Trending Assets

Top investors this month

Trending Assets

Top investors this month

@piggyback

Johan Eklund, CFA

$12.2M follower assets

866 following337 followers

ESG Investing Is A given! Or Is It?

Because who would not want to "do good" if given the choice... Right?

Well, the devil is not in the pretty marketing slide deck packaging but in what's in the box.

Here both ESG (Environmental, Social and Corporate Governance) Investing embracers and their recent "Anti-ESG" opponents are arguable a bit too naive and dogmatic.

Finance Professor Aswath Damodaran gave a great recent presentation on why ESG has its share of basic conceptual problems. Anyone interested should take 18 worthwhile minutes to watch.

3-letter acronym consultant checklists, or their inverse (Anti-ESG), are not a very reasonable guide to how societies' long-term capital should be allocated by big businesses and states.

Well-regulated capitalism works by a series of very "unfair" and messy tradeoffs, but it has

steadily propelled human progress in the process.

Inspired by this, Your Analyst's latest edition of PiggyBack Newsletter features an article on why we should just stop outsourcing subjective morality and virtues to short-term populism:

This issue also features:

- A bear market value investing strategy comment, shared @commonstock here.

- "PiggyBack's Value Elsewhere" links, to free, worthwhile investing content with long "shelf-life"

Your Analyst,

Johan Eklund, CFA

PiggyBack

PS: You may want to consider subscribing (for free!) if you appreciate PiggyBack! Also, any likes, reposts, or follows @piggyback are highly appreciated! 🐖🐖🐖

www.piggyback.one

ESG = Emperor Sans Garments(?)

The consensus ESG investing movement provokes an inverse "Anti-ESG" reaction. Human progress through capitalism is a series of messy tradeoffs. Wise investors look inward for "fairness" and virtues.

Strategy: Cool Bear Market Heads Prevail

Value investing in bear markets requires keeping a cool head.

- Initially, a cool head NOT to buy

- Here we must avoid relative “value” trades that only anchor on percentage drawdowns from peak valuation, or on relative multiples versus peer investments.

- But also value traps, with deteriorating absolute fundamentals and no clear catalysts.

- Eventually, a cool head if we reach truly depressed valuations, in absolute and intrinsic value discount terms.

- There we need it to buy bargain opportunities as aggressively as allowed for by risk mandates and prudence.

Most human investors will make errors of both (1.) commission and (2.) omission. Our emotions and market sentiment become less reliable during periods of more extreme price movements.

As value investors, we can try to reduce making large errors in stressed markets by reducing the puzzle to good old boring fundamentals.

This was a @commonstock republication is of an article in PiggyBack Letter 7/2022:

This issue also features:

- A main ESG Investing-critical (and anti-ESG-critical) article. An intro has been shared @commonstock here

- "PiggyBack's Value Elsewhere" links, to free, worthwhile investing content with long "shelf-life"

Your Analyst,

Johan Eklund, CFA

PiggyBack

PS: You may want to consider subscribing (for free!) if you appreciate PiggyBack! Also, any likes, reposts, or follows @piggyback are highly appreciated! 🐖🐖🐖

www.piggyback.one

ESG = Emperor Sans Garments(?)

The consensus ESG investing movement provokes an inverse "Anti-ESG" reaction. Human progress through capitalism is a series of messy tradeoffs. Wise investors look inward for "fairness" and virtues.

Strategy: Cool Bear Market Heads Prevail

Value investing in bear markets requires keeping a cool head.

- Initially, a cool head NOT to buy. Here we must avoid relative “value” trades that only anchor on percentage drawdowns from peak valuation, or on relative multiples versus peer investments. But also value traps, with deteriorating absolute fundamentals and no clear catalysts.

- Eventually, a cool head if we reach truly depressed valuations, in absolute and intrinsic value discount terms. There we need it to buy bargain opportunities as aggressively as allowed for by risk mandates and prudence.

Most human investors will make errors of both (1.) commission and (2.) omission. Our emotions and market sentiment become less reliable during periods of more extreme price movements.

As value investors, we can try to reduce making large errors in stressed markets by reducing the puzzle to good old boring fundamentals.

This was a @commonstock republication is of an article in PiggyBack Letter 7/2022:

This issue also features:

- A main ESG Investing-critical (and anti-ESG-critical) article

- "PiggyBack's Value Elsewhere" links, to free, worthwhile investing content with long "shelf-life"

Your Analyst,

Johan Eklund, CFA

PiggyBack

PS: You may want to consider subscribing (for free!) if you appreciate PiggyBack! Also, any likes, reposts, or follows @piggyback are highly appreciated! 🐖🐖🐖

www.piggyback.one

ESG = Emperor Sans Garments(?)

