Trending Assets

Top investors this month

Trending Assets

Top investors this month

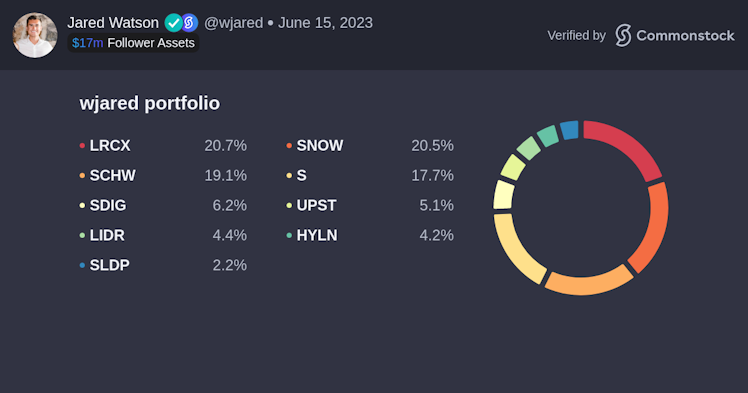

June Portfolio Update

I’ve been actively trading over the last month so I wanted to do a lil’ mid-month catch up. I’ll describe the general trades with rationale (when applicable) below.

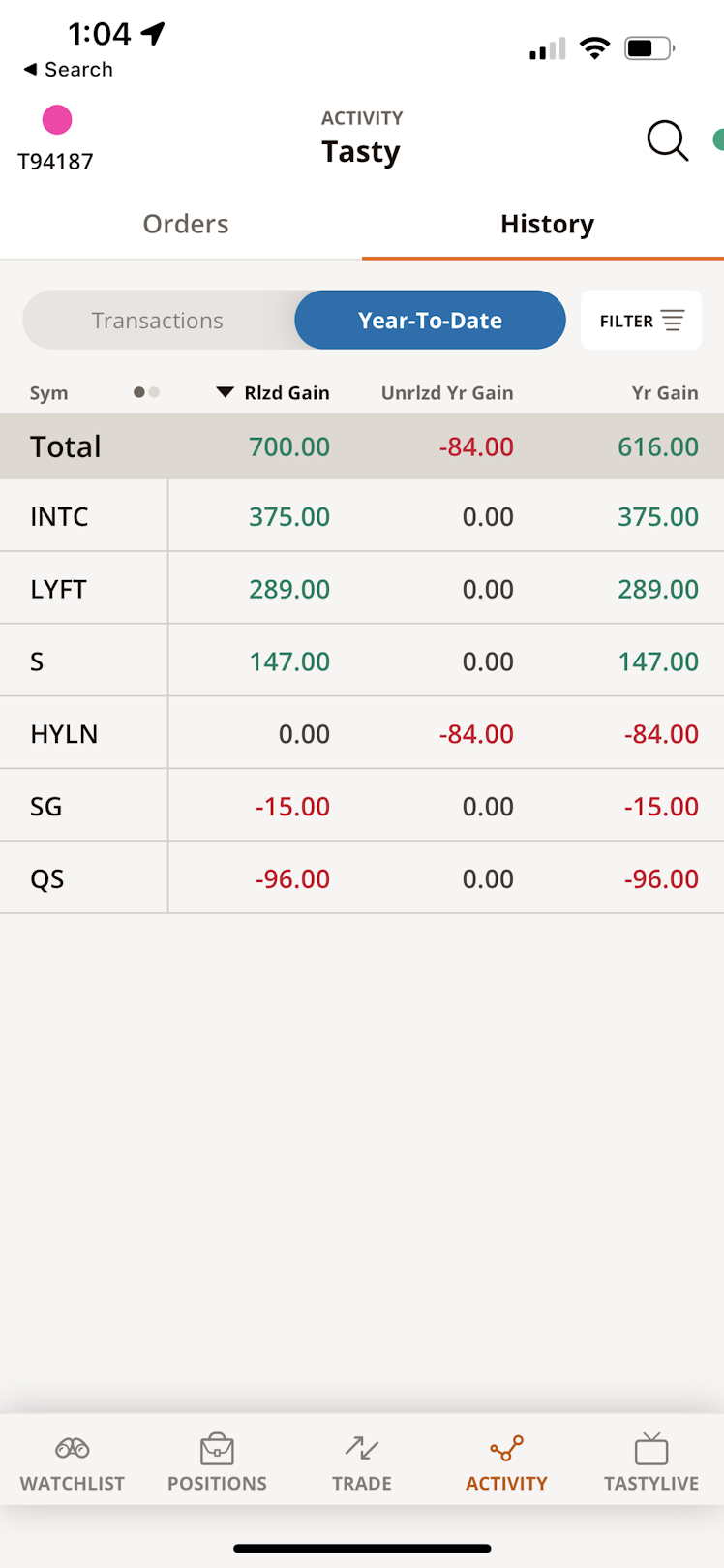

Options

As you can see below, I’m up around 100% in my (small) options account YTD. I slowly scaled out of the 3 $LYFT calls, taking profit at 50-250%. I was trying to wait and see my thesis play out, but decided to take the free money and run.

Equities

$LRCX: Increased my weighting by 11%, making it my largest position. Despite the recent rally in semiconductors, I think Lam Research has room to run; with an abundance of catalysts and tailwinds on the horizon with AI and Moore’s Law.

$SNOW: Trimmed slightly after a weak earnings report and guide. I’m still extremely confident in Snowflake, but brought it in line with my other overweight positions. Just like Lam, I think Snowflake will be a winner as a result of the platform shift we’re seeing with AI proliferation.

$SCHW: Ever so slightly increased my position size. I’m very comfortable with Schwab staying near the top of my portfolio allocation, but am monitoring net new assets and accounts, which they report on monthly.

$S: Significantly averaged down on SentinelOne when they dropped by 30%. I purchased large blocks of shares at $13.05 and $13.71, bringing my average down to $14.97. I didn’t want to be overweight here, but felt like my hand was forced below $15/share.

$SDIG: Small buys. Slowly accumulating while trying to stay confident in my thesis despite negative price action.

$UPST: Trimmed at around 100% profit to shift capital to $LIDR. Nice to see the market recognize the deep value I saw below $20/share.

$LIDR: Doubled my allocation. The price still doesn’t make sense with their net cash position and roadmap. I think the market will catch on eventually.

$HYLN: No change.

$SLDP: Trimmed significantly after some recent strength. I didn’t time it perfectly as Solid Power saw a bit of a run with the CEO announcement, but since I see the company as a 2025 and beyond play, I don’t feel the need to maintain a more than underweight position, especially with what I see as excellent opportunities for alpha in the current market.

Already have an account?