$U Unity: developing a "digital" moat

Introduction

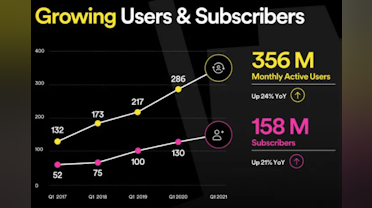

Some of you may not be familiar with Unity Software, but you are likely a beneficiary of the content developed using their software. For example, in 2020, 71% of the top 1,000 mobile games were made with Unity and had 2.7 billion monthly active end users who consumed content, created, or operated with Unity.

My newsletter primarily focuses on identifying the competitive advantages that differentiate the company. Other terrific newsletters go into greater detail on Unity’s history, financials, management team, and other information.

Brief business overview

Unity Software is a game engine, a technology platform for creating and operating interactive, real-time 2D and 3D content. Its platform’s software solutions help game developers, artists, automotive designers, filmmakers, and others, create, run and monetize interactive, real-time 2D and 3D content across multiple devices (mobile phones, tablets, PCs, consoles, AR/VR).

"Today, Fortune and Global 500 companies in industries such as architecture, engineering, construction, automotive, transportation, manufacturing, film, television, and retail are using Unity across many new use cases, including automobile and building design, online and augmented reality product configurators, autonomous driving simulation, and augmented reality workplace safety training. These new forms of content are emerging parts of our business and represent a significant opportunity for growth." - Unity

If you don’t have a gaming background or are unfamiliar with Unity, skip through parts of the video below to gain an understanding of Unity’s capabilities.

Unity surpassed 2 million active developers using their software, making it one of the largest developer communities. Unity monetizes its software through tiered paid subscription plans:

- Unity Personal/Student: The company offers two free plans to support creators with less than 00k of revenue and verified students.

- Unity Plus: ($40/month/seat) targets SMB and independent customers and provides platform access, including analytics, diagnostic tools, and other services.

- Unity Pro: ($150/month/seat) is suited for customers with over $200k in annual revenue with incremental features including prioritized customer support, collaboration tools, ability to purchase professional services, extra support, and license to Unity’s source code.

- Unity Enterprise: ($200/month/seat) targets larger teams with additional customization and flexibility depending on its customers’ needs.

Unity also provides its customers the tools to grow their end-users, run and monetize their content, and increase the lifetime value of their end-users through optimizing customer acquisition costs. As a result, for this revenue segment, Unity profits on a usage basis and revenue share.

Industry changes that shaped Unity’s success

"Gaming engines succeed because game distribution has grown, and publishing is more commoditized; by being the next layer of the supply chain after a commodity, they end up with monopolistic economics and a growth tailwind." - The Generalist

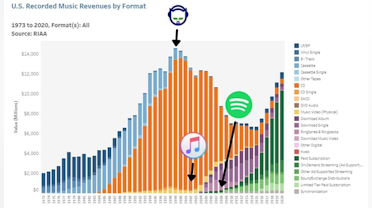

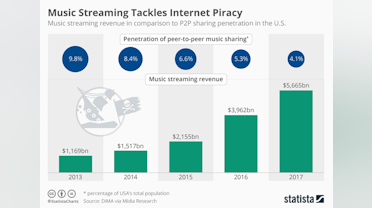

The video game industry caught significant tailwinds from structural changes over the last couple of decades. As a result, video games are now a mainstream form of entertainment. Monumental industry changes:

- Internet access grew globally, providing people with access to video games and other forms of media.

- Smartphones greatly expanded the total addressable market. In the past, the end-users were limited to people with PCs or video game consoles.

- Digitization through smartphones and other devices changed the distribution method. Instead of distributing games through retailers like GameStop, Walmart, etc., video game publishers deliver their content directly to people using digital downloads.

In contrast with the old model:

"Publishers sold physical discs and cartridges through retailers to consumers who mostly played on consoles. Because of the persistent increase in development costs, this model ultimately became a strongly hit-driven one, resulting in a comparatively high degree of consolidation among participants, as only a handful of publishers, retailers, and platforms controlled the larger bulk of the market." - One Up

In this new era, these structural changes lower the barriers to entry into the video game market and broaden the addressable audience. This clearly bodes well for Unity as they continue to democratize 2D and 3D content creation and is taking advantage of the growing audience.

In the past, the video game market was mostly controlled by large corporations that had the capital to build their own game engines. However, Unity lowered the cost of game development as its engine is available to all types of creators at a relatively low cost.