The consensus ESG investing movement provokes an inverse "Anti-ESG" reaction. Human progress through capitalism is a series of messy tradeoffs. Wise investors look inward for "fairness" and virtues.

PiggyBack's Value Elsewhere (PBL #6 2022)

PiggyBack Letter #6 2022 is out(!) 🖨️

In the new "PiggyBack's Value Elsewhere" section we offer value investing content and other recently enjoyed curiosities with “shelf-life”.

CHARTS:

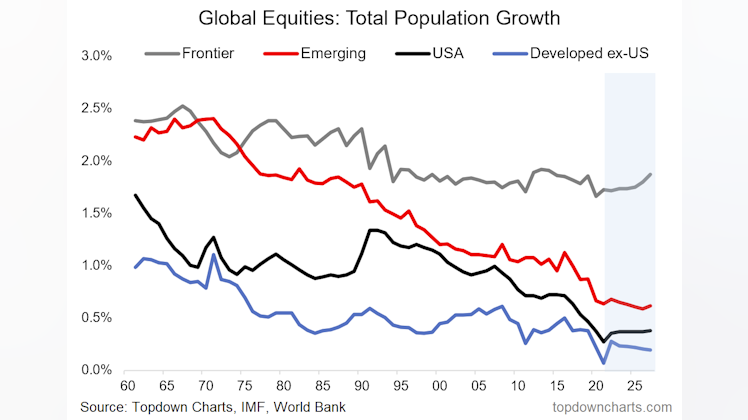

Chart of the Week - Global Equity (Population) Growth (~2 min)

An easy-to-forget demographic challenge for the world economy: population growth is stalling to a near halt in Developed Markets, and to very low levels in Emerging.

Chart by Callum Thomas’ paid publication Topdown Charts. Mr. Thomas also publishes the free The Weekly S&P500 #ChartStorm, a PiggyBack Recommendation.

Combine with populations that generally (1) are getting older and (2) already have seen women joining the workforce. This means that the Developed and Emerging world will have to do without the historical tailwind of a steadily growing labor supply.

Optimists look to Frontier Markets for more predictable demographic tailwinds. S&P Global Ratings have highlighted Sub-Saharan Africa in particular.

LISTEN:

The Wolf in Cashmere’s Conglomerate (~53 min)

Ever wondered about the origins and playbook of global luxury conglomerate LVMH? (Moët Hennessy Louis Vuitton, Euronext Paris ticker: MC)

Mr. Christian Billinger, CFA, a Swedish investor operating the private family holding company Billinger Förvaltnings AB, breaks it all down. Get great insight into the economics and practical realities of investing in true luxury. Hint: Quite different from performance-focused premium brands. Host: Zack Fuss for Business Breakdowns

READS:

BEEPING Holding Company Discounts (~10 min read, ~2 min comment)

“For various reasons, holding company discounts are evident across the world. Most management teams shrug their shoulders when the right thing to do for shareholders is to just spin off their holdings. However, a corporate manager’s natural compulsion is to preside over the largest possible empire rather than a smaller one.”

— David Eborall, CFA portfolio manager SaltLight SNN Worldwide Flexible Fund

SaltLight SNN Worldwide Flexible Fund published an interesting investor update this summer. Portfolio manager David Eborall’s topic was holding company discounts. Specifically, the value that insiders and major shareholders can unlock from big discounts.

SaltLight’s example was extreme: the Amsterdam/Johannesburg-listed holding company Prosus (ticker PRX for both, and U.S. ADR $PROSY). Prosus's main asset is a long-term stake in the Chinese Internet giant Tencent (Hong Kong-ticker HKG: 0700, U.S. ADR $TCEHY). Earlier this year, the market value of Prosus’s Tencent stake was around twice Prosus’s total market value.

This means the market was so pessimistic that one could buy Prosus shares to:

- Get indirect Tencent exposure for only half price.

- And get the rest of Prosus “for free”. (This remaining portfolio at the time had got a low accounting book value, compared to the Tencent stake.)

Professional speculators: One could also buy Prosus while short-selling Tencent. This creates a purer bet on a narrowing Prosus discount. More or less isolated from Tencent’s short-term share price movements.

