Trending Assets

Top investors this month

Trending Assets

Top investors this month

Write-up: O'Reilly Automotive ($ORLY)

Here is the link to the original post: http://topcornerinvesting.com/2023/03/16/oreilly-automotive/

In the book 100 Baggers, author Chris Mayer writes: “I’d add that many of his chosen stocks had top-management teams that made good capital decisions about how to invest company resources. There was often a large shareholder or an entrepreneurial founder involved. These can overcome the growth hurdle. One interesting example here is AutoZone. It was a 24-bagger in Martelli’s study [which looked at 10 baggers over the last 15 years] despite registering ho-hum growth rates of 2-5 percent.”

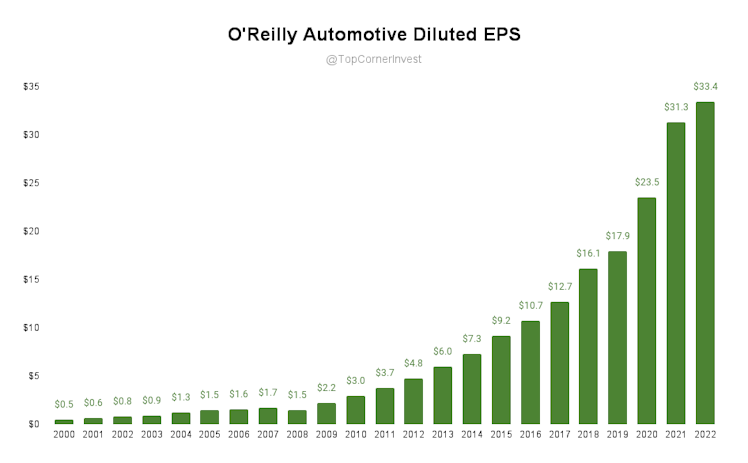

While Mayer mentions AutoZone as an example of a company with spectacular returns, O’Reilly Automotive has also delivered similar results over the past few decades. Since 2000, O’Reilly has compounded EPS at an average annual rate of ~21% - and AutoZone’s numbers are similar - despite slower top line growth. Both are among S&P 500’s best performing companies since the turn of the millennium, an impressive feat for two niche retailers.

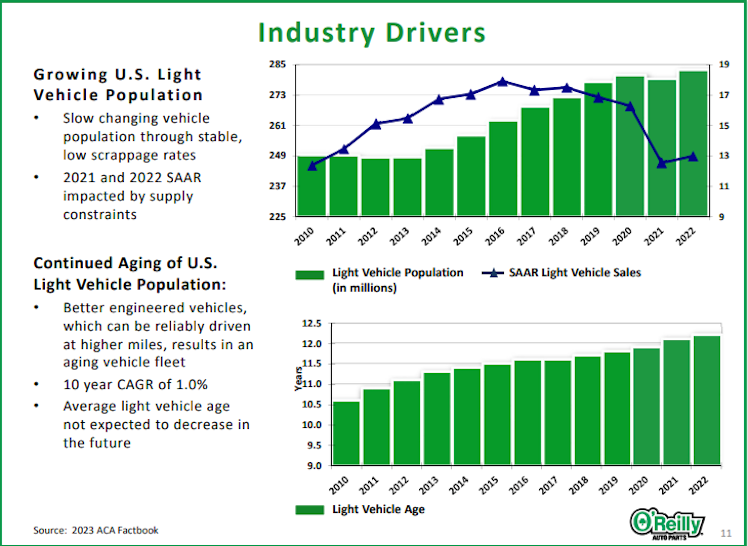

The automotive aftermarket industry (essentially meaning products and services purchased for vehicles after the original sale) has experienced some big tailwinds over the past decades. The main drivers are longer car lives and increasing numbers of cars on the road. Because O’Reilly typically services older vehicles that are out of warranty and require more maintenance compared to new cars, an aging vehicle population means more customers. Americans also drive more (as measured by miles driven per year), leading to higher demand for parts and maintenance. Per O’Reilly, these industry drivers are not expected to decline in the future.