Now smaller game studios are launching because of the turnkey game engine solution Unity provides. Before Unity and other game engines, video games were designed from the ground up and tailored to specific hardware, like the Atari 2600 console. If you are a new game studio, it’s an obvious decision to use one of the few prevalent game engines, like Unity, versus building your own solution. The equivalent to building your own game engine would be a start-up company wanting to spend a significant amount of capital building out their cloud infrastructure instead of using AWS, Azure, or Google Cloud.

Winning the Developer - Switching Costs

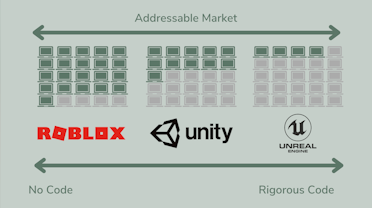

Unity’s most significant competitor is Epic Game’s engine called Unreal Engine. However, they currently serve two different markets. Unreal mostly serves AAA games, which are higher fidelity, more code-intensive games. Unity mostly serves mobile games with coding complexity. Roblox is a game platform that allows users to program games with little to no code, of which 67% of users are under the age of 16.

The difference in coding complexity is not a software bug but rather a feature that allows them to capture their desired markets. That’s not to say that they can’t converge into each other’s markets over time.

Learning to build in Unity or other engines is like learning a new language. Developers need to dedicate roughly 6-9 months using Unity to have a foundational grasp of the software, and it takes years to become an expert.

Switching costs are high for both the developer and game studio:

- Developer Switching Costs: After years of a developer learning Unity’s software, the likelihood of relearning a new game engine language diminishes. The developer then becomes increasingly more likely to stay within the Unity ecosystem as companies prioritize and seek out developers that know the same engine the company uses.

- Game Studio Switching Costs: A game studio would not switch their game engine unless there is a significant benefit in doing so because there is an enormous cost to switching. If a company switches, they can’t reuse useful code written in the past, the company would have to retrain their entire staff, and games built in the past would be harder to update.

Activision, EA, and other large game studios created and use their own game engines, which is a source of competitive advantage for them because it helps retain employees. EA, for example, uses a proprietary engine called Frostbite, and its developers are trained with that engine. Since the Frostbite engine is unique to EA, employees can’t easily quit and go to another competitor. Instead, the developer would need to relearn a new game engine language. The bottom line is whichever game engine a developer learns, they become stuck to that game engine, especially as their experience increases in using the game engine.

Unity is winning in building a large competitive advantage by addressing the largest developer market in video games: mobile games. Unity’s less code-intensive product enabled a larger audience to build games using their software. And from what I mentioned above, it’s challenging to switch to engines. Therefore, Unity is in a position to retain a massive share of developers in the future.

Unity can further widen the funnel's mouth of acquiring developers by adding no/low code features and moving down the market into rudimentary game development (like Roblox). Unity also partners with universities to train students, which engrains them into the ecosystem early on. Also, there is 750 hours worth of learning content on Unity’s website and certifications that developers can earn, which gives most people the tools to learn their software.

As Unity’s technology improves and closes the gap between Unreal Engine, they can leverage their large, experienced developer community and move up the market into higher quality content development.

Network Effect #1: Developer Talent Pool

Developers skilled in Unity software are fungible across industries that use Unity to create content. Architecture, engineering, and construction firms will pull talent from game studios well-versed in Unity and vice versa. The lines are blurred between the industry developers work in, but one thing remains the same, Unity’s software to become the infrastructure to build content across multiple industries.

"Because it generally is too expensive to develop in-house tools (e.g., game engines), most studios rely on essentially the same technologies. Consequently, a studio’s greatest asset is its talent pool." - One Up

Unity exhibits a network effect moat within the context of the developer talent pool:

- Value proposition for game studios: A studio’s greatest asset is its employees. Therefore, as part of a company’s decision-making process of which game engine to use, companies will see Unity as more valuable because of its potential to attract the best employees from the largest talent pool. There are currently 2 million developers that use Unity.

- Value proposition for developers: developers will gravitate towards learning a game engine that will be the most attractive to employers.

"Unity’s popularity is a highly defensible moat itself. It is the engine most students and professionals use to build interactive 3D content. As a result, it is preferred by companies because of the large talent pool to recruit from and there are a lot of young professionals trained in Unity who will see applications for it at non-gaming companies they work at." - Monetizing Media

37% of Unity’s revenue was generated by customers in EMEA; 35% of revenue was generated by customers in Asia-Pacific; and 28% of revenue was generated by customers in the Americas. Thus, their global audience is broad, and their talent pool is diverse.

