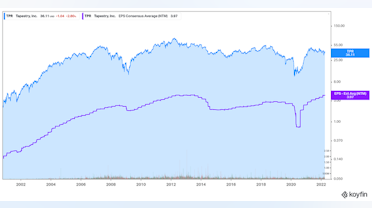

- The business of Tapestry is undergoing a transformation, turning around a business that in and of itself should be highly profitable

- Given its growth and margins, the current valuation appears inexpensive

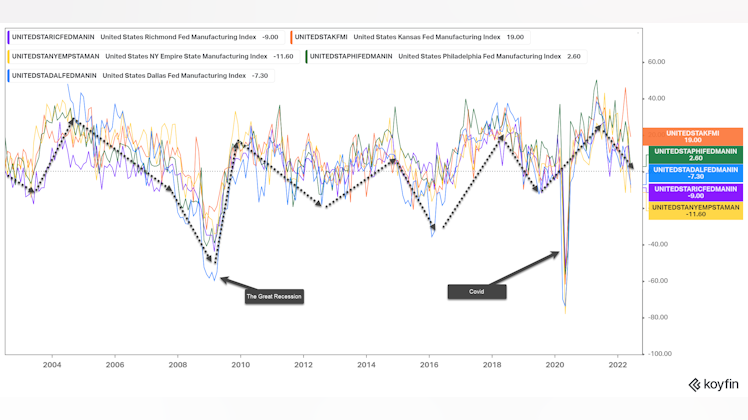

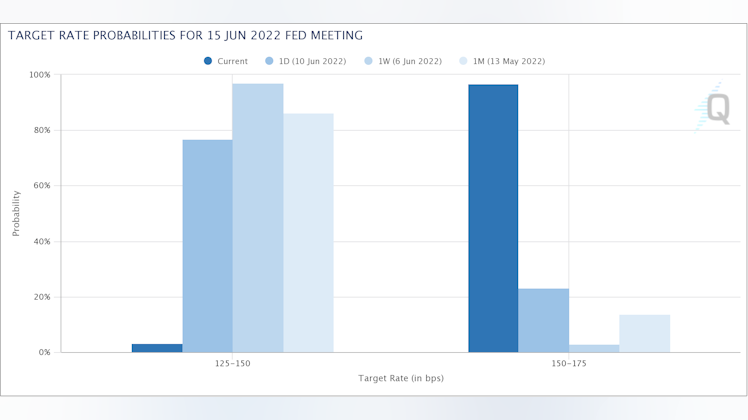

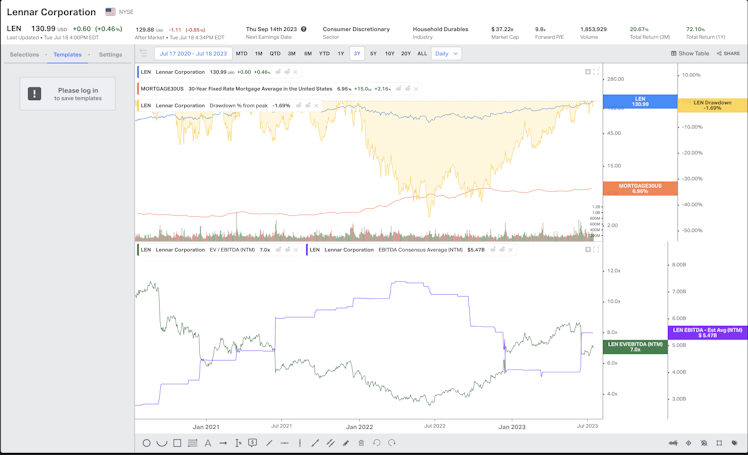

- That said, the luxury accessory market remains a cyclical market and any investor should be careful when we are at the tail-end of an economic cycle

- It is clear $TPR’s operating performance has improved, but I think we should wait for an economic downturn before considering an investment.

Company Overview

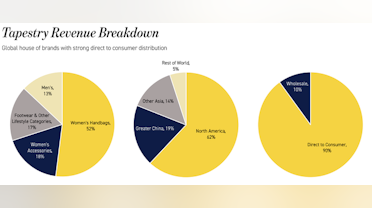

Tapestry is a company focused on the luxury accessory market. Tapestry owns three brands, Coach, Kate Spade New York, and Stuart Weitzman. It sells products through company-operated stores, wholesale channels, and e-commerce.

Coach has undergone a transformation, improving its profitability and expanding sales. Although Coach had trouble with excessive distribution in the past, Tapestry has turned it around with the optimization of stores, restrictions on discounting, and increased e-commerce during the pandemic, which has grown significantly as a distribution channel. Now the focus will be on Kate Spade and Stuart Weitzman. I think Kate Spade can grow in both North America and Asia through store openings and new products.

In the past 2 years, Tapestry has invested in an ERP and data analytics. This has provided them with tools that has increased operating visibility and ultimately improving decision making. I believe they are in a much better position to deliver sustained EBITDA margin increases across Kate Spade and Stuart Weitzman.

At the BofA Securities 2022 Consumer and Retail Technology Conference, Tapestry explained its transformation.

"...And we were positioning our transformation efforts to enable us to have stronger consumer engagement in this, what we were considering the new world of retail where it was all headed. That came down to 3 fundamental principles that we saw back then that are even more true right now today."

- Getting closer to the Customer. Understanding the trends and what customers valued from brands, what they valued from our brands. This led them to focus on digital.