Your Analyst has nothing intelligent to add about Tencent’s valuation at this moment. Most of our readers should however sense the bargain opportunity. PiggyBack will hopefully get to offer readers a fair share of digging deeper into holding discounts.

PiggyBack Letter #6 2022 also includes a simple longer-term stock market outlook comment by PiggyBack, as of August 2022. Shared here @commonstock.

Your Analyst,

Johan Eklund, CFA

PiggyBack

PS: You may want to consider subscribing (for free!) if you appreciate PiggyBack! Also, any likes, reposts, or follows @piggyback are highly appreciated! 🐖🐖🐖

Topdown charts is always fun to read.

Beware Of Undercurrents – Especially In U.S. Stocks (August 2022 PiggyBack Market Comment)

The stock market's surface lays still after a summer recovery rally. So things are rosy? Not really. Long-term investors face fundamental undercurrent risks, especially in U.S. stocks.

August 2022. A treacherous calm has set in on the global stock market’s surface after a summer recovery rally. Sentiment- and macro-wise, this may look/walk/talk/smell like a bear market rally. So market strategists and traders suggest tactically reducing risk exposure as the sensible thing in the short run.

If they are wrong? A “pain trade” for short-term market timers would be "recovery" to new levels of low-interest rate market craziness. Fear Of Missing Out (FOMO) all over.

We are not in the business of making or trading these shorter-term market calls. PiggyBack is in the business of making long-term fundamental risk-reward calls.

Strategically, there are a few important stock market undercurrents to beware of today. Fundamental forces that will affect the long-term investor's expected returns. Beyond the next month/quarter/year leg price move in the markets.

Medium Term Risk: The Inflation Problem

Let’s say inflation does not come down fast with increased interest hikes into a global recession. Then we have a stagflation problem. (As we discussed here.) Here it is better to be safe than sorry in equity portfolio risk management.

But playing safe does not need to mean market timing, in terms of selling everything in hope of being able to buy back cheaper. As long-term investors, we can also express the inflation risk in our security selection.

Until the inflation shock is under control there is a clear risk of lower equity valuations:

If central banks fight inflation credibly with (much, much) higher interest rates, those interest rates mean higher discount rates and lower valuation multiples on stocks. Here the highest valuation multiple, “glamour” stocks are most susceptible to return headwinds. They get crushed via falling share prices, the classic valuation multiple compression. Especially if their businesses are cash-flow negative and rely on issuing new equity to keep their doors open. Like many recent year unprofitable growth tech darlings and SPAC IPOs. Falling share prices here means worsening dilution of existing shareholders, with each new round of capital needs.

Lower earnings/asset quality business stocks may face severe headwinds if higher interest rates deepen a recession. Even risks of being impaired in a restructuring/bankruptcy if cyclical customer demand drops to where it no longer supports fixed costs or debt loads.

And if central banks capitulate and let inflation run to “save” the economy, the same lower earnings/asset quality stocks may still destroy capital, only more slowly but steadily. Here the problem is lacking pricing power, to compensate for long-term cost inflation on inputs and reinvestment.

Note that low quality businesses include low quality value stocks. If shareholders do not demand strategic asset sales, mergers or liquidation in time, their initial asset discounts are like melting ice cubes.

So where to hide in stocks?

One can try to position in at least some stocks with built-in inflation protection, or even inflation upside. Think commodities, energy, infrastructure, utilities, staples, and well-positioned suppliers to such industries.

Another option are strong pricing power asset-light “quality” businesses with non-cyclical demand. Easier said than done to buy these at discount valuations, but bear markets present some such opportunities.

Related to inflation-fighting via higher interest rates are risks of tighter financing conditions. Given the levels of debt that have been propped up by near-zero interest rates and central bank purchases, expect some things to break if inflation interest rates continue higher.

While the timing, chain of events, and collateral damage in terms of regions and sectors are uncertain, major stress events to the global financial system are a recurring phenomenon after long periods of credit expansion. It is prudent to plan for short-term credit to tighten or dry up:

- Refinance for longer maturities and fewer covenants on any well-motivated financial, business, and personal debt leverage.

- The same goes for stock-picking. Avoid firms that depend on highly levered, short term debt profiles to produce meaningful shareholder returns.

- A positive leverage case can be found in firms that lock in attractive long-term debt against some convincing long-term investment plans. While not without risk, properly used leverage can create long-term printing presses. Debt creates the opportunity to build real equity as inflation reduces the debt’s real payback value. Debt also provides a cash tax shield, so that more current income can be reinvested or distributed.

