Trending Assets

Top investors this month

Trending Assets

Top investors this month

Replacing equity exposure with options + USDC on Voyager

The investment strategy laid out in this post utilizes USD Coin (USDC), a cryptocurrency known as a stablecoin and pegged to the US dollar, and Voyager, an app-based digital asset trading and financial services platform.

USDC is issued by Circle, a US-based company which is currently expected to go public in the US via SPAC combination with Concord Acquisition Corp (NYSE: CND). USDC is fully backed by USD and treasuries and is seen as the most stable, reliable and resilient stablecoin in the market, but is potentially subject to unknown risks stemming from the crypto economy and/or regulators. For example, in a worst-case scenario, one might conceive of regulators freezing and/or confiscating crypto assets, including USDC.

Voyager (TSE: VOYG | US OTC: $VYGVF**) is a publicly traded company on the Toronto Stock Exchange and US OTC. If you’re unfamiliar with different crypto platforms, you can think of it like Coinbase.**

USD deposits on Voyager are FDIC insured. However, USDC and other digital asset holdings are not FDIC insured, and in the event that Voyager were to go bankrupt, depositors of digital assets might lose some or all of their deposits.

Read more about Voyager and USDC here and here.

I highlight these risks upfront because other stablecoins, most recently Terra (UST), which was an algorithmic stablecoin not fully backed by USD, have lost their peg and gone to effectively zero. USDC’s primary competitor and the stablecoin with the largest market share currently, Tether (USDT), is another “fully backed” stablecoin but there have been doubts about the nature and quality of the assets backing USDT.

While Voyager doesn’t support algorithmic stablecoins, they do support USDT. If USDT were to lose its peg, it’s not clear to me what the ramifications would be Voyager as a company. As such, I consider the risks to include bankruptcy and potential customer forfeiture of some or all of their digital assets on the platform.

I consider these tail risks, perhaps of the nature inherent to almost any investment. As such, I do not recommend putting 100% of your capital in this trade, even though I will refer to aspects of the trade below as risk-free for simplicity of communication. Owning USDC is not risk-free in the sense that owning USD is risk-free, and some (but surely not all!) of the risks specific to USDC have been covered above.*

NOT INVESTMENT ADVICE!!!

Now, on to the fun part :)

If you’re like me, in between pondering if you’re just completely wrong about everything recently you might have been pondering how to take advantage of Voyager’s high interest rates on USDC without reducing your exposure to stocks or crypto after a 60% drawdown.

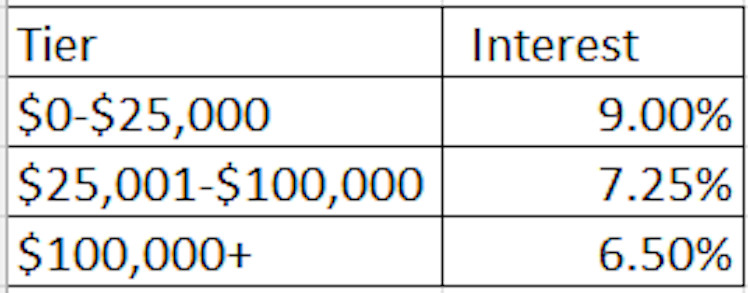

Currently, you can get paid interest on USDC held on Voyager according to the following tiers:

Just straight selling everything and investing $100k at a risk-free* blended 7.69% is not a bad option. In fact, it’s a really, really good option. The long-run average annual return for the S&P 500 is ~8%.

In hindsight, this would have been a great option in, say, November 2021. But punching out of the stock market now after the S&P 500 just suffered its worst start to the year through April since World War II might not be best time to find religion with respect to your investments (or maybe it is!).

But what if I told you you could have your cake and eat it too? Retain all of your equity exposure and protect your capital in the event we are in a multi-year bear market and stocks still have much lower to go?

The Trade

Imagine you own 100 shares of SPY at today’s closing price of $412.93 for a total investment of $41,293. By using long-dated call options and utilizing Voyager’s interest rates on USDC you can retain 100% of the upside of owning 100 shares of SPY and limit your downside to +4% over the next 2.5 years.

Yep, that’s right. Your risk " is +4%.

If the S&P 500 falls by 50%, you make 4%.

If the S&P 500 gains 50%, you make 54%.

All of the reward and none of the risk.

