Trending Assets

Top investors this month

Trending Assets

Top investors this month

Teladoc Health Inc. – The Future of Doctor Visit

Hello everybody! I just finished my Valuation report for Teladoc Health Inc. $TDOC

I will summarize for you the most important parts:

Survey the Landscape

In valuation one of the first steps is to set the landscape, looking at the following parameters:

- How much growth the Telemedicine sector will have?

- Competition from the companies who operate in the sector.

- How much is the market share of Teladoc Health in this market?

- How exactly the macro environment, which operates, will affect the operations?

Following a report from the website www.futuremarketinsights.com, the whole value of the Telemedicine market in 2023 will be 106 Billion and is projected to grow to 912 Billion by 2033, exhibiting a compound annual growth rate (CAGR) of 24%. Furthermore, the company held a leading position (Top 5 company) in the market share of Telemedicine which is estimated at 6% in 2023 (source: here).

Teladoc Health Inc. Narrative

My narrative for Teladoc Health goes as follows:

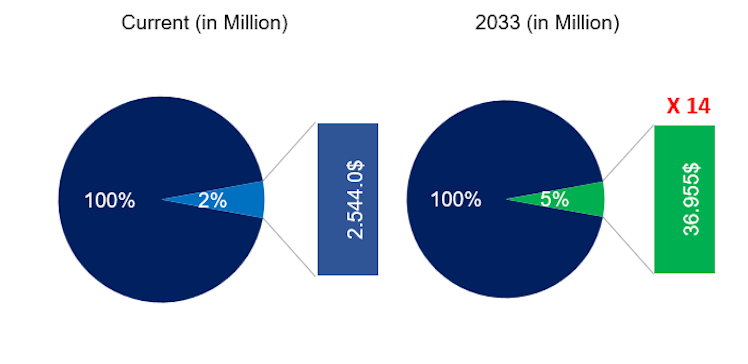

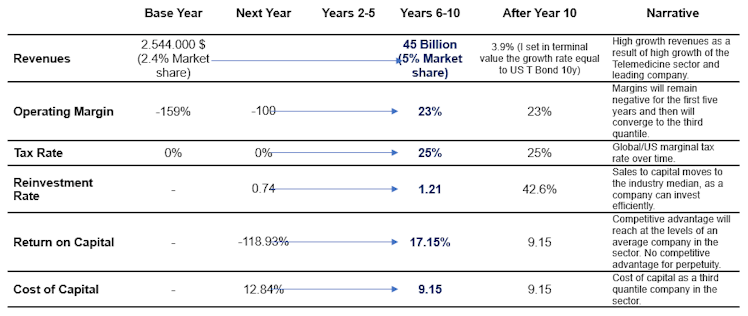

- Leading company in the Telemedicine industry with revenues to multiply 14 times by 2033 (Market share equal to 5%).

- In profitability, I searched at the third percentile of the Healthcare Technology and Information sector which is equal to 23%.

- Reinvestment Rate: This sector has a generally high reinvestment rate (median sales to capital just above 1) and at the same time, Teladoc has to face the high-interest rate and inflation, which has affected Livongo, with higher investment than in the past. As a result, I set for the first five years, sales to capital equal to 0.74 (high reinvestment rate) and after 5 years equal to 1.21 (median of the sector)

Valuation Results of Teladoc Health Inc.

Teladoc Health Inc is one of the leading companies in the Telemedicine sector which is going to grow at a fast pace in this decade. I assumed that the market share of Teladoc will be improved from 2%(2023) to 5%(2033) because as a leading company will have a higher competitive advantage than the competitors. Furthermore, I assumed that operating income in the first year will remain negative at -100% as a result of the poor operation of Livongo and then will converge to the third quantile of the sector. Due to high expenses from Livongo, Teladoc will need to make higher reinvestment rates than an average company in the sector and as a result, I set the value at 0.74 for the next years. After year 5, the company will have improved its operations with an established business model and average Reinvestment rate. As a global company that wants to offer a whole care solution, I attached a cost of capital at the third quantile of the sector which is 12.84%. Finally, the company will be efficient as an average company in the sector with no competitive advantage (in perpetuity).

Value of Teladoc Health Inc

Value of Teledoc $7,216,025

Probability of failure = 0.00%

Value of operating assets = $7,216,025

-Debt $1,575,060

-Minority interests$0

- Cash $958,695

- Non-operating assets $0

Value of equity $6,599,659

Value of options $64,601

Value of equity in common stock $6,535,059

Number of shares 159,675.00

Estimated value /share $40.93

Price per share $29.00

% Under or Over Valued -29.14%

If you want to learn more about their business mode, fundamentals and results from Monte Carlo simulation ( with Scenario and sensitivity analysis) then you can follow the links below. Thank you for the support!

Download for free the Valuation Report here: https://readysetvalue.gumroad.com/l/guarv or

you can read it at my Substack Newsletter:

Do you believe that Teladoc Health Inc. is undervalued?

58%Yes

41%No

12 VotesPoll ended on: 8/4/2023

Already have an account?