Network Effect #2: Asset Store Marketplace

Every detail seen in a game needs to be developed, from trees to car tires, to the characters' eyes. Depending on the level of granularity, this can be a daunting task to game studios that takes a lot of developer’s time. Therefore, all game studios reuse old code that can be transferred and integrated with new games, decreasing redundancy in coding and saving the studio time and money. However, reusing old code limits a game studio to only their team’s developments.

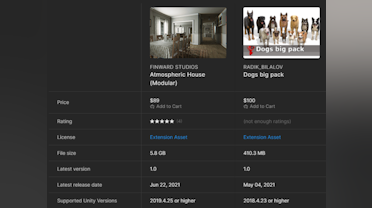

Unity has a marketplace called the Asset Store, where developers can buy and download code created by someone else and integrate the code into their own content. The types of assets include items, landscapes, visual effects, audio, game templates, and more. The image below shows examples of a house and various dogs for $89 and $100, respectively.

Source: Unity

Searching the asset store and purchasing a $100 asset could potentially save hours, weeks, or months of work for game studios. The idea of the asset store is to reduce the time spent recreating code and redirect developers’ time on more creative tasks to enhance the game.

The Asset Store benefits from marketplace network effects:

There are always two sides to a marketplace, the supply and demand side. The supply side is developing code and contributing the asset to the store for others to buy. The demand side is developers who buy the asset and integrate the code into their content. As more developers use Unity and contribute to the Asset Store, the value of Unity’s software becomes greater because there will be more variety and higher quality code to buy from the store. The Unity Asset Store aggregates the supply and demand and creates a self-reinforcing cycle of growth built on network effects. As more developers contribute to the marketplace, customers will find that it provides a more efficient game development process.

The picture below illustrates the top publishers on the Asset Store. The top publishers are both professional and user-generated content. Which effectively demonstrates the value proposition of making money for contributing code assets.

Source: Unity

CD Projekt, a game studio, released a game last year called Cyberpunk 2077, which ended up flopping because of bugs related to performance. But they built an incredibly detailed world (see the picture below)! It cost $121 million in development cost for roughly 9 years and a team of 500 people to create an open world that takes place in a futuristic, cyberpunk city dominated by technology. The level of graphical detail pushed the video game industry limits (perhaps too far, hence why it flopped). However, imagine if CD Projekt sold the assets that were created in the game on a marketplace. For example, they could sell the code of buildings, cars, hands, guns, and numerous other assets.

Source: Cyberpunk 2077

The risk of creating a game is that you don’t know how gamers will respond until it’s published. But what if there were greater assurance that game studio’s return on investment could increase if they sell assets on a marketplace? Perhaps more game studios would undertake ambitious projects that take lots of time and money.

Pricing Power

Pricing power is often an indication of a moat. Customers tend to be more price-sensitive when the product is undifferentiated, and the product does not add significant value.

In Unity’s case, if you are a game studio or developer using their software, you are essentially stuck and will take most price increases. At the beginning of 2020, Unity raised its price for Unity Pro and Unity Plus subscriptions.

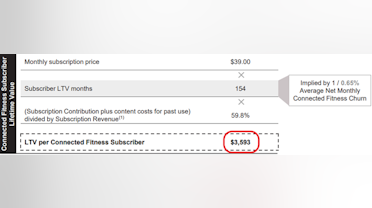

Unity Pro increased 20% or $25/month/user. This is a no-brainer for game studios to continue using Unity. An average salary for a game developer is $100k. In the eyes of a game studio, the Unity Pro subscription is 1.8% of a developer’s salary, and the price increase was 0.3% of their salary.

Unity’s switching cost moat is great enough to drive its prices and profits upward as long as the cost to the customer does not exceed the cost of switching to a competing provider. I could make the case that Unity’s software is vastly underpriced compared to the value that game studios receive. However, Unity is keeping prices low to gain market share from new game studios and new developers and is not focused on maximizing profits for their current customers.

Final thoughts: I mostly referenced the gaming industry because it is currently Unity’s largest market. However, everything I wrote about above applies to all the different industries that Unity serves.

Subscribe:

Thanks for the post. Your final thought is something I am tracking closely. Expansion of the TAM beyond gaming which they are already making great progress on. It's definitely on my watchlist, though haven't hit buy yet given the valuation