Long Term Risk: The U.S. Valuation Problem

Geographically, the U.S. stock market is still historically expensive. See for example Research Affiliates’ excellent cyclically adjusted P/E (CAPE) summary.

The basic fundamentals: U.S. stocks price in low interest rates and near-record profit margins. In the long run. Nothing new here, but still time to reconsider. If we are to make a macro bet, do U.S. equity valuations provide worthwhile “bang for the buck” (risk reward)? Your Analyst doubts it, more broadly speaking. A market that is not a good value will still have its pockets of value though.

Long-Term Opportunity: Global Value

Let's end on a positive note. Research Affiliates' data also highlights an aspect overlooked by today’s U.S.-focused equities bears:

Many regions around are already getting more reasonably priced, or even cheap. Both from historical and fundamental valuation perspectives.

Global diversification we have already discussed. An active, long-term investor making use of that opportunity should currently have no lack of value stocks to pick apart. And PiggyBack.

This was a @commonstock republication of "Beware Of Undercurrents", an August 2022 stock market comment from PiggyBack. All references are to the original article.

Johan Eklund, CFA

PiggyBack

PS: You may want to consider subscribing (for free!) if you appreciate PiggyBack! Also, any likes, reposts, or follows @piggyback are highly appreciated!

www.piggyback.one

Beware Of Undercurrents (PiggyBack August 2022 Market Comment)

The stock market's surface lays still after a summer recovery rally. So things are rosy? Not really. Long-term investors face fundamental undercurrent risks, especially in U.S. stocks. (PBL #6 2022)

Takeaway on Robert Heilbrunn: An Original PiggyBack Investor

Warren Buffett, Benjamin Graham, and Walter Schloss.

One man invested with them all early on.

Long before track records and teachings made them, more (Buffett) or less (Schloss), household value investing names.

The man was Robert Heilbrunn (1908–2001). So what can we learn from him?

Robert Heilbrunn. From circa 1990s group photo (with Markus Stoffel and Harriet Heilbrunn). Photo credit: The Rockefeller University (unknown photographer)

PIGGYBACK TAKEAWAY

With experience, we may realize how little we know what others know. Then we may start seeing some peers, role models, and competitors as great investing opportunities.

This does not mean that we have to become fully passive, fund investors. Think of it more as expanding our current abilities. By allocating capital with or in the spirit of unique investors and entrepreneurs, we can get in on:

- More attractive fundamental setups (that we might not have found ourselves)

- Hard-to-access or exclusive term deals

- Superior investment execution

If available in public markets, as minority investors we can "piggyback" with liquidity.

So lose some of that active investor ego. Like Robert Heilbrunn, we should be on the lookout for our hard-to-copy investing superiors.

This was a @commonstock preview of "An Original PiggyBack Investor", Your Analyst's look into Robert Heilbrunn's value investor life lessons. All references are to the original article.

PiggyBack Letter #5 2022 features the rest of this article, plus some modern-day value investing link curiosities already shared @commonstock.

Johan Eklund, CFA

PiggyBack

PS: You may want to consider subscribing (for free!) if you appreciate PiggyBack! Also, any @commonstock likes, reposts, or follows @piggyback are highly appreciated! 🐖🐖🐖

www.piggyback.one

An Original PiggyBack Investor

Robert Heilbrunn went from client and student to investment research associate of Benjamin Graham. In time, Heilbrunn found his edge in piggybacking on other, selected value investors. (PBL #5 2022)

PiggyBack's Value Elsewhere (PBL #5 2022)

PiggyBack Letter #5 2022 is out(!) 🖨️

Slightly new format: The free letter now ends in a few selected highlights of recent value investing and other, longer "shelf-life" free, learning curiosities. (= not news)

Listen:

I Beg to Differ (~47 min)

“I believe most investors have their eye on the wrong ball. One quarter’s or one year’s performance is meaningless at best and a harmful distraction at worst.”

Howard Marks, Co-Chairman of Oaktree Capital, goes back to key principles on why investing outperformance requires long-term, contrarian thinking (Recommendation).

The Bear Has Arrived (~1h 22 min)

Jeremy Grantham, co-founder & Chief Investment Strategist of GMO, on the pandemic hangover. Trey Lockerbie hosts for TIP Network (Recommendation).

