Trending Assets

Top investors this month

Trending Assets

Top investors this month

PiggyBack's Value Elsewhere (PBL #5 2022)

PiggyBack Letter #5 2022 is out(!) 🖨️

Slightly new format: The free letter now ends in a few selected highlights of recent value investing and other, longer "shelf-life" free, learning curiosities. (= not news)

Listen:

I Beg to Differ (~47 min)

“I believe most investors have their eye on the wrong ball. One quarter’s or one year’s performance is meaningless at best and a harmful distraction at worst.”

Howard Marks, Co-Chairman of Oaktree Capital, goes back to key principles on why investing outperformance requires long-term, contrarian thinking (Recommendation).

The Bear Has Arrived (~1h 22 min)

Jeremy Grantham, co-founder & Chief Investment Strategist of GMO, on the pandemic hangover. Trey Lockerbie hosts for TIP Network (Recommendation).

(Yes, still multi-year relevant. The summer bear market rally did not improve a poor fundamental return outlook for U.S. stocks. It brought back a valuation headwind.)

William Thorndike, investor and author of capital allocation case bible The Outsiders, has launched a new podcast called 50X on a long-term compounding research project. Here, Thorndike serves a great introduction to 50X’s deep dives into Transdigm’s ($TDG) capital allocation. Hosting the host: Patrick O'Shaughnessy of Invest Like the Best (a colleague in 50X's pod network).

Read

I Beg to Differ (~20 min)

Pattern recognition on how investments in publicly listed businesses with strong microeconomics are not victims of periods of tanking stock prices, but potential great long-term beneficiaries. (Hint: disciplined, valuation-driven capital allocation.) Via Jake Taylor, CEO Farnam Street Investments. Autozone ($AZO) serves as an example.

Understanding Jane Street (~20 min)

An interesting analysis on competitive dynamics and technical mechanics in play at proprietary trading shop Jane Street. By The Diff’s Byrne Hobart (Recommendation).

Charts

Reminders that global stocks remain less stretched than U.S. and that U.S. small-caps are breaking. Callum Thomas The Weekly S&P500 #ChartStorm (Recommendation).

Is Everyone Out There Cray-Cray? (~1 min)

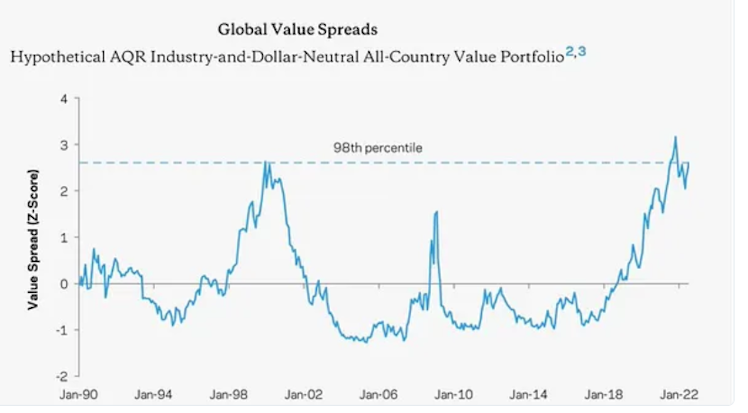

Clifford Asness, co-founder of AQR Capital Management, provides a (rhetorical?) question. The below chart shows the global relative cheapness of the “value” factor. In simple terms, the statistically lowest valuation multiple stocks trade at near modern history record discounts, to the highest multiple “glamour” ones.

In hindsight, the bursting and aftermath of the first Internet Bubble was a decent time to be picking up “old economy” value stocks. Eventually, the more robust shiny tech stuff muddled through and could be had at “low conviction” prices.

PiggyBack Letter #5 2022 also includes PiggyBack's learning from Robert Heilbrunn, a

Benjamin Graham client, student, and research associate. An original PiggyBack Investor.

Your Analyst,

Johan Eklund, CFA

PiggyBack

PS: You may want to consider subscribing (for free!) if you appreciate PiggyBack! Also, any @commonstock likes, reposts, or follows @piggyback are highly appreciated! 🐖🐖🐖

www.piggyback.one

An Original PiggyBack Investor

Robert Heilbrunn went from client and student to investment research associate of Benjamin Graham. In time, Heilbrunn found his edge in piggybacking on other, selected value investors. (PBL #5 2022)

Already have an account?