Here’s how (prices reflect 5/31/2022 last traded prices):

- SELL: 100 shares SPY @ $412.93 for $41,293

- BUY: 1 $410 (at-the-money) strike SPY call option expiring 12/20/2024 for $6,380

- BUY: $34,913 USDC on Voyager

By replacing your stock portfolio with options, you limit your losses to the premium paid, in this case $6,380.

Of course, typically the trade-off for limiting your downside by using call options is a commensurate reduction of your upside. It’s like buying insurance. It only pays off if shit hits the fan.

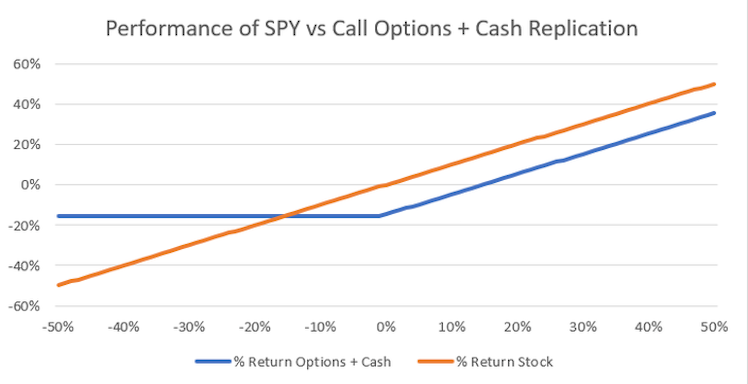

A typical call option payoff profile looks like this:

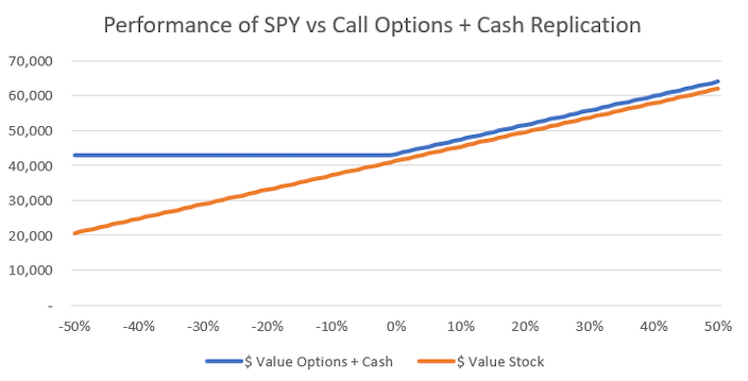

The y-axis is the portfolio % return. The x-axis is the % return of the underlying equity.

The blue curve represents the % return of the option + cash portfolio. It’s losses are capped at -15.5% (the flat left half of the blue curve), which represents the premium paid to acquire the option ($6,380 loss). No matter how low the underlying equity goes, you can only lose what you paid for the option. But on the upside the option + cash portfolio underperforms by the cost of the option (illustrated by the blue curve being below the orange line for all positive returns of the underlying equity).

The orange line represents the % return of the all stock portfolio. The orange line is just y = x.

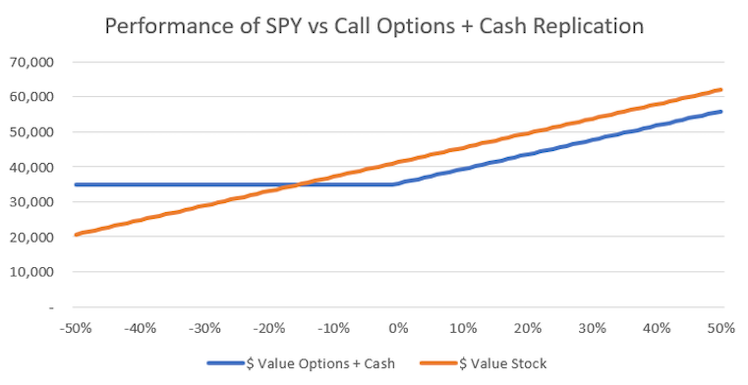

Here’s the same payoff profile using portfolio $ value for the y-axis instead of % returns. Remember our starting portfolio is $41,293, indicated by the intersect of the orange line at 0% return.

Options are a capital efficient way to get exposure to financial asset prices. Said differently, they have embedded leverage.

In the trade above, you gain exposure to $41,293 worth of SPY but only have to put up $6,380 to do it. Now you’ve got SPY exposure and $34,913 in cash laying around.

