Trending Assets

Top investors this month

Trending Assets

Top investors this month

I Bought Spotify

I'm not sure why I can't link the trade (maybe I'm just a brick), but I'm proud to say I took a small position in Spotify this morning.

Call me crazy (fr, do it, I'm kinda into it), but after this year's ~60% decline in value, I believe Spotify's fundamentals, relationship with users & creators, and much more give it a substantial probability of long-term outperformance.

THESIS

[for now, I'm going to keep the thesis simple and mostly qualitative. if you guys are into it, I'll publish a full analysis with a price target on my Substack (link in bio) in the coming days, just let me know.]

Spotify's service is amazing

This part of my thesis is as Lynch-ian as it gets. I'm sure most if not all of us are familiar with Peter Lynch's book "One Up on Wall Street", in which he argues for the validity of an investing style that incorporates what you actually use, do, and observe as a consumer.

I can't stress this enough - I love Spotify. As a broke college student, I'm naturally a cheap f_ck. I won't subscribe to a monthly subscription for anything unless I physically need it to function or can get the bank of Mom & Dad to pay for it. Unfortunately, I have never been able to get approval from the bank in question to perform this acquisition, so I do so with my own capital. Spotify is the only thing I pay a monthly fee for, and you better believe I do it with a smile on my face.

In simple terms, now that I'm a shareholder, I can view my monthly payment as writing a $10 check to myself. Obviously, that's insane, but who cares, it works for me.

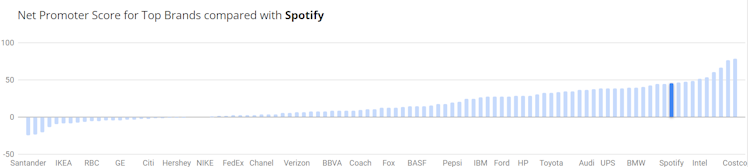

Moreover, Spotify's other users also seem to love the service. It carries a massive NPS score of 46 (one point below $AAPL and one above $MSFT), meaning that out of 100 random users, 73 of them will be active promoters of the service.

Yeah, yeah users love Apple Music too, but in my experience (and I might be a little bias) Spotify's service and UX is materially superior to Apple. The App store and Apple's control of distribution is an elephant in the room, but in the long-run, better services tend to win out...and Lina Khan might have something in the works around Apple's App store control.

In sum, I love it, you love it, and the service is only getting bigger and better.

Streaming music and podcasting are rapidly growing industries

From radio, to LimeWire, to Napster, to Pandora - we've finally developed a way for people to easily stream whatever audio they want in a cheap and efficient way, thanks to Spotify.

I don't think I need to tell you that streaming music is largely preferable to radio. Plus, Spotify and its main competition (hi Tim Cook!) are essentially the same here. Where Spotify wins, however, is podcasting.

Per today's earnings report, Spotify added 400,000 shows to its content catalog, bringing the total to 4 million. According to the most recent data I could find (04/2021), that's double the amount on both Apple Podcasts and Google Podcasts.

Further, Spotify is going hard with acquisitions in the space. In addition to purchasing podcast shows and studios like The Joe Rogan Experience and others, Spotify is going vertical into podcast advertising, production, and analytics. Just last quarter, the firm bought Podsight (pod ad measurement service) and Chartable (pod audience analytics service). But maybe the most exciting aspect of the earnings report as it relates to podcasts was the results from Anchor.

Anchor is a podcast production platform completely free to users and owned by Spotify. As of today, we learned that a massive 85% of new shows on Spotify are produced in-house via Anchor. The firm is slowly growing its control over the entire podcasting landscape, and that's great for advertisers.

Ads embedded within podcasts have repeatedly proven to be the most effective as far as listener retention. According to Super Listeners 2021 Report, podcast ads are the most recalled form of advertisement, with 86% of respondents saying they remember seeing or hearing a certain ad. For comparison, social media ad recall was 80% and website ads were 79%.

And it gets even better. An insane 64% of respondents in the same survey literally said they enjoy podcast ads, reason being, they simply appreciate the brands who support their shows. Still not sold? 76% of respondents report to have engaged with or taken action with companies or products they discovered via a podcast ad.

It's an advertiser's dream. Something about audio makes human beings feel a closer relationship to the content, and Spotify is taking full advantage of this. Podcasts FTW.

Basic financial analysis suggests high-potential for strong, long-term growth

We'll keep this part short and sweet.

Management provided underwhelming guidance for the next quarter, detailing lower gross margins and a probably operating loss. However, Wall Street gets far too up in arms about the next quarter, largely forgetting the real question is what will happen over the next decade.

Revenue has consistently grown around 20% per quarter on a YoY basis. The business is relatively capital-light, carries 0 inventory, and has net debt of -1.8bn. Free cash flow has been a struggle, but the firm posted its first profit in just Q1 2021 (when digital ad spending was miserable thanks to COVID). Since then, quarterly profitability has been sporadic at best but appears on track to achieve consistent profitability in the coming years (I'm not a damn oracle, idk exactly when).

Moral of the financial story is this: things aren't looking great right now, but with an elite management team and ultra-strong tailwinds, we can have reasonably high expectations for this to be cleaned up in the future. Financials matter, but you remember that Buffet said to be greedy when others are fearful.

CONCLUSION

So what do you think? Obviously, this is mostly qualitative, which isn't super useful, so feel free to fight me with some numbers. But whatever you bring, I'm staying long for a long time.

Spotify:

80%Bullish

20%Bearish

15 VotesPoll ended on: 4/29/2022

Already have an account?