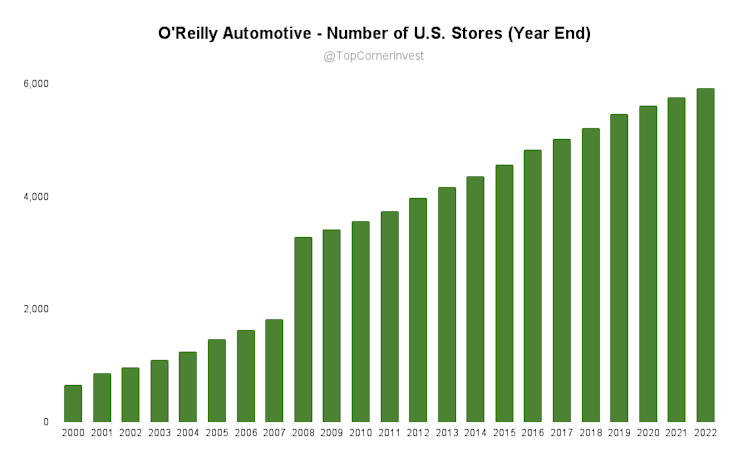

The industry is also very fragmented despite the consistent growth O'Reilly and AutoZone have seen over the past few decades: “The automotive aftermarket industry is still highly fragmented, and we believe the ability of national auto parts chains, like O’Reilly, to operate more efficiently and effectively than smaller independent operators will result in continued industry consolidation,” (2022 10-K). O’Reilly has historically added 100-200 new stores per year and only occasionally engage in M&A. For example, the jump in stores from 2007 to 2008 was due to the acquisition of CSK where O’Reilly acquired 1,342 new stores.

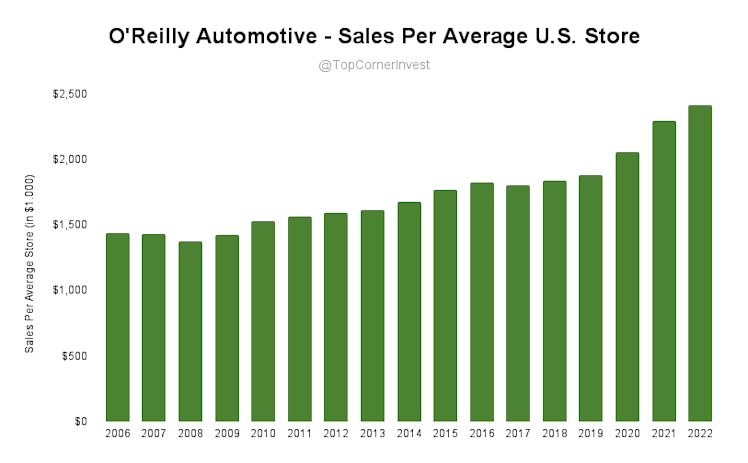

O’Reilly caters to both DIY (do-it-yourself) customers and professional service providers, with about 56% of sales coming from DIY and 44% from professionals for the 2022 fiscal year. DIY is more consolidated due to the growth of the largest auto parts chains in the U.S., but the fragmentation in professional services appears to be an opportunity for O’Reilly. To take advantage of this, O'Reilly continues to invest in its distribution network to ensure efficient delivery of parts to its stores. This has become one of O’Reilly’s competitive advantages - through its 28 distribution centers and 375 hub stores across the country, most O’Reilly retail stores have access to same-day delivery of a huge number of parts. Fast and cost efficient delivery is also important to professional customers who typically decide where to order parts from based on these factors. In turn, distribution efficiency will drive higher adoption from professionals and same-store-sales growth (see chart below) going forward.

It’s also worth mentioning opportunity for international expansion as O'Reilly currently operates 42 stores in Mexico. Given the plans to open the first distribution in Mexico later in 2023, it seems reasonable to believe that significant efforts will be made to further expand store foot print within the country as well.

