Trending Assets

Top investors this month

Trending Assets

Top investors this month

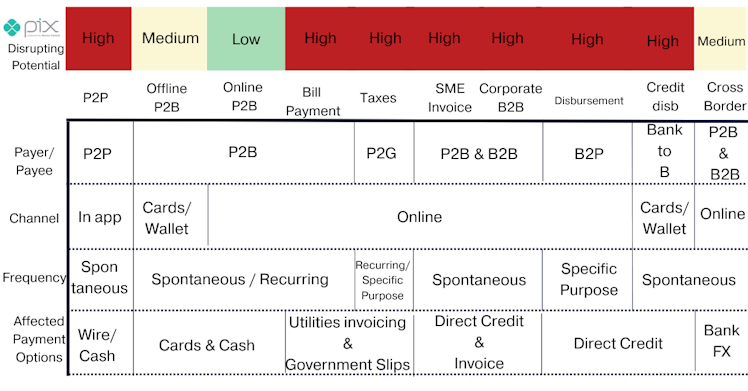

According to our proprietary research and expert channel checks, instant payments can affect many use cases involving merchants and consumers.

In the past month, we heard over a dozen CFOs and Senior Product Managers trying to map where instant payment schemes could offer a threat to profit.

Our perception is that C-level management doesn’t see Pix as a core, and Product Executives are solely focused on implementation.

Even though we agree they should focus on their respective roles, we missed more granularity about the economic impact of Pix.

So, illustrated below, we set our war table for estimating where and by how much Pix and probably most instant payment schemes should affect profit pools.

Source: Giro Lino.

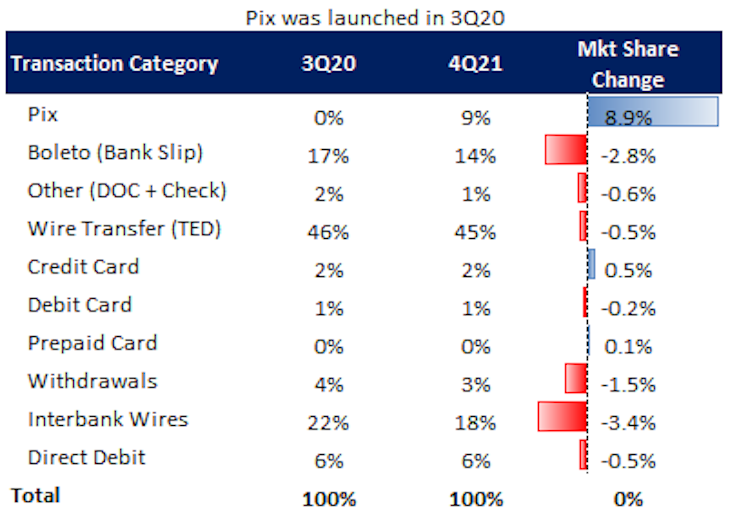

We built this table based on the available evidence, gathering and processing all data since Pix was launched in the 3Q20 and in our new top-down model for payment companies.

The first evidence we highlight is the transaction market share. By the 4Q21, Pix had gained an 8.9% market share. Also, it’s worth mentioning that credit cards gained market share during the period.

As the following illustration shows, bank slips, wire transfers, and withdrawals (cash) were the main losers.

Source: Giro Lino, BCB.

However, based on historical growth, we observed that Debit and Prepaid Card growth decelerated since Pix was launched, raising the question of whether Pix isn’t stealing the incremental volume directed to Debit.

If that is the case, and the argument sounds reasonable, Debit card penetration should slow in the following years.

On the other hand, we see evidence of accelerating credit card adoption since Pix was launched. After deep research, we concluded there is a different external factor for such acceleration.

Already have an account?