The payoff profiles above assume you don’t earn any return on that cash. For the better part of the last 15 years, that has been an accurate assumption and thus this trade hasn’t been as exciting. The unique opportunity we are presented today arises from the fact that we can invest a stable, dollar-pegged, risk-free asset in USDC at advantageous interest rates of up to 9%.

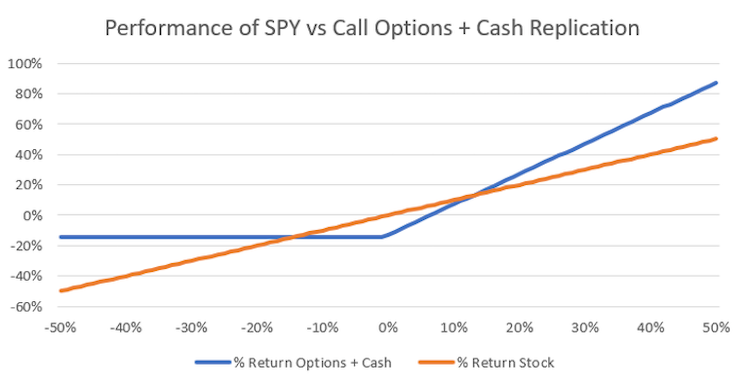

Let’s look at these payoff profiles again, this time assuming we invest the $34,913 in USDC on Voyager at the tiers offered above.

Notice that the blue “options+cash” curve is now permanently above the orange “stock” line. The rates we can get on USDC are so good that we can more than recoup the premium paid for the call option in interest paid on USDC over our holding period, which is determined by the expiration date on our option, 12/20/2024 (2.56 years from now).

The blended interest rate on $34,913 invested in USDC on Voyager is 8.5%. $34,913 compounded at 8.5% for 2.56 years = $43,026 for a $8,113 gain on investment.

This $8,113 gain more than pays for the $6,380 premium on our option!

Thus, by replacing our 100 shares of SPY with a 12/20/2024 $410 strike call option and cash invested in USDC on Voyager, we can create a portfolio with more return for less risk.

We effectively get paid to take on an insurance policy. We lock-in a minimum 4% portfolio level gain over the 2.56 year holding period while retaining all of the upside if the market takes off.

Reward: check. Risk: none*.

Absent tax consequences or an inability or aversion to holding options and/or USDC on Voyager (fair!), or a view that the interest rates on USDC are going to imminently collapse (also fair!), there’s not a good reason in my mind to continue holding SPY exposure when implied volatility is this low in this environment and you can earn 9% on cash.

The Other Trade

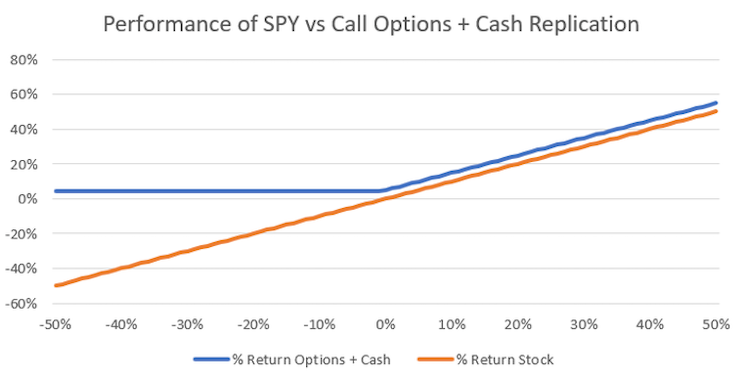

Let’s say you actually have a view stocks have bottomed and expect decent returns from here over the next couple years. You’re willing to take on a little downside risk for some more upside exposure.

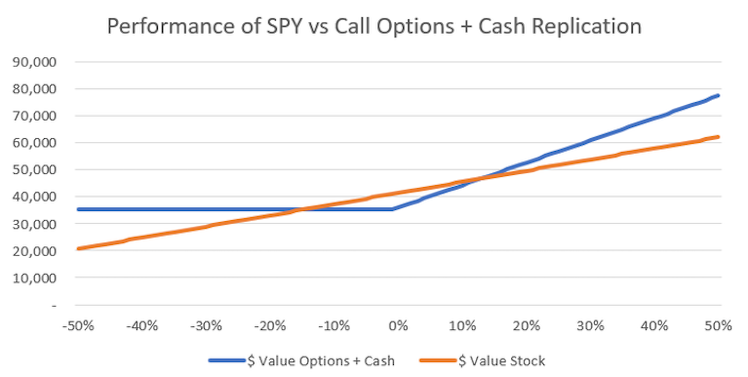

By purchasing two options contracts instead of one, you can juice your returns and get a more convex payoff curve.

