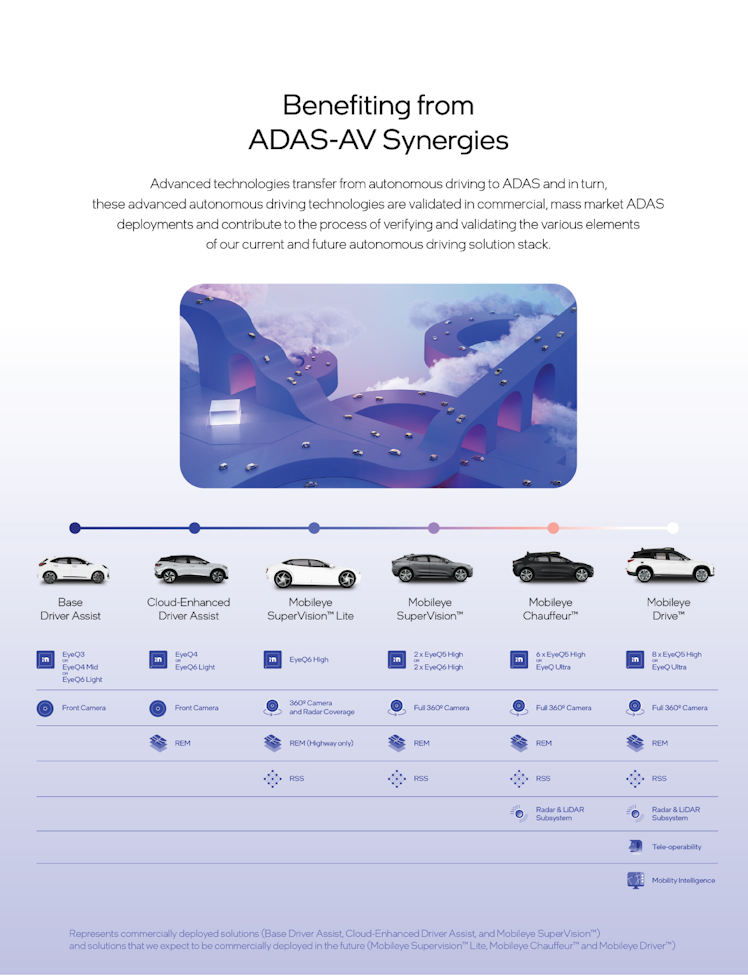

- Driver Assist: Base Driver Assist functions such as real-time detection of road users and markings to provide safety alerts and emergency intervention

- Cloud-Enhanced Driver Assist: High-accuracy interpretations of scenes in real time using the REM mapping system

- Mobileye Supervision Lite: Premium Driver Assist which will provide eyes-on/hands-free high navigation, assisted driving, and autonomous marking with over-the-air (OTA) updates

- Mobileye Supervision: Highest functioning Premium Driver Assist with fully operational point-to-point assisted driving navigation and OTA updates

- Mobileye Chaffeur: 360 degrees of coverage with True Redundancy, along with REM AV maps and RSS, for increased scalability and safety

- Mobileye Drive: Expands on Mobileye Chaffeur to deliver driver functions without any in-vehicle human intervention. Mobileye Drive may be offered across two vertically integrated product sets: (1) B2B channels to a range of transportation network operators and vehicle OEMs, which would operate services such as Autonomous-Mobility-as-a-Service (AMaaS), transportation on demand, and delivery of goods (2) AMaaS to interface with Moovit’s platform, which provides a service layer and ready-made user base.

Takeaways:

Mobileye is a sleeping giant in the ADAS industry, and a dark horse in the race to true autonomous driving. The company has consistent and predictable cash flow from their leadership position in ADAS, a visionary founder as leader who is committed to the mission, and a comprehensive plan to capture a significant share of the autonomous driving total addressable market (TAM).

If you don't fully buy Elon Musk's vision of Tesla's leadership in self-driving, or you think that there's room for more than one winner, I think that Mobileye is certainly worth a second look as an investment.

I'm going to keep this memo as a qualitative review, so I won't get into any DCF calculations or discuss company valuation, but if there's interest I can absolutely do a deep dive into the company's financial position and projections. As always, let me know if you have questions about my research and thanks for reading!

Resources:

Mobileye

Investor Relations | Mobileye

The Investor Relations website contains information about Mobileye's business for stockholders, potential investors, and financial analysts.

Already have an account?