(Yes, still multi-year relevant. The summer bear market rally did not improve a poor fundamental return outlook for U.S. stocks. It brought back a valuation headwind.)

William Thorndike, investor and author of capital allocation case bible The Outsiders, has launched a new podcast called 50X on a long-term compounding research project. Here, Thorndike serves a great introduction to 50X’s deep dives into Transdigm’s ($TDG) capital allocation. Hosting the host: Patrick O'Shaughnessy of Invest Like the Best (a colleague in 50X's pod network).

Read

I Beg to Differ (~20 min)

Pattern recognition on how investments in publicly listed businesses with strong microeconomics are not victims of periods of tanking stock prices, but potential great long-term beneficiaries. (Hint: disciplined, valuation-driven capital allocation.) Via Jake Taylor, CEO Farnam Street Investments. Autozone ($AZO) serves as an example.

Understanding Jane Street (~20 min)

An interesting analysis on competitive dynamics and technical mechanics in play at proprietary trading shop Jane Street. By The Diff’s Byrne Hobart (Recommendation).

Charts

Reminders that global stocks remain less stretched than U.S. and that U.S. small-caps are breaking. Callum Thomas The Weekly S&P500 #ChartStorm (Recommendation).

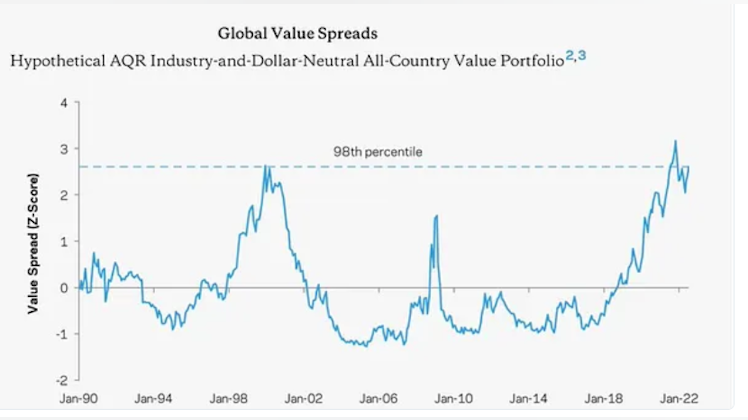

Is Everyone Out There Cray-Cray? (~1 min)

Clifford Asness, co-founder of AQR Capital Management, provides a (rhetorical?) question. The below chart shows the global relative cheapness of the “value” factor. In simple terms, the statistically lowest valuation multiple stocks trade at near modern history record discounts, to the highest multiple “glamour” ones.

In hindsight, the bursting and aftermath of the first Internet Bubble was a decent time to be picking up “old economy” value stocks. Eventually, the more robust shiny tech stuff muddled through and could be had at “low conviction” prices.

PiggyBack Letter #5 2022 also includes PiggyBack's learning from Robert Heilbrunn, a

Benjamin Graham client, student, and research associate. An original PiggyBack Investor.

Your Analyst,

Johan Eklund, CFA

PiggyBack

PS: You may want to consider subscribing (for free!) if you appreciate PiggyBack! Also, any @commonstock likes, reposts, or follows @piggyback are highly appreciated! 🐖🐖🐖

www.piggyback.one

An Original PiggyBack Investor

Robert Heilbrunn went from client and student to investment research associate of Benjamin Graham. In time, Heilbrunn found his edge in piggybacking on other, selected value investors. (PBL #5 2022)

Investing Newsletters - Recommendations Part 2: Investing & Trading

Below is a short-form summary of @piggyback's initial Newsletter Recommendations in the Investing & Trading categories. We only present Title, "Why" (why we should read it), and @commonstock alias (if active, just DM if we missed any).

Investing & Trading Newsletters

“Stock market earnings games put the investing public at a clear disadvantage. Management and IR spin stock storytelling with nonsense ‘headline’ adjustments. Accountants sign off aggressive GAAP management. PBN's analysis helps investors see the underlying earnings quality.”

“Focused discussion on option-market fundamentals and technicals.”

"Options opportunities for fundamental macro trades. Derivatives pioneer Mr. Bassman teaches improved upside and limited downside (long convexity) common-sense investing. Risk-reward lessons for long-term investors. Trades for traders and professionals."

“Quality business-focused fundamentals in a quick read format. Aspiring investor Mr. Olsson's new newsletter is promising. The initial coverage mixes Nordic and U.S. stocks, with Swedish serial acquirers as a particular interest.”