- Leveraging data and analytics with a focus on how do they take the data (90% direct-to-consumer business) and apply that knowledge across our value chain while also strengthening that engagement between their brands and consumers.

- Agility. Once they have real-time consumer information, they need to be able to act on in. This requires companies to become more responsive to changes in trends because we were seeing those changes happen more frequently.

Tapestry is following the same playbook as Zara, UNIQLO, and H&M, but in the luxury accessories segment.

How did they get there?

- They invested ~$30m in an ERP system across the 3 brands (source)

- Adding new customers through e-commerce in North America and achieving fast growth in digital, increasing purchase frequency and reactivating lapsed customers

- Driving growth in China which has become the 2nd largest geography

- Managing resources more efficiently with reduction of SKUs, closure of underperforming locations, and a reduction in corporate headcount

Pandemic Effects

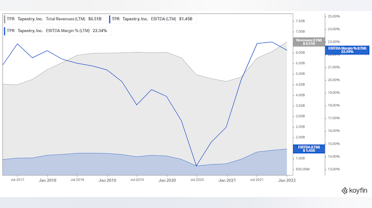

Tapestry was a pandemic loser but sales and EBITDA have recovered.

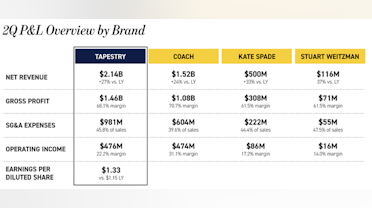

2Q Update by Brand

Margins for Stuart Weitzman suffered as they used a significant amount of air-freight to circumvent the supply chain issues.

Balance Sheet

$TPR's balance sheet has never been a point of stress. Tapestry's balance sheet is in a good condition. At the end of December 2021, it had $1.2 billion in long-term debt, but this was exceeded by $1.65 billion in cash. In addition, Tapestry has a revolving credit facility of $900 million. According to our forecasts, the firm is expected to generate between $1.0 and $1.5 billion in free cash flow annually over the next decade, which should ensure that it is able to pay down its remaining debt.

$TPR's capital expenditures should not exceed 5% of sales, and most of it will be spent on building e-commerce, opening and retrofitting new stores, which should strengthen its brand.

Capital Return

$TPR has historically had a mixed performance as a good manager of shareholder capital, but there are some positive signs here.

The Good: Management scaled up share repurchases when the company's shares were undervalued.

The Bad: I don't think the purchase of Stuart Weitzman and Kate Spade were good ones. Coach is clearly a better business and focusing on that one should have been the priority.

The decreasing number of shares outstanding is a great sign.

Pricing

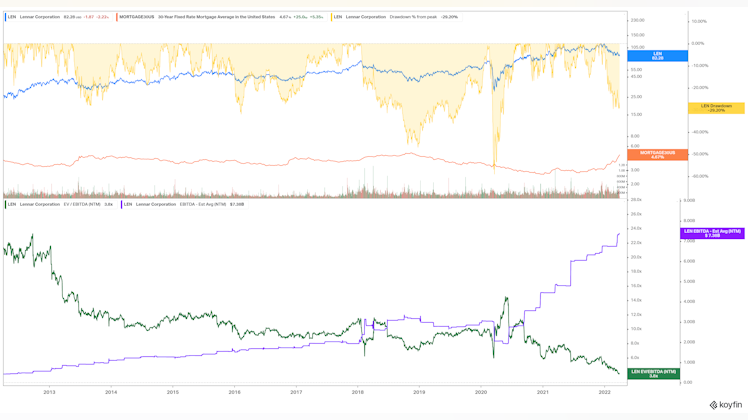

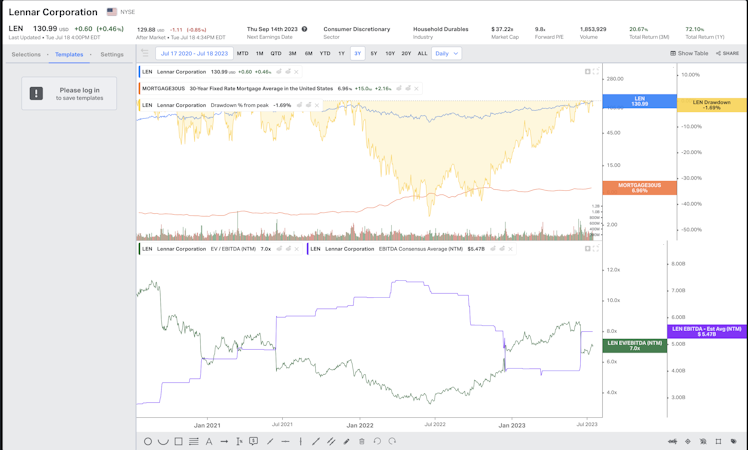

- EV/EBITDA (NTM): < 8.0x (Range is approximately 6.1x to 12.0x)

- It is currently trading at 10.2% Free Cash Flow Yield (Unlevered).

Risks

- China to be a key growth region for Coach. Currently key regions of China is suffering from Covid outbreaks which leads me to believe we might see a slowdown in China sales.

- Stuart Weitzman is a small niche brand and may suffer from fashion risk.

Conclusion

$TPR's operating performance is improving, but there are macro risks that cause me to hold off until sh*t hits the fan. I will add it to my watchlist.