Trending Assets

Top investors this month

Trending Assets

Top investors this month

Compound Collaboration, Month #14

Every month I put aside some money into a portfolio aimed at long-term bets over the next 20 years. I will be gifting this portfolio to my future kids someday. I hope to use these memos as an educational tool to teach them about the world. With any luck, managing the portfolio will become a shared activity to collaborate on as they grow up.

It is one of the main reasons why I invest.

Performance from the first 13 months:

Month #1 Aug 2020: $ARKK +32%

This month's addition: Ethereum

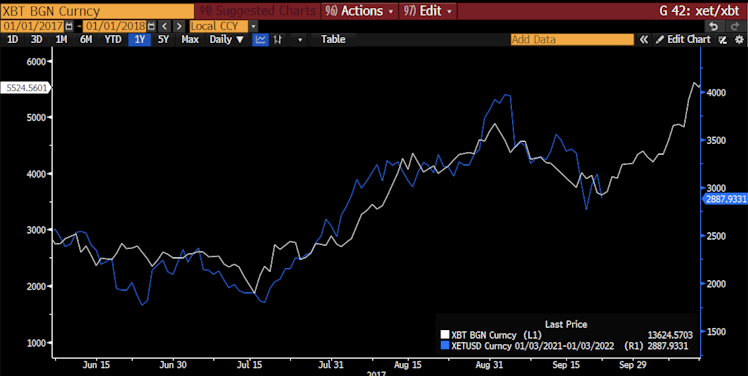

The bet is that Ethereum in 2021 is like Bitcoin in 2017. Here's the chart:

If this correlation continues through the end of the year, Ethereum could end up anywhere between $10k and $20k.

The theory for why the two are so correlated is that both are priced using Metcalfe's law.

Metcalfe's law states that the value of a network is proportional to the square of the number of connected users of the system.

Example: A single phone is useless, but the value of every phone increases with the total number of additional phones in the network, because the total number of people with whom each person can call increases exponentially. Similarly, in social networks, the greater the number of users on the platform, the more valuable it becomes to the community.

Ethereum, like Bitcoin in 2017 is becoming exponentially more valuable as more people join the network.

en.wikipedia.org

Quadratic growth - Wikipedia

Already have an account?