“Thoughtful fundamental investing writing leveraging the arts and history.”

@devinlasarre

“Investing learning and curation from a clear, value-add voice. Plus Mr. MacNiel’s thoughtful business-oriented equity deep dives.”

“Corporate finance thinker, author, and teacher extraordinaire. Mr. Damodaran teaches how to actually invest by using valuation. While providing a wealth of investing insight and data.”

“Behavioral lessons, big ideas, and transformative events in the lives of interesting investors. Mr. Gieschen’s elegant essays also feature the personal journey of trying to find our true selves.”

“Thoughtful cross-asset strategy. Mr. Rich Excell’s breakdown of complex macro market issues leverages the experience of a market veteran using Fundamental, Behavioral, and Catalyst lenses. Markets can seem deceptively easy. So Stay Vigilant.”

“Investment professional? Drowning in macro morning trading briefs? With The Morning Hark, you get one that is super-powered by the financial content wisdom of the crowd.”

“The not boring macro strategist. Mr. Peccatiello provides a clear language translation of macro mechanics in play in big, global asset markets. Professionals get current market sentiment readings and shorter-term tactical trading calls.”

“This free collection of mostly U.S. equity visuals is a must for anyone closely following the markets. Mr. Thomas is a master chartist in both the fundamental and technical realms.”

“Expert human conference call curation. Investing insights quote by quote.”

@ekmokaya

“Tuttle Ventures advocate value-oriented, active stock portfolios. Mr. Tuttle shares to-the-point insights on strategy, value cases, and timely tactical positions.”

@tuttleventures

“Tactical, cyclical, and structural indicator insights for investment professionals. Team Variant Perception's free briefs cover the global economy and major markets. Free of charge and free of guru calls.”

This followed Part 1: Value Investing.

As with our Podcast Recommendations, we extend to investing-related complementary perspectives and topic areas. In the full post, there are further categories than what we present on Commonstock. Such as Business, Corporate Distress, Economics, Finance, Technology, Personal Finance, and Media.

www.piggyback.one

Investing Newsletters

PiggyBack's Newsletter Recommendations. Most cover investing niches. Many cover more or less related aspects of the world that we find interesting. All offer unique views and voices. (Recommendations)

Love this list too 🤓

Investing Newsletters - Recommendations Part 1: Value Investing

Below is a short-form summary of @piggyback's initial Newsletter Recommendations, being a newcomer publisher over at Substack:

- Most cover investing niches.

- Many cover more or less related aspects of the world that we find interesting.

- All offer unique views and voices.

We only present Title, "Why" (why we should read it), and @commonstock alias (if found and active, just DM if we missed any).

Value-Investing Newsletters

“Premium Asia Pacific Equity Research. Mr. Fritzell is both a thoughtful investing guide and a picker of the region's best value stocks.”

“A great overview of U.S. special situations. Mr. Paolella provides condensed, current curation of deal rumors, announcements, and implications. The value-tilted equity write-ups hopefully hint at more to come.”

“Compounding high-quality business analysis. Mr. Morris shares his concentrated, long-term, U.S. quality stock investing.”

@tsoh_investing

“Mr. Simms runs a proper fortnightly (two-week) value investing journal that picks apart just about anything that can be valued. With classic comics and all.”

@valuabl

"Public value investing through a private equity lens. The free edition of Mr. Maguire's Premium Equity Research offering covers actionable, special situation stocks. U.S. and European Small/Mid cap tilt. For professionals.”

“News from around the value investing world and learning inspiration that goes far beyond. The free edition uses the most time-efficient format possible: a link list. With sparse, thoughtful context added by the publication's curator, Mr. Koster.”

“Fast-paced and in-depth on quirky situation value stocks. Mr. Walker’s free edition provides both U.S. thematic and single ticker insights and a podcast on activism and cases.”

Next up: Part 2: Investing & Trading

As with our Podcast Recommendations, we extend to investing-related complementary perspectives and topic areas. In the full post, there are further categories than what we present on Commonstock. Such as Business, Corporate Distress, Economics, Finance, Technology, Personal Finance, and Media.

www.piggyback.one

Investing Newsletters

PiggyBack's Newsletter Recommendations. Most cover investing niches. Many cover more or less related aspects of the world that we find interesting. All offer unique views and voices. (Recommendations)

This is an awesome resource and definitely bookmark worthy :)

Watchlist

Something went wrong while loading your statistics.

Please try again later.

Please try again later.

Already have an account?