Trending Assets

Top investors this month

Trending Assets

Top investors this month

Amazon.com Healthcare services - A true Risk or an Illusion one?

Hello folks. Three days ago I wrote a post (can be found here: https://commonstock.com/post/3aa53673-a861-4845-b02b-6008187e93ab) on the Valuation of Teladoc Health Inc and I attached a value of operating assets at 7 Billion. One of the comments was from @rihardjarc who asked about my view on the risk that could be created. It is a very logical question and in this post I will try to answer it, looking at the fundamentals.

Introduction

On the 1st of Aug 2023, Amazon announced that will offer telemedicine services in 50 states in the US via Amazon Clinic and the price of Teladoc Helath Inc declined about 6%. Many thoughts and comments were expressed on that day about Amazon.com and the advantage that will be gained from that sector.

It is clear that Amazon wants to show up in another one more sector because in 2022 acquired One Medical for 3.9 Billion to improve in-person whole care services.

Amazon.com Healthcare services

Let's examine what Health care services, Amazon provides:

Amazon Clinic: Offers affordable and convenient virtual care for more than 30 common health conditions—it’s great when you need to get treatment quickly from home or on the go, and you’ll always know the cost of a visit upfront.

One Medical: This is a membership-based primary care organization that combines in-person care with 24/7 on-demand virtual health services. Members enjoy seamless access to comprehensive care with primary care providers that support them on their health journey across every stage of life.

Amazon Pharmacy: This is a full-service pharmacy in the Amazon.com store. Customers can use Amazon Pharmacy to purchase medications prescribed by their doctor and have them delivered to their door, with free two-day delivery for Prime members. Amazon Pharmacy accepts a wide range of insurance plans, or Prime members can save with RxPass or Prime Rx.

What we conclude is that Amazon offers Telemedicine services via two different “departments” and tries to mitigate the delivery cost of Amazon Pharmacy into the Amazon Primers.

Looking at the FAQ of the Amazon Healthcare website I found that Amazon clinic using a group of companies to provide the services which are: Wheel, SteadyMD, Curai Health, and Hello Alpha

How I view Amazon.com– Musings and Concerns

Before starting to value each company I would like to make my basic narrative about how I see Amazon.com as a whole company and the advantage that will gain. As most known, Amazon is an online retailer with the main focus to become the biggest marketplace on the internet. A place where everyone will join and can find everything they want at the price they want. On one hand, this business model offers high revenues but the disadvantage is that has huge intermediate costs from the seller to the customer. This effect can be translated into low operating margins with high reinvestment rates. As a result, Jeff Bezos to mitigate that cost, created the Amazon Primer Membership in 2005, and the next year, AWS (Amazon Web Services) was launched as an Infrastructure Service (cloud services) to improve the

operating margins. In my valuation, I will assume that the main focus of Amazon remains on Online retailing, AWS, and Amazon Primers, and as a result, the telemedicine will become a service that Amazon Primers will be the main beneficiaries (like drug delivery and consulting for free) and not the casual users.

Valuation of Amazon.com Healthcare Services

Since I have breakdown the evolved companies, the only barrier that I have to pass through, is the valuation of them. I will value One Medical separately and I

will breakdown Amazon Clinic into four sub-parts:

- Wheel

- SteadyMD

- Curai Health

- Hello Alpha

- One Medical: This was a public company from 2020 and 2022 and was acquired in July 2022 by Amazon.com to deepen its presence in health care and to improve the experience of getting medical care. This company seems to offer whole-care support to the customers like wellness and lifestyle advice, chronic conditions, mental health even urgent concerns.

To value this company, I could have used the acquisition deal of 3.9 Billion but I don’t know if M&A has taken into account the premium that will be created from Amazon Primers. The company offers a subscription model that provides all the necessary healthcare services and that’s why I will value the subscription model to find the total value of One Medical.