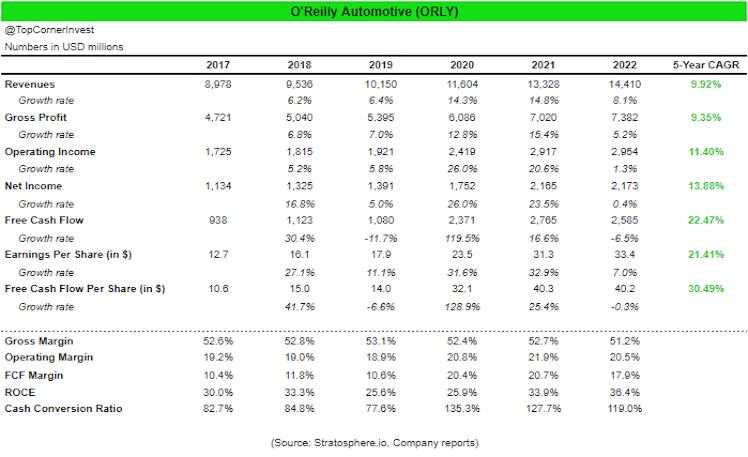

Financials & Capital Allocation

As I quoted in the intro, O’Reilly and AutoZone are sometimes referred to as slow growers - sort of the "slow and steady wins the race" type of companies (for the record, these are the businesses I would like to own myself). Perhaps rightly so considering the fact that same-store sales are up about ~4.5% CAGR since 2013. However, O’Reilly has re-accelerated revenue growth after a few “slow” years between 2016 and 2018. I think it’s fair to say that the pandemic and the spike in inflation that followed had a positive impact on the numbers because O’Reilly could pass on most of the higher prices to customers. Topline growth will likely revert back to 6-9% annually moving forward.

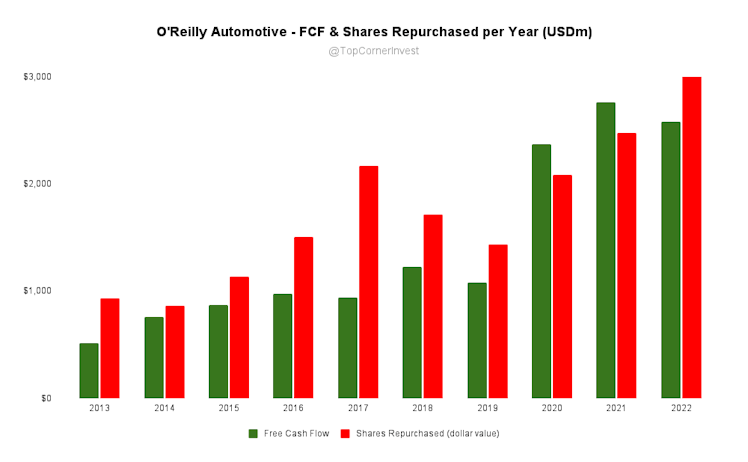

Nevertheless, the elephant in the room is the massive growth in EPS and free cash flow per share. Since the share count peaked in 2010, O’Reilly has repurchased over 54% of its shares outstanding, equivalent to roughly 6% on average annually. What’s interesting is that the dollar value of the repurchases is higher than what O’Reilly generates in free cash flow most fiscal years (see chart below). To finance a portion of the buybacks, long-term debt has increased from $1.4bn in 2015 to $4.4bn at the end of 2022.

For what it’s worth, I don’t believe this is a red flag because O’Reilly has sufficient interest coverage (18x EBIT/Interest Expense in 2022) and very predictable cash flows. However I’d be interested in hearing from management how they think about the increased leverage and what the goal is in terms of a target leverage ratio or debt-to-capital ratio or similar.

