Trending Assets

Top investors this month

Trending Assets

Top investors this month

4/1/22 - Dividend Portfolio Update

The below post is a summary of information on my recent portfolio article, you can read the full thing here!

Market Update

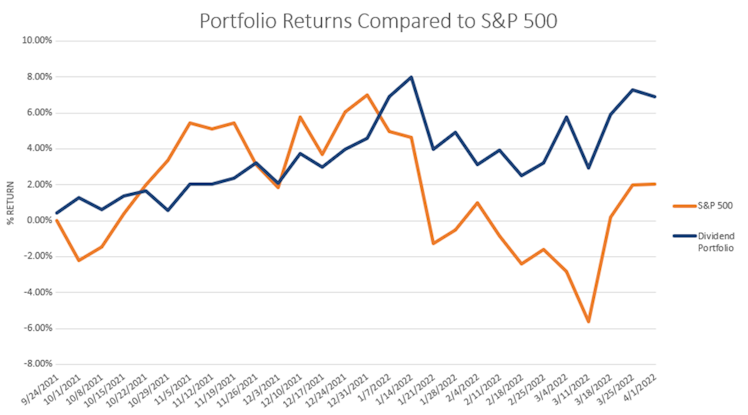

We saw a whipsaw week in the market with gains made on Monday and Tuesday that were later wiped out leaving the S&P at a 0.1% gain for the week. From a sector perspective, cyclical financials, energy, and industrials were the worst performers while real estate, utilities, and consumer staple stocks outperformed.

The week started with good momentum while supposed cease fire talks were taking place. Stocks rallied even as the treasury yield 2-10 spread inverted on Tuesday which is historically a signal of a coming recession. Those gains were removed through the end of the week as Russia refused progress in cease fire talks, inflationary measures hit high levels, March employment numbers reported well but support additional expected hawkishness form the Fed, and investors balances and took profits for quarter-end.

Portfolio Update

To date, I have invested $7,780 into the account, the total value of all positions plus any cash on hand is $8,317.33. That’s a gain of $537.33 for a total return of 6.91%. The account is up $17.89 for the week which is a 0.22% gain.

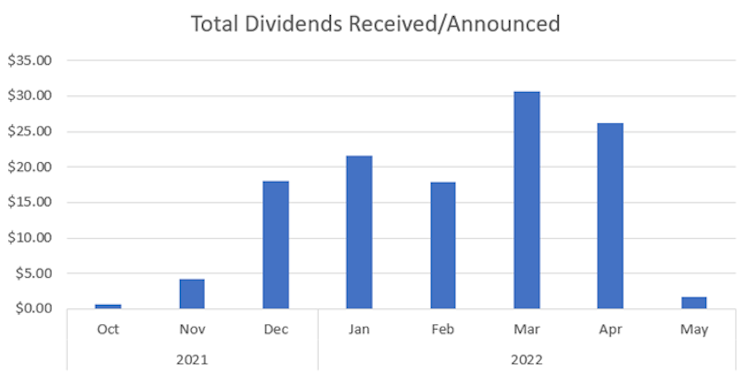

This week we received $9.77 in dividends from six tickers. $1.64 from $SCHD, $1.86 from $XYLD, $3.09 from $EOG, $1.70 from $ALL, $1.04 from $PB, and $0.44 from $KO.

In my portfolio, all positions have dividend reinvestment enabled. I don’t hold onto the dividend, I don’t try to time the reinvestment, I just let my broker do it automatically. All dividends were reinvested (except for KO, that will be reinvested on Monday).

Dividends received for 2022: $73.25

Portfolio’s Lifetime Dividends: $96.17

Here’s the breakdown of the trades I made this week:

• March 28th

o T – added 2 shares at $23.98

o UWMC – sold 4/1 $5 cover call for $1 premium (expired worthless for a $1 gain)

o SCHD – dividend reinvested $1.64 at $79.73 per share

• March 29th

o SNDL – covered my put position from last week ($1 loss)

o XYLD – dividend reinvested $1.86 at $46.69 per share

o EOG – dividend reinvested $3.09 at $121.84 per share

• March 30th

o SCHD – added 0.125447 shares at $79.71 (recurring investment)

o XYLD – added 0.201523 shares at $49.62 (recurring investment)

o O – added 0.5 shares at $70.32

• March 31st

o BBY – added 1 share at $91.67

o CMCSA – added 1 share at $47.11

• April 1st

o UWMC – added 1 share at $4.44

o ALL – dividend received $1.70 (not reinvested closed position)

o PB – dividend received $1.04 (not reinvested closed position)

That is it for the update this week. Let’s kill it next week. Stay patient and be ready to buy income producing assets at a discount!

Dividend Dollars

Dividend Portfolio: 4/1/2022 Week in Review | Dividend Dollars

Weekly update on the dividend portfolio! To date it is up 6.91%

Nice idea to share here and start some conversation! Really impressive how quickly your account has grown 👍

Already have an account?