Valuation of the Subscription Model

The last disclosure about the total subscribe users can be found in 4Q-2022 which was 836.000. Revenues for the same year were 1.046 Billion which means that each user spend 1250$. From 2020 to 2022 the growth rate in users was 24% and the average growth of Amazon Primers in the last 10 years is 19%. To depict the premium of Amazon Primers (since they will be the main beneficiaries) in the growth rate I will almost double the growth of subscription users from 24% to 40% for the first 5 years and then I will decline the growth at 10%. Furthermore, Amazon Primers are 93% more probable to stay with the service after one year and that’s why I used a similar (but lower) number for the retention rate of 90%. Finally, I assumed that the cost of revenues contributes to keeping its existing users and the

total operating expenses will contribute to acquiring new users. The results are the following:

Value of Existing Members: $ 1.89 Billion.

Value of New Members: $ 4.78 Billion.

PV of Corporate Expenses: $0.490 Billion.

Value of Subscription Membership/One Medical: $6.18 Billion

(Note: To find the value of each user, I used a paper from Professor Aswath Damodaran and the excel spreadsheet from his website)

- Wheel: Is a private company and I couldn't find any disclosure about the financial statement. But, looking at this site I could find that backed by Salesforce and Tiger Global Management, and valuation range between 1 Billion to 10 Billion. As a result, I used the worst-case scenario for the competitors and I valued Wheel at 10 Billion.

- SteadyMD: I just follow the same approach as above and I attached the value of 50 Million.

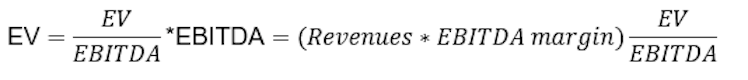

- Curai Health and Hello Alpha: For these two companies I could find only a range of revenues and that’s why I calculated the Enterprise value using the following equation:

Then I used the dataset from Aswath Damodaran website with EV/EBITDA=19.3 and EBITDA margin= 17%.

The equation for an average company in the Healthcare Technology and Information sector now becomes :

EV=Revenues*3.2 and the value of Curai Health and Hello Alpha is 23.8 and 10 Million respectively.

Finally, the total value of Amazon.com Healthcare services will derive as sum of all the above companies, which is: 16.3 Billion.

Monte Carlo Simulation and Sensitivity Analysis

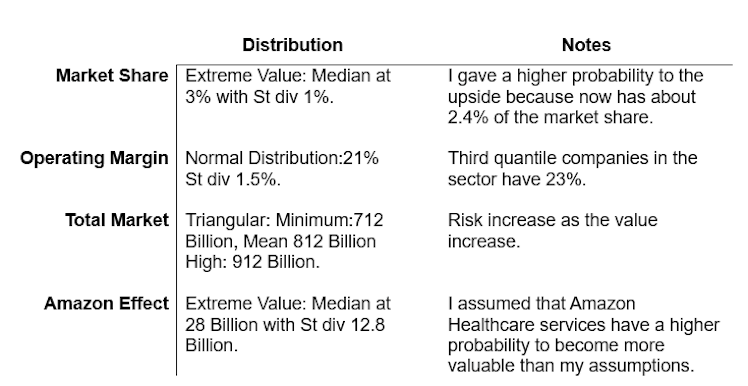

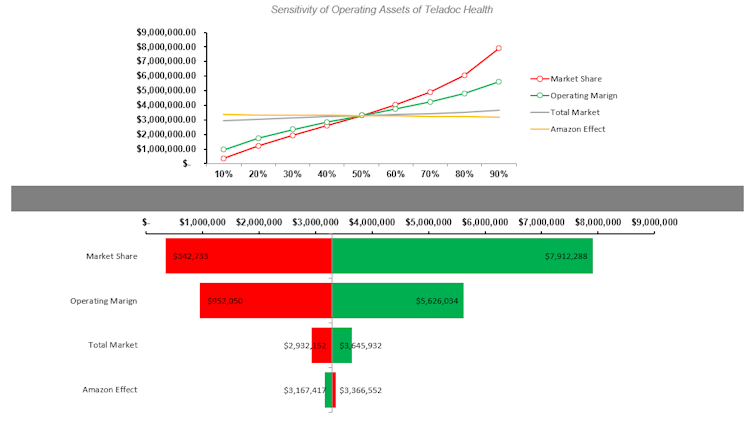

Since I have measured the value of Teladoc (7 Billion) I will examine the effect of the following variables:

- Amazon.com Healthcare services operating assets (16.3 Billion). (In my analysis i illustrate this variable as "Amazon Effect")

- Total Market Value (Which is decreased each time in accordance with the value of Amazon ("Amazon Effect"))

- Market share of Teladoc Health in Telemedicine sector.

