Trending Assets

Top investors this month

Trending Assets

Top investors this month

Weekly Economic Commentary and Portfolio Update 📈

Below is a paraphrase of the full portfolio update and market review article I write weekly. Click here for a full portfolio with more statistics, an economic review, plus a break down of all my trades (which you can see in my Commonstock profile as well).

Market Review

"This week the S&P 500 broke a seven-week losing streak. Last Friday the S&P hit its lowest level since March of 2021, only to rally back a strong 6.6% this week. The NASDAQ did better with a gain of 6.8% while the DOW was at 6.2%.

All eleven sectors of the S&P finished positive with consumer discretionary leading the way with a 9.2% performance to follow its rather disappointing performance last month. The sector still down over 5% for the month of May, largely due to the terrible showing of large retailers being shocked by inflation and supply chain concerns. However, the second half of this past week saw renewed gumption from the retailers with hopes that the worst is behind us. This is evident if the performances of Best Buy ($BBY), Costco ($COST), Target ($TGT), and Walmart ($WMT) with respective gains of 16.7%, 12.2%, 8.3%, and 7.7% for the week.

Mega caps also did some work with Apple ($AAPL), NVIDIA ($NVDA), and Tesla ($TSLA) contributing to the rally with similar gains.

Through this rally, the energy sector continues to show strength and is up to almost 17% gains for the month of May. Crude oil is back to its high prices for the month.

Treasuries continued their gains for the third consecutive week this week, drawing some strength from speculation that the Fed could pause its rate hikes in September.

Portfolio

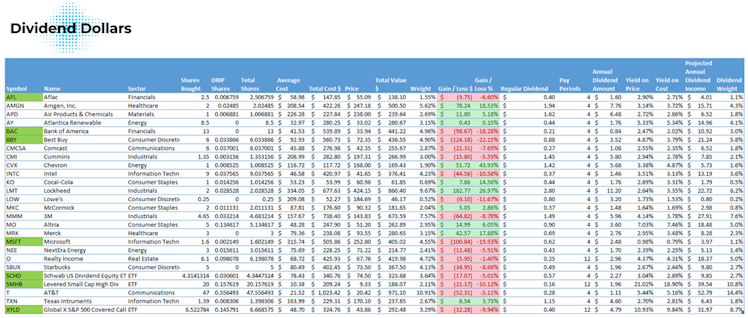

To date, I have invested $9,100 into the account, the total value of all positions plus any cash on hand is $9,531.06. That’s a total gain of 4.74%. The account is $448.18 for the week which is a 4.93% gain, after briefly being in the negative territory last week.

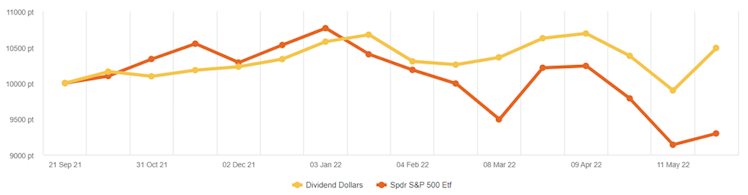

I love tracking my portfolio against a benchmark like the S&P. The above chart comes from Sharesight which makes portfolio and dividend management a breeze!

Below is a table of everything we are invested in so far. There you can see my number of shares, shares bought through dividend reinvestments, average cost, gains, and more. The tickers in green are positions that I bought shares in this week.

Dividends

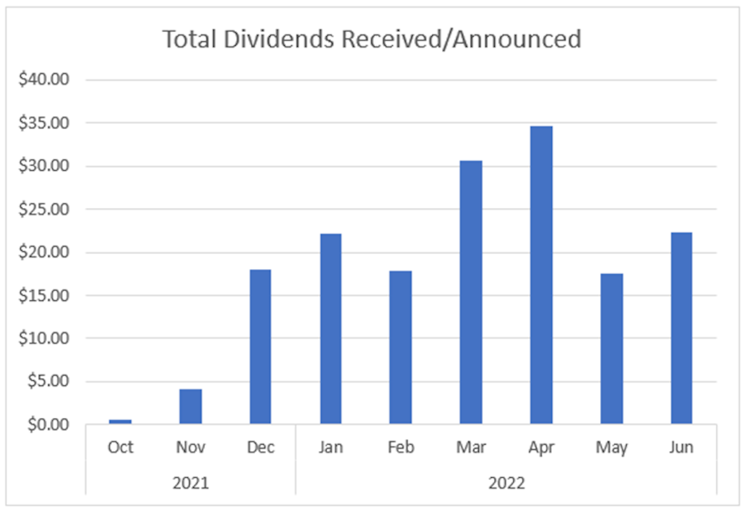

This week we received two dividends. $1.84 from ETRACS levered dividend ETN ($SMHB) and $2.45 from Starbucks ($SBUX).

In my portfolio, all positions have dividend reinvestment enabled. I don’t hold onto the dividend, I don’t try to time the reinvestment, I just let my broker do it automatically. All dividends were reinvested.

Dividends received for 2022: $122.84

Portfolio’s Lifetime Dividends: $145.76"

Sharesight

Sharesight for Dividend Dollars followers

Dividend Dollars followers: Save 4 months on an annual premium Sharesight plan.

Already have an account?