Volatility is not risk on itself but in many cases it's a catalyst to the most significant risk of all: constant trading.

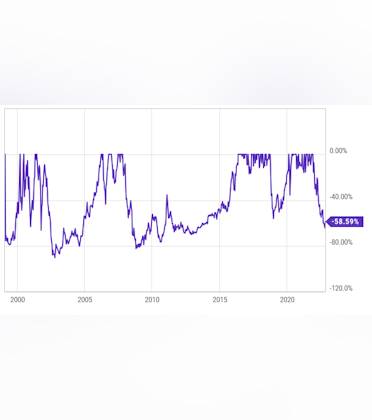

If an investor can't withstand volatility, it's highly unlikely they can cope with several 30% drops.

How many investors can hold this stock? Few, imho.

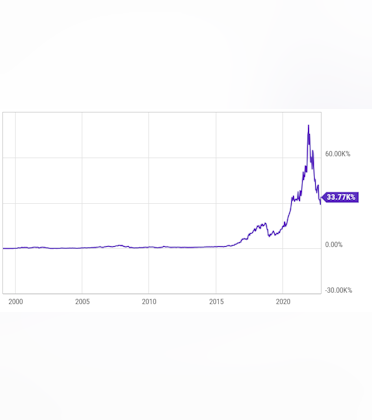

These are the returns the stock has provided despite those drops:

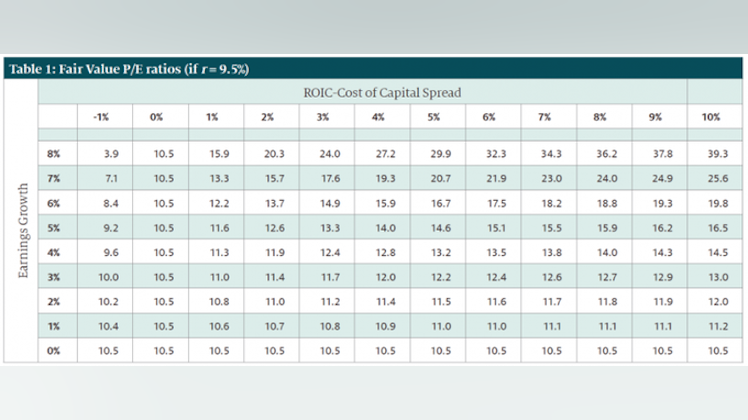

There are two legs to any worthwhile investment:

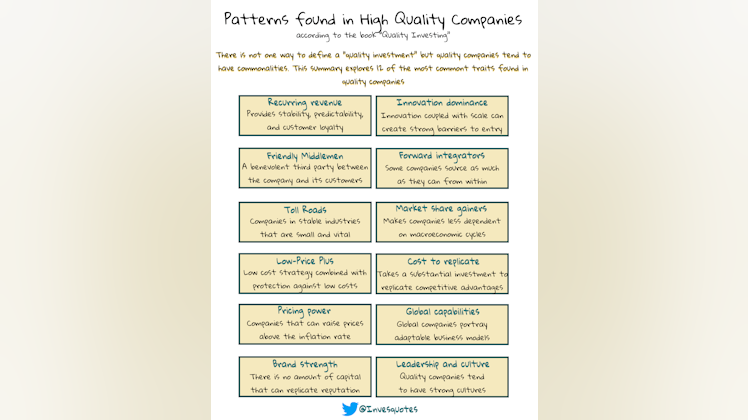

- Finding a high quality company and purchasing it at a fair price

- Being able to hold it for a long time

In my opinion, #2 is much more complex than #1.

Many investors think they can stomach volatility, but this is not something you can "think", it's something you must have gone through already to be 100% sure.

"Everyone is a long-term investor on the way up."

It's very different saying you can going through a 50% drop than actually doing it. If a stock drop makes you rethink your thesis then...

- You didn't do your homework

- Stock price is having an outsized impact on your rationality

Distinguishing between both isn't easy!

But don't worry! There are solutions. If you can't stomach volatility, you can...

A. Follow a coffee can approach where you protect yourself from volatility by not looking at stock prices

B. Build a portfolio that does not suffer such sharp drops frequently

The drawback for (a) is that it requires a static portfolio and most portfolios are dynamic.

Dynamic not in the sense of constantly changing positions, but dynamic in the sense of continuous contributions.

The vast majority of people contribute throughout their lifetimes to their portfolios, so isolating from stock prices is not easy.

(b) is achievable, though.

To build a portfolio tailored to your needs, first, you need to know what level of volatility you can cope with (ie., know yourself).

Once you know this you can then build a portfolio that is "easy" to hold.

Volatility is NOT a risk, but it can surely lead you to cutting the flowers and watering the weeds

The graphs belong to

$NVDA btw!