- Operating margin.

The distribution that i used and the (value) range between 20th and 90th percentile can be found at the following two pictures:

Sensitivity Analysis

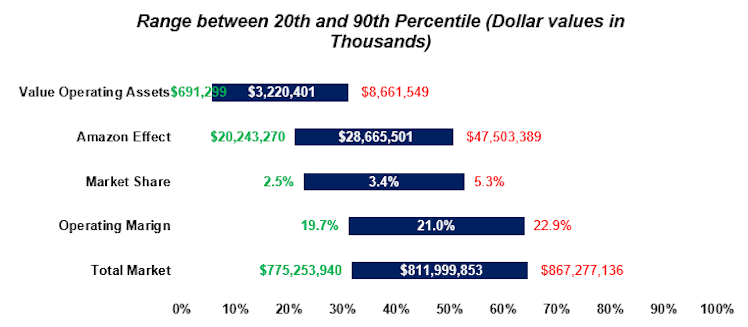

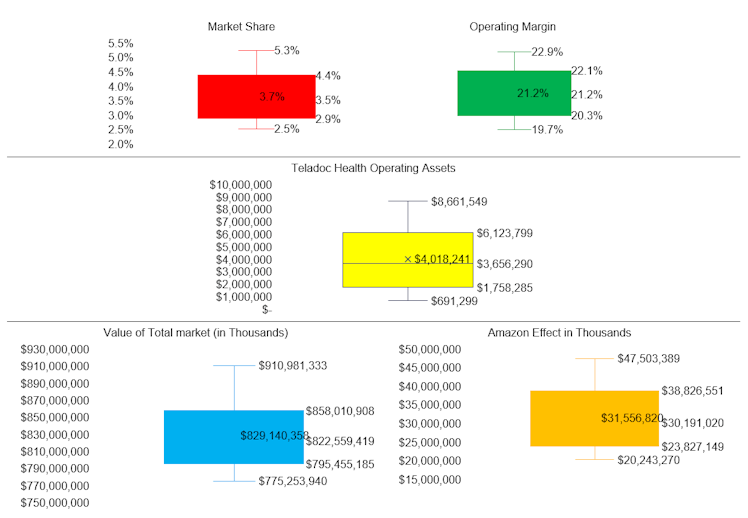

Since i have define the range of each variable within a random distribution, i will examine the effect of each variable to Teladoc Operating Assets:

Final Thoughts

My initial thought was to examine how exactly Amazon will benefit from the expansion of Healthcare Services and I conclude that Amazon Primers would be the main force that will increase the value of this service. My second step was to value each involved company, with any available information, and I tried to “Boost” my results with the effect of Amazon Primers. As a result, I came up with a value for Amazon Healthcare Services, at 16.3 Billion (Double of that Teladoc Health Inc).

Since I calculated the value of Teladoc and Amazon operating assets, I ran a simulation and sensitivity analysis to examine which factor has the most effect on the value of operating assets of Teladoc. Even with an increase of 46 Billion for Amazon Healthcare Services (“Amazon Effect”) and at the same time decrease in the Total

Market at 715 Billion, the effect against Teladoc was minimal. On the other hand, market share and operating margin seem to affect Teladoc the most because the growth of revenues is dependent from the total market share and the increase of operating margin from the goodwill impairment of Livongo.

Thank you and I hope good investments. Goodbye!

Do you believe that Amazon Healthcare service is undervalued?

33%Yes

66%No

3 VotesPoll ended on: 8/7/2023

Already have an account?