Write-up: The Estée Lauder Companies ($EL)

Here is the link to the original post on my website: http://topcornerinvesting.com/2023/07/21/estee-lauder-companies/

The Estée Lauder brand was founded in 1946 by Mrs. Estée Lauder and her husband. In many ways, Estée Lauder pioneered the prestige beauty industry in the United States through her unique marketing skills and willingness to demonstrate her own products on women at no cost. In addition to her burning passion for cosmetics, Estée Lauder was also a brilliant saleswoman with a vision to “never underestimate a woman’s desire for beauty.” As a result of the word-of-mouth marketing from satisfied customers, Estée Lauder slowly but surely turned into a prestige beauty empire that is still thriving today (David Senra of the Founders Podcast brilliantly covers her biography A Success Story for those interested).

“I want to paint a picture of the young girl I was. A girl caught up mesmerized by pretty things and pretty people. My drive and persistence were always there, and those are qualities that are essential for building a successful business. Still, I sometimes wonder if I had set my heart on selling tassels, cars, furniture or anything else but beauty, would I have risen to the top of a profession? I doubt it. I believed in my product. I loved my product. A person has to love her harvest if she's to expect others to love it, and beauty was such a bountiful harvest."

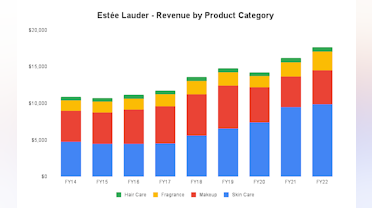

Today, The Estée Lauder Companies owns a portfolio of 19 fully-owned brands as well as the licensing rights for brands like Tom Ford and AERIN and 76% ownership of Deciem Beauty Group. Estee Lauder separates its product into four different categories (in addition, a fifth category named “other” includes ancillary products and services that represented a tiny 0.3% of 2022 revenues):

- Skin Care represents about 83% of operating income as of FY22 and grew 4% year-on-year. This category includes the Estée Lauder brand (which also is big in makeup and fragrance) and prestige brands like Bobbi Brown and La Mer.

- Makeup makes up 4% of operating income as of FY22, led by the famous M·A·C brand which the company acquired in 1998.

- Fragrance grew 30% YoY and makes up about 13% of operating income. This product category is the fastest growing category, partially because fragrance sales plummeted during the early stages of the pandemic but also from a few successful product launches from brands like Jo Malone London and Tom Ford Beauty.

- Hair Care reported a $28 million loss in FY22 and $19 million loss in FY21. This segment was arguably hit the hardest over the past few years as salons and retail stores were closed; the operating loss over the past two fiscal years have mainly been a mix of pandemic related closures + increased expenses to support the recovery of the stores.

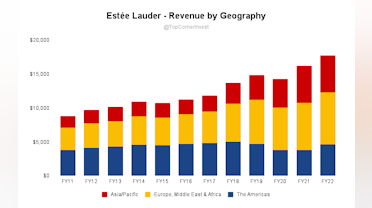

For the majority of the 75+ years The Estée Lauder Companies has been in business, the United States has been the largest market and where the company deployed most of its resources. However, the story has evolved over the past two decades or so with slowing growth in the Americas (mainly U.S.) and an increased focus on growing market share globally. For example, net sales in the Americas grew about 2.5% annually between FY10 and FY22. Net sales in the Asia/Pacific region increased by ~11% over the same time frame. Further, the United States represented 38% of overall revenues in 2010. 12 years later (per FY22), that number was 22.6%. Mainland China is now the largest country in terms of revenue with about 34% of company-wide net sales.

This shift has happened for a few reasons. Firstly, the demographic trend in many emerging markets is that a larger percent of the population becomes a part of the middle class. These people will typically spend a larger portion of their income on discretionary items such as beauty products. This trend is forecasted to continue in countries like China and India. For example, growth in per capita spend on prestige beauty increased by 185% in China between 2015 and 2020. In the U.S., that number was 9%.

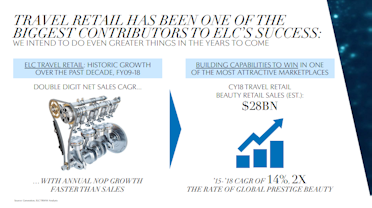

Second, travel retail has become a more important growth channel of the global prestige beauty market (Estée Lauder solely focuses on prestige beauty). Despite the various travel restrictions over the past three years, travel retail has over the past decade been one of the fastest growing channels within global prestige beauty. This will again benefit Estée Lauder as international travel continues the pre-pandemic trend of steady growth: Travel retail has been one of the biggest contributors to ELC’s [Estée Lauder Companies] success.” As a larger percent of the population in emerging markets spend more on travel as their discretionary income rises, Estée Lauder gains an increased number of potential customers. Interestingly, 59% of prestige beauty buyers’ first purchase is in travel retail. That explains much of why travel retail is an area where the company spends much of its attention trying to expand consumer reach and conversion.

