Trending Assets

Top investors this month

Trending Assets

Top investors this month

Cybersecurity Supremacy

Cybersecurity spending isn’t slowing down!

Palo Alto Networks $PANW reported earnings yesterday posting:

- Adj. EPS of $1.79 vs. $1.68 expected

- Revenue of $1.39B vs. $1.36B expected

A rare double beat for this earnings season. As a result, $PANW was up over 12% after-hours.

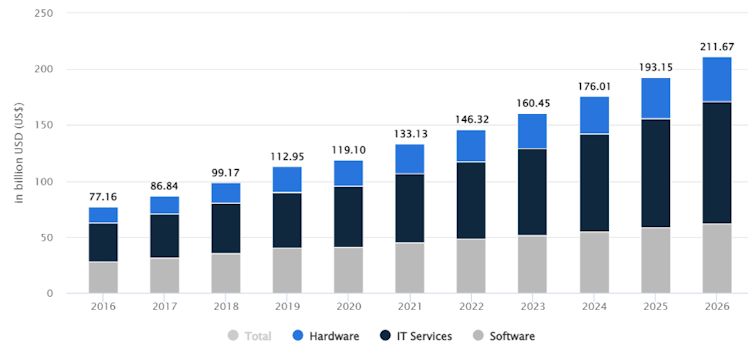

The cybersecurity industry is projected to be worth around $146B by the end of the year. Statista expects this industry to grow at an annual rate of 9.7% until 2026.

With tailwinds like these, cybersecurity stocks are in a great position over the next few years.

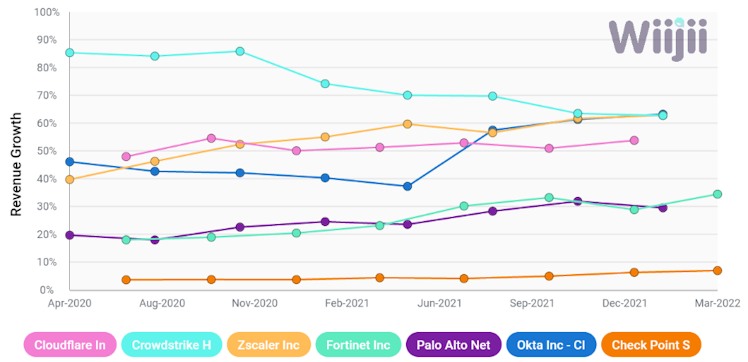

We can see this stability ourselves by looking at revenue growth for companies in this sector.

Crowdstrike $CRWD is the only stock to see its revenue growth decline over the past two years, but it is still at 63%!

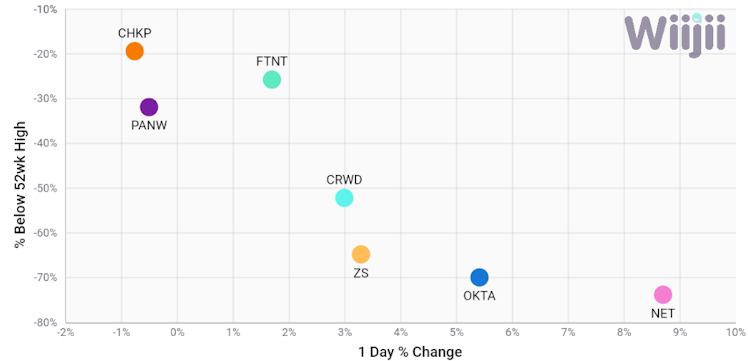

Even with these tailwinds, cybersecurity stocks have been hit hard in the recent sell-off. Only Check Point $CHKP has stayed out of a bear market level down 19% from previous highs.

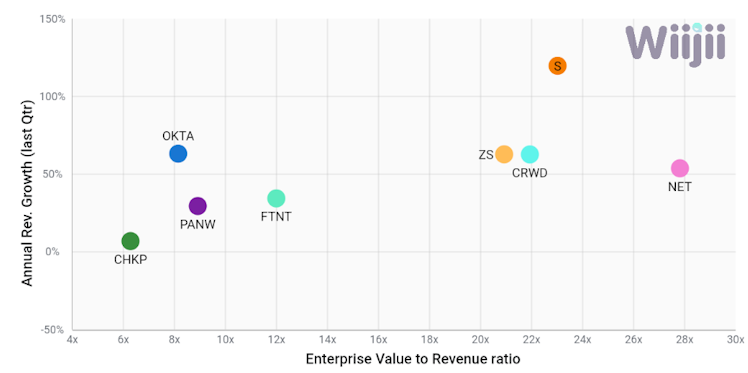

After this sell-off here is how these stocks currently compare based on revenue multiples and their respective growth rates.

Do you have a favorite cybersecurity stock? Which one? Tell us below!

viz.wiijii.co

Mezzi

The fastest way to analyze and compare stocks. Click to turn this Mezzi dash into your own!

Already have an account?