Trending Assets

Top investors this month

Trending Assets

Top investors this month

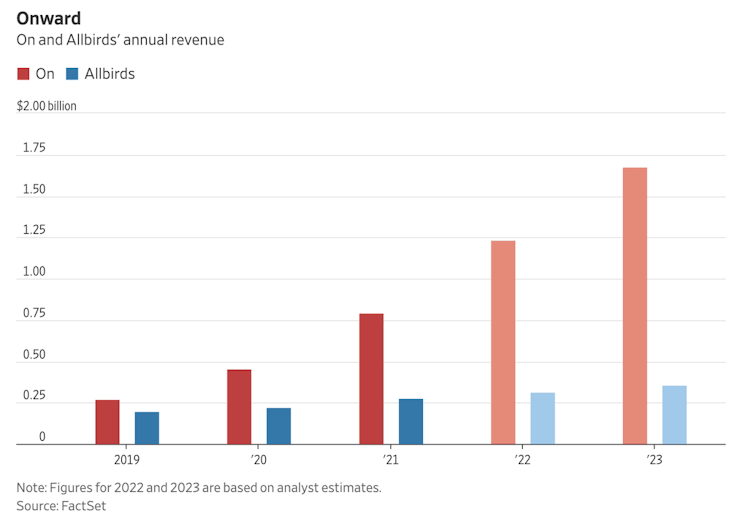

The success of On Holdings $ONON shows that wholesale, not DTC, is the way to go for growth and profits

Last month, I wrote a memo called Will these retail brands see success like Lululemon or struggle like Under Armour?. While writing that memo, I found myself questioning why Allbirds, a brand that is more well-known than On, was struggling to grow and reach profitability. The first I ever heard of the On running brand was when they went public. Their public debut spurred the creation of various memes depicting On customers as people that would buy their shoes to look athletic but never use them in the gym. Since they went public, I started seeing people wear On shoes at restaurants, at the gym, and on public transportation.

Personally, I'm in the Allbirds camp. After buying my first pair of Allbirds a few months ago and having a great experience with them, I bought two more pairs of Allbirds. Allbirds were appealing to me back in my college days because many of my friends had them and they were known for being made from sustainable materials. Plus, they were very comfortable. Allbirds $BIRD is a DTC brand with 5% of its revenues coming from wholesale and with that business model, I'd assume that they'd get higher gross margins than On and have a better profitability situation.

After looking at the financials of both companies, I was wrong. On Holdings, while having 67.5% of its sales from wholesale, has a gross profit margin of 57.1%. Allbirds, they have a gross profit margin of 52.9%.

Also, because On Holdings chose to utilize third-party retailers, they were able to grow faster and achieve profitability sooner. Allbirds went DTC from the beginning and because of that, it had a harder time scaling its business. Even with the immense word-of-mouth marketing that the brand receives from VCs back in 2019 and from various everyday people today, Allbirds continues to lag behind On.

The great thing about the wholesale channel is that the customer acquisition costs are a lot cheaper on the shoe retailer. On has spent a lot less on marketing to get the number of customers it has today than Allbirds, and that speaks a lot! On's wholesale partners, like Dick's Sporting Goods $DKS and other retailers, help promote On's running shoes to their own audiences. Also, because wholesales naturally order higher volumes of shoes, On is able to reap economies of scale and see its cost per shoe go down significantly as a result. For Allbirds, they have to be more careful on the number of shoes they keep in inventory because they don't have wholesalers ready to order tons of merchandise at any moment.

As this WSJ article quotes:

"So far, this wholesale-forward strategy has paid off, not just on sales growth but also on the bottom line. On has been profitable for the past three quarters; Allbirds hasn’t turned a net profit just yet. It helps that On spends less on attracting new incremental sales: On spent about 10% of its revenue on marketing in its latest reported quarter, while Allbirds spent 17%."

There is hope for Allbirds to catch up as last year, the DTC shoe brand chose to start selling shoes at Nordstrom $JWN and Dick's Sporting Goods $DKS stores. This move will allow Allbirds to greatly boost its brand awareness.

Even if Allbirds might be a smaller client of these third-party wholesalers than On, we have yet to see how the relationship between the third-party retailers and Allbirds goes. For On, they've earned the love of the third-party retailers as On chose to prioritize putting shoes in wholesalers' shelves than in its own stores during the supply chain crisis of 2021.

Even if the theme of retail is to go DTC and cut out the middleman, many of the big brands that talk about going DTC, like Nike $NKE, have been slow in reducing their dependence on wholesale partners like Footlocker $FL. Also, there's a reality that fashion brands need to face when considering a withdrawal from traditional wholesale:

"As big as Nike is, retailers’ brick-and-mortar reach is difficult to ignore: Nike had 1,046 stores globally as of mid-2022, but that is just 37% of Foot Locker’s store count. Meanwhile, Foot Locker’s strong non-Nike sales are probably enough to induce fear of missing out. In its last quarter, Foot Locker said New Balance sales grew nearly 70% compared with a year earlier. And while the Covid-19 pandemic initially decimated foot traffic to retail, consumers’ return to normal shopping behavior has given a boost to brick-and-mortar retailers. Both Foot Locker and Dick’s Sporting Goods defied Wall Street expectations last quarter by posting increases in same-store sales."

To conclude, I will now be walking to the On Running camp.

Highsnobiety

On’s Future Is Lifestyle But It’s Not Moving On From Performance

This year, On turns ten and is officially pushing on with its move into lifestyle following the launch of the Cloud Hi Edge at atmosCon in Tokyo last fall.

Already have an account?