- SELL: 100 shares SPY @ $412.93 for $41,293

- BUY: 2 $410 (ATM) strike SPY call options expiring 12/20/2024 for $12,760

- BUY: $28,533 USDC on Voyager

Now you’re risk is truncated at -14% since you’re spending twice as much on premium and have less cash left over to invest in USDC.

Notice now we also have some area where the blue payoff curve is below the orange payoff line of simply owning equity. If SPY returns all in a range of -14% to 12% from now until 12/20/2024, we will have performed worse than if we had just continued to hold SPY.

But notice also how we start to outperform more and more for higher returns of the underlying SPY. If SPY gains 50% from here, this portfolio returns a whopping 87%, as opposed to the 54% in our risk-free* portfolio construction above. With a 50% gain in SPY during our holding period, this portfolio grows to a nominal $77,265 vs. the prior portfolio’s $63,955. This turbocharged portfolio has better returns for all returns of the underlying SPY 18% or greater.

What we have created is functionally a way to maximize returns on the view that the stock market is going to rebound strongly from current levels over the next 2.5 years, while keeping a parachute in our back pocket in case we’re totally wrong. In a sideways market, we end up leaking capital.

A Few Considerations…

- Your actual returns won’t precisely match the payoff curves above due to other factors that influence the price of your option, namely time to expiry and volatility. But if you hold all the way to expiry (when time value and volatility = 0) your payoff curve will match the graphs above.

- Why the 12/20/2024 expiration date? It’s simply the longest-dated option available currently. We want to utilize the longest-dated option available to us because the time-value decay on the option will be the slowest. If you do this trade, you’ll want to keep an eye on the options chain and probably roll your exposure into the longer dated expirations as they are listed, absent any tax consequences or an updated view (e.g. more bullish or bearish).

- This trade only works as advertised if Voyager continues to offer the same interest rates on USDC for the duration of the trade. If the rates adjust down (or up!), the model inputs need to change and the trade reconsidered. Here is a google sheet with the model that produces the payoff curves above. The inputs, including interest rates on USDC, are in blue. Change the static blue inputs and the payoff curves should adjust dynamically.

- Taxes! Before you run out and sell all your equity exposure to buy options, consider taxes. If you sell equity you might have a taxable event (if you have a gain). If you have a loss, replacing exposure with options may be considered a wash sale. If it is a wash sale, your cost basis on your new position is adjusted upwards by the amount of the loss (i.e. you don’t lose your capital loss in a wash sale, you just don’t incur it yet - it remains unrealized).

- One disadvantage of holding options instead of equity is you have a forced taxable event when the option expires. Simply holding SPY, in the example above, might be more tax efficient depending on your tax status.

- You can do this with any stock or ETF that has listed options! I just used SPY for illustrative purposes. One caveat though - options cover 100 share lots of the underlying, so you need to have at least ~100 shares of the underlying in order to accurately replace your exposure with options. If you have 200 shares of the underlying, you buy two options contracts to match the exposure; 300, three, etc. As such, replicating this trade is probably only feasible for most retail investors with either large index positions or positions in individual stocks with lower nominal stock prices. Not too many people can afford 100+ shares of AMZN or GOOG (pre-split).

- This trade is most attractive on a relative basis for equities that have low volatility, since options premiums on low-vol stocks are lower.

- For example (considering points 6 and 7) I’m executing this style of trade in my portfolio right now on DBX, ANGI, ATUS, and KRBN. I modeled it for ARKG and SNAP, but the implied volatility on these equities is so high that the option premium costs more than the potential gain on investment in USDC, making this a less attractive trade for continued ARKG or SNAP exposure.

- If you like this trade in theory but don’t want to fux with anything on crypto rails right now, Series I Savings Bonds are currently yielding 9.62%. It’s a 30 year bond redeemable with no penalty after 5 years and with a 3-month interest penalty after 1 year. The rate is linked to CPI inflation and resets every 6 months. The maximum investment is $10,000 per individual per year.

Thanks to Harley Bassman (@convexitymaven on Twitter) for the idea that inspired this trade. Here’s a link to his piece from November 2021 where he explains what I try to explain above, but way better. If I only I’d have listened to him then…

Disclosure: I own USDC, DBX+calls, ANGI+calls, ATUS+calls, KRBN+calls and ARKG

Already have an account?