- Inventory

- Accounts Receivables

Each factor reveals important trends about a business's underlying health.

Inventory: Can You Actually Sell Your Sh*t

There are three types of Inventory "Goods":

- Raw: materials needed to make product

- In-progress: product's almost done

- Finished: Packaged & ready to ship to customers

Each type tells an important story ...

1/ Inventory: What Change Means

Growth in each of the above could signal a few things:

- Increased production, higher forecasted consumer demand, or a company trying to time a market.

All good things.

But sometimes growth (especially in finished goods) is a major red flag.

2/ The Dangers of Growing Finished Goods

Rising finished goods indicates a few things:

- Declining consumer demand

- Potential for future product writedowns and discounts (headwind for earnings)

- Better alternatives, consumer trade-offs or substitution effect

Why it matters.

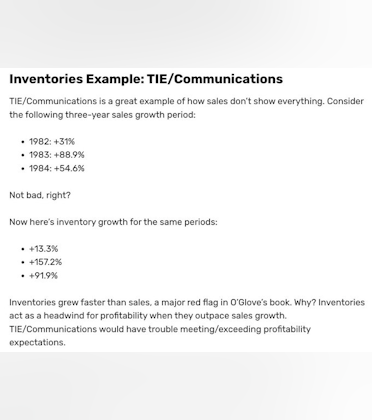

3/ The Future Cost of Rising Inventory

Inventory is a cash consumer.

So more inventory growth = greater cash needs

A when inventory growth > sales growth as company needs more $ in inventory but can't generate the extra $ from sales.

Onto Accounts Receivables (A/R) ...

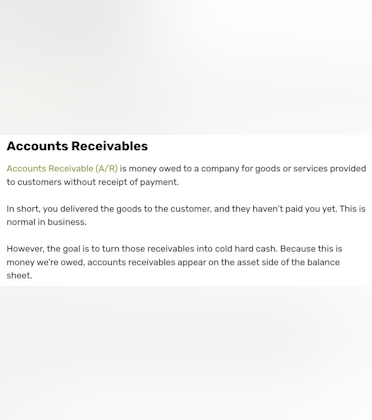

Accounts Receivables (A/R): Can You Collect?

A/R is money owed to a company for goods or services provided to customers without receipt of payment.

In other words, its the credit you extend to customer for future payment of delivered finished goods.

Here's what it tells us.

1/ It's All About A/R Turnover

The quicker a company turns its A/R into cash, the better.

Why? Like Inventory, A/R CONSUMES cash as it grows.

Which makes sense. The more A/R you have, the less cash you're collecting from your customers for those finished goods.

Not good!

2/ Why A/R Growth Happens

A/R growth happens for a few reasons:

- Company extended flexible credit terms (Net 60-90, etc.). You'd see this as rising Days Sales Outstanding (or DSO).

- Distributors can't sell product to end consumers.

- Bad A/R Collections procedures

3/ How To Spot A/R Red Flags

A major is when A/R grows faster than revenues.

Why?

It means the company can't collect cash from its customers and must pay for growing operations w/ cash on hand or finance w/ debt or equity.

4/ A/R Growth Can Be A Thesis Breaker

A/R Growth > Sales Growth could also signal that management is playing accounting games.

They're booking revenue but not collecting because they want to hit some Wall St. target.

Don't be fooled by this gimmick.

Always follow the cash!

H/T: @marketplunger1 on twitter