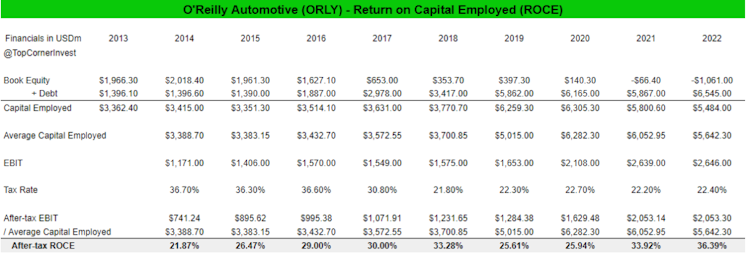

Furthermore, ROCE has also trended upwards along with the increased debt. There are clearly attractive opportunities out there for O’Reilly to invest its capital which is magnified by the leverage. I like to think that management will take a more conservative approach to capital allocation when O’Reilly reaches full maturity, for example by instating a dividend or repaying some of the debt. As for now, and most likely for many years to come while O’Reilly is still growing, I don’t see an issue with the leveraged buybacks.

One of the biggest lessons I have learned from researching O’Reilly is how powerful buybacks can be, but also why most companies might be better off allocating their capital in other ways. I think the reason O’Reilly (and AutoZone) has been so successful with this approach is the combination of industry tailwinds and the ability for these companies to take market share. O’Reilly has done very well strengthening its competitive advantage through the investments in distribution centers, but the growing customer base (from the aging vehicle population) has undoubtedly played a non-trivial role in the success story. I don’t mean to discredit O’Reilly (the disciplined capital allocation is truly impressive), the point is more so that investors shouldn’t just demand companies to buy back shares simply because O’Reilly has been successful doing so.

Valuation

O’Reilly shares are currently trading at ~24x LTM earnings or a ~4% free cash flow yield based on 2023 estimates.

Below is my simple model on O'Reilly's earnings with the simple assumption that revenue growth will compound at 8% annually over the next few years (similar growth as between 2013-2019), profit margins will be at 14% and the company will buy back about 5% of shares outstanding per annum. I think it's fair to assume that the earnings multiple won't deviate too much from where it is currently and so ORLY shares seems to be fairly valued at the current price (given that my assumptions are fair).

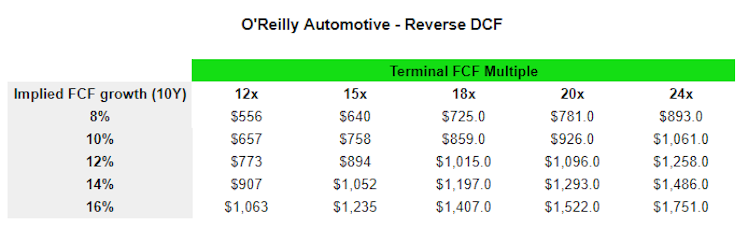

I also attempted a reverse discounted cash flow (DCF) to see what the market expects at today’s price of $822 per share given a discount rate of 11%. If you think 18x FCF is a reasonable multiple in Year 10, the market currently expects O’Reilly to grow FCF by about 10% per year. Remember that FCF has compounded at 19% over the past 10 years, so it doesn’t look unreasonable.

Closing thoughts

Even though O'Reilly is a truly unique, high-quality company combining growth with industry tailwinds, a consistent capital allocation and a fair valuation, there is still one issue remaining that I am struggling with; I can't help but feel that I am too late to the party. O'Reilly is now a $50bn company with shares trading close to all time highs and the stock has pretty much gone up and to the right since going public in 1993. How long can this continue for? I don't have the answer and I need to give it some more thought before I make a decision. Until then, O'Reilly will probably continue to climb.

Thanks for reading!

Jorgen - Top Corner Investing

O’Reilly Automotive

In the book 100 Baggers, author Chris Mayer writes: “I’d add that many of his chosen stocks had top-management teams that made good capital decisions about how to invest company resources. There wa…

Already have an account?