Trending Assets

Top investors this month

Trending Assets

Top investors this month

Don't look at P/E ratios in isolation

If you're looking at P/Es in isolation, you're doing it wrong.

ROIC plays a critical role in determining what an appropriate multiple is for any given company. High returns matter, even if you can't see them at first sight.

The rationale is that higher ROIC companies will achieve earnings (or FCF) with less reinvestment needs, so there will be more excess cash to return to shareholders.

This means that FCF (ie., excess cash) will be higher for any given level of growth for high-ROIC companies.

Quick question...

- Company A is trading at a P/E of 10

- Company B is trading at a P/E of 30

Which company is cheaper? Turns out that an investor shouldn't answer this question without digging deeper. Still, many investors would choose company A.

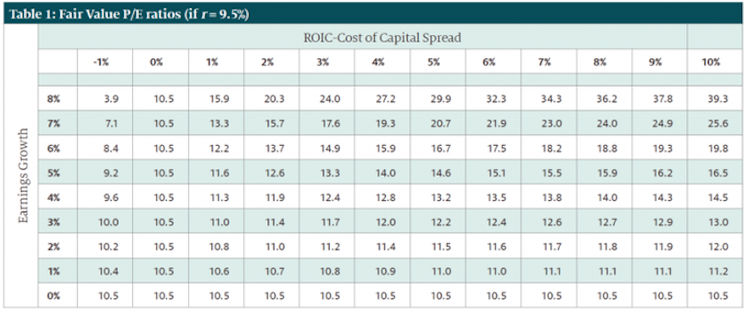

Let's look at the table above. Assuming the required return is 9.5%...

- Company A will be overvalued if its ROIC spread is negative and the company is growing. Negative ROIC spread coupled with growth destroys shareholder value.

- Similarly, company B will be undervalued if ROIC spread is above 6% and earnings growth is 8% of higher (table above).

Valuation, like everything in investing, needs context. The market will price a company according to:

1) Free Cash Flow

2) Growth

3) ROIC spread

If an investor estimates what the market prices into those metrics and gets to the conclusion that the market is being too pessimistic, it might offer a good opportunity, regardless of an apparently high PE

This is a great piece on the matter:

www.eipny.com

The P/E Ratio: A User’s Manual

Already have an account?