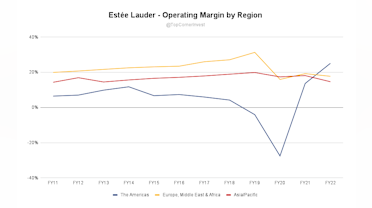

The increased dependence on emerging markets and travel retail also helps explain why Estée Lauder has had a difficult past few years. For example, reported operating income decreased by 60% and earnings per share declined 72% in the most recent quarter (Q3 2023 compared to Q3 2022). The company also lowered its fiscal year guidance, blaming a volatile recovery in travel retail and lower conversion of travelers to consumers in prestige beauty.

At the risk of being too short-term oriented, I think it’s evident that Estée Lauder’s management overestimated the pace of the recovery in Asia. The company is also working through issues with elevated inventory at several retailers, in turn leading to lower replenishing orders and hence part of the reason why Estée Lauder had to lower its FY23 outlook. The increased uncertainty, politically as well as consumer behavior, is perhaps part of the challenge that comes with betting on China and emerging markets for growth. Over the long-term though, I think it’s reasonable to believe that Estée Lauder’s strong portfolio of brands will carry them through most challenges.

Financials

Since FY10, Estée Lauder has spent about 62% of its capital on capital expenditures and 38% on acquisitions. Capex varies from new manufacturing facilities, distribution capabilities and the opening of freestanding stores and retail stores around the world, among other investments. Over the past few years, additional investments were also made to support the reopening of stores that were closed during the pandemic.

Moreover, the company announced a restructuring program in 2020 to address the changing landscape of retail such as the shift to online and decrease in brick-and-mortar sales, especially in the United States and United Kingdom. This has required additional investments to reorganize the distribution networks as the company has closed several department store counters in order to direct resources to the much faster growing online channel.

(For what it’s worth, tax rate fluctuates with the geographical mix of earnings. We will likely see more of this going forward as emerging markets revenues become a larger part of Estèe Lauder overall sales. In addition, a one-time repatriation tax increased the FY18 effective tax rate to 43.6% and materially impacted the after-tax ROCE as shown above.)

The purchase of skin care brand Dr. Jart+ for ~$1.2 billion in December 2019 is the most recent acquisition of material size. In total, Estèe Lauder has spent north of $4 billion on acquisitions since FY10, mainly aimed at expanding distribution channels and geographical reach. For a company that opportunistically pursues M&A, a long-term track record is likely one the best way to judge if the acquisitions have created value for shareholders. The Estèe Lauder Companies has arguably one of the best track records in the beauty industry as evidenced by its current portfolio of brands.

An example is Estèe Lauder’s first brand acquisition back in 1995; the company helped scale Bobbi Brown Cosmetics from a local New York City makeup brand into a global powerhouse. For the record, not all purchases have been successful - such as Becca Cosmetics that was initially acquired in 2016 before it was shut down just five years later. However Estèe Lauder Companies arguably still has one of the best track records out there when it comes to acquiring other brands.

Valuation

Below is my current financial model for Estèe Lauder:

For FY23 (ended June 30 but numbers are not public yet), the company is guiding for a 10-12% decline in revenue and unadjusted EPS in the range of $3.29 to $3.39 - I assume the midpoint of that guidance in the model.

In FY24, I assume ~10% revenue growth with EPS around $5.30 (only a 10% increase from FY19) as we should approach a more or less normal operating environment for Estèe Lauder again. From there, Estèe Lauder could be earning ~$8.3 in EPS five years from now with high single-digit topline growth and slightly increasing profit margins. That’s about 22x 2027e earnings at today’s stock price ($190).

I believe a fair value in the range of $150-$170 per share is reasonable for Estèe Lauder. That implies a terminal P/E in the high 20s to low 30s for a company with extremely strong brand equity, pricing power and multiple engines of growth for the foreseeable future (such as a growing customer base in several emerging markets and the growth of travel retail).

While the current price is not a bargain, I also think it's unfair to write it off as overvalued simply because it’s trading at a headline P/E of 62x LTM earnings. Earnings over the past three years have been depressed to a large degree as a consequence of lockdowns and travel restrictions in most markets. If The Estèe Lauder Companies is able to operate in a more or less normal environment in FY24 (for the first time in many years), I think we could see a shift in investor sentiment to once again appreciate the business and the durability of the brands in the portfolio.

If Mr. Market continues with his pessimistic view of the company and the share price drops further, I will consider adding Estèe Lauder to my portfolio. For that to happen though, I would need to make sure I’m comfortable with much of the future growth coming from emerging markets and through channels such as travel retail that is cyclical in nature. For now, I will be watching from the sidelines on this one.

Thanks for reading!

Colossus - Business Podcasts

#136 Estée Lauder

David Senra is the host of Founders, where he studies history's greatest entrepreneurs. This is what he learned from reading A Success Story by Estee Lauder.

@topcornerinvest Great update!