Trending Assets

Top investors this month

Trending Assets

Top investors this month

The holiday season is upon us, and what better way to spread the holiday cheer than performing historical fundamental/valuation comparisons between next-gen cybersecurity vendors, am I right?

Jokes aside, in this post for @commonstock I'm going to dive into the actionable data I've come across while researching SentinelOne and CrowdStrike. I'm specifically going to cover the fundamental comparison between present day SentinelOne, and close-to-post-IPO CrowdStrike in late 2019 as they are staggeringly similar in a few key performance indicators (KPIs).

But before I dive in headfirst, let's level set and take look at the current state of the stocks. SentinelOne's market cap is $3.92B and has steadily declined from the 52W high of $53.97, not unlike the rest of the tech market.

Crowdstrike's chart looks eerily similar - at a current valuation of $25.13B - which isn't too surprising when you consider that SentinelOne and CrowdStrike are direct competitors.

I'm not going to spend time and space in this post explaining what SentinelOne does as a company, but if you do have any questions please don't hesitate to reach out. I've covered SentinelOne extensively in the past, specifically covering their last few earnings, so I'll link those posts at the bottom along with other helpful resources if you're getting up to speed in the cybersecurity sector.

KPI Comparison

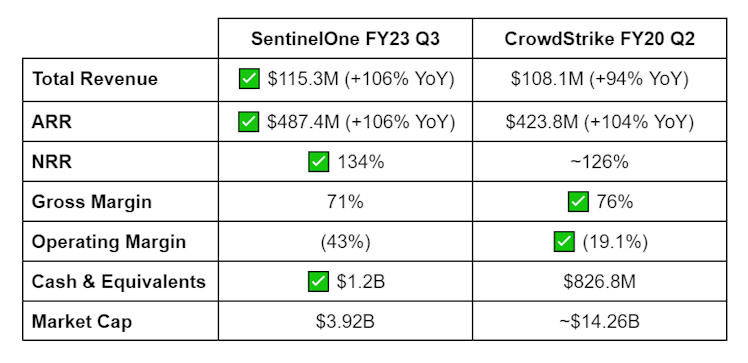

Behold, my Google Doc table creation skills. As you can probably guess I added the check marks to signify a superior relative KPI. I selected CrowdStrike's FY20 Q2 (September 2019) to compare to SentinelOne because Total Revenue and ARR were by far the closest.

Revenue and ARR I count as a win for SentinelOne, with slightly higher YoY growth rates at a similar scale.

NRR (Net Retention Rate) is also a victory for SentinelOne at 8 points higher than CrowdStrike. 126% is strong, but 134% is best-in-class.

Margin is where FY2020 CrowdStrike edges out SentinelOne, and at least partially explains CrowdStrike's lower growth rate. From studying SentinelOne, I know that stock based compensation (SBC) and hiring costs have driven operating costs through the roof, causing GM to appear strong while OPM pales in comparison.

SentinelOne is choosing to spend opportunistically in a challenging labor market to drive growth, which I concur with at a high-level. I know that for SentinelOne, margins have been improving consistently QoQ and YoY, and it is something I continue to monitor as a critical part of my investment thesis. If SentinelOne doesn't show that they can catch up to CrowdStrike on margins, it will be a deal breaker for me.

When it comes to cash and cash equivalents, SentinelOne is reaping the benefits of IPO-ing in a technology bull market. A $400M difference isn't chump change, but I think that both cash balances are well within the range of enabling a runway for growth. 3 years later CrowdStrike is a free cash flow (FCF) machine, and I believe that after looking at the KPIs, it's not crazy to think that SentinelOne will follow their lead.

Finally, market cap. In mid to late 2019 CrowdStrike was valued at $14.26B. That's 3.6x SentinelOne's market cap of $3.92B today.

Conclusion

Present day SentinelOne and FY2020 Q2 CrowdStrike are fundamentally similar companies. While SentinelOne takes the cake in revenue and ARR growth, cash, and NRR; CrowdStrike makes up for lost ground with wins in gross and operating margins. These differences are likely due to variance in management and go-to-market strategy, in addition to operating in disparate economic environments.

Despite these differences, it's clear that the companies are on a comparable if not identical trajectory. And yet, you can see the stark contrast in valuation, both historically and present day.

I think once the market begins to appreciate the similarities between the companies, in addition to the fundamental advantages that SentinelOne has over CrowdStrike, the share price will catch up. Until then, I'll continue to DCA.

Resources

If you're interested in learning more about SentinelOne, CrowdStrike, and/or next-gen cybersecurity in general, here are some helpful resources:

- Twitter thread comparing SentinelOne and Crowdstrike from 2021

- Finviz - SentinelOne

- Finviz - CrowdStrike

- My SentinelOne FY23 Q3 earnings highlights

- SentinelOne FY23 Q3 Shareholder Letter

- CrowdStrike FY20 Q2 earnings press release

- Twitter thread about SentinelOne

- Tweet breaking down SentinelOne's acquisition of Scalyr

My Portfolio

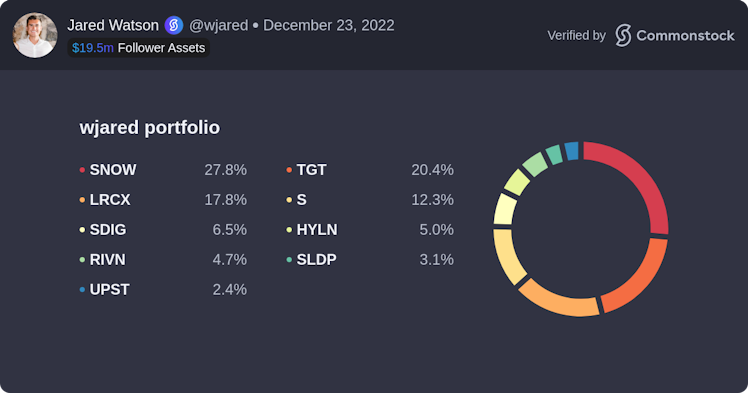

If you've made it this far, stay a little while longer and check out my portfolio. As you can see, SentinelOne is a top 5 position for me and one that I consider a core holding.

X (formerly Twitter)

Francis (@InvestiAnalyst) on X

Platform benefits of Crowdstrike (Humio) and SentinelOne (Scalyr) below:

My prediction is that over the next 2-3 yrs, we'll see Snowflake (and somewhat Databricks) begin to compete against security companies for who can store/ingest the best log + event data.

Watch this space.

Already have an account?