Trending Assets

Top investors this month

Trending Assets

Top investors this month

$CRSR, Some Good, A Lot of Bad

Another one of the largest positions in my portfolio just reported earnings and it's not looking great. While there is some good there is certainly a lot of bad.

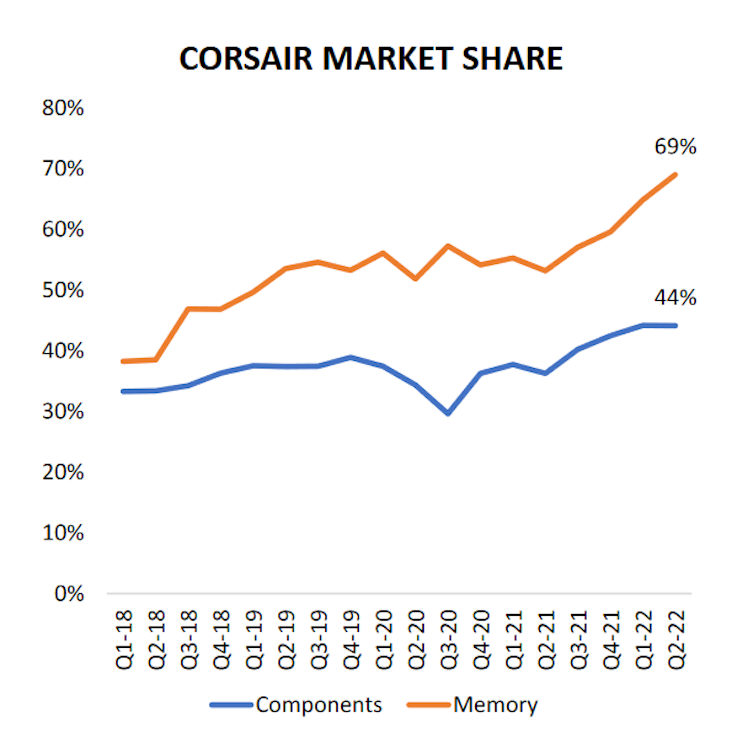

Corsair is still gaining market share in memory and components.

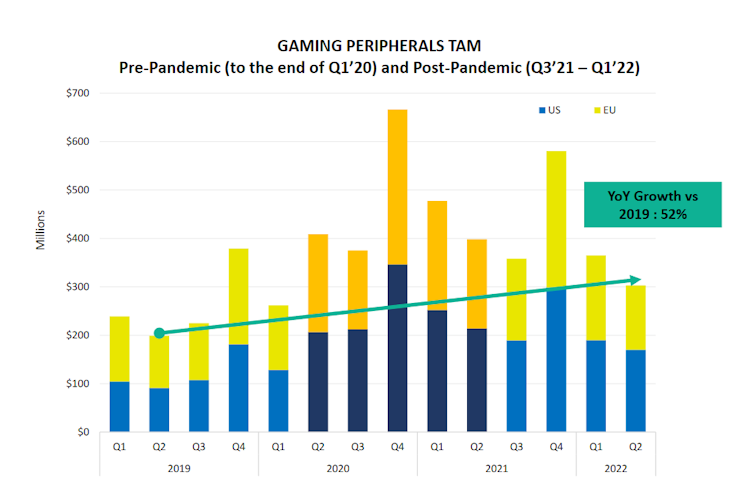

While $INTC and $AMD talk about a slowdown in demand for PCs. Corsair is still optimistic as the space is still a lot larger than it was pre-pandemic.

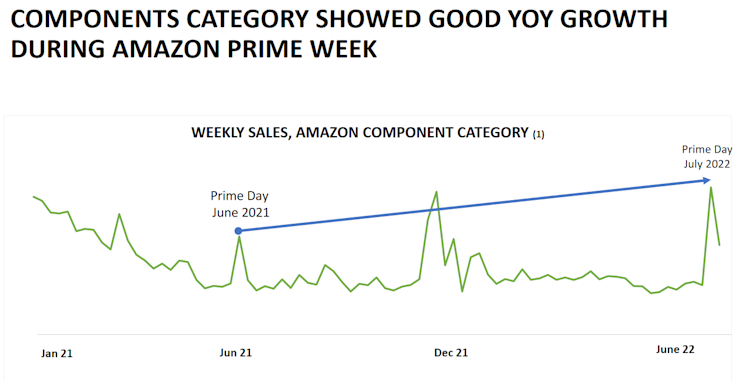

Sales on Amazon continue to be somewhat steady over the last few years.

A new partnership with Nvidia will help build out Elgato's ecosystem of products and offer a better user experience.

Also in their filing, $CRSR mentioned their 51% investment in iDisplay has settled and added $150m in intangible book value.

All that's good...

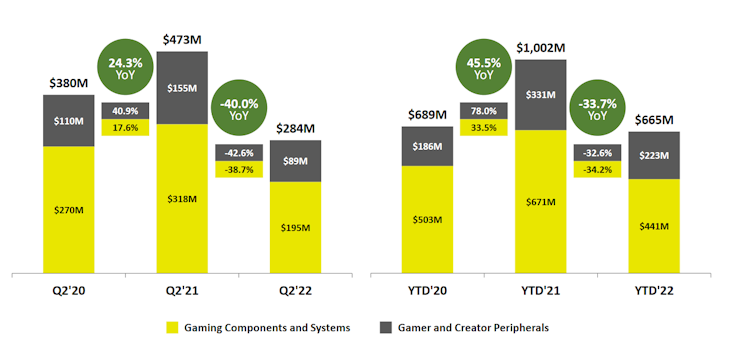

The bad starts with Revenue down huge Y/Y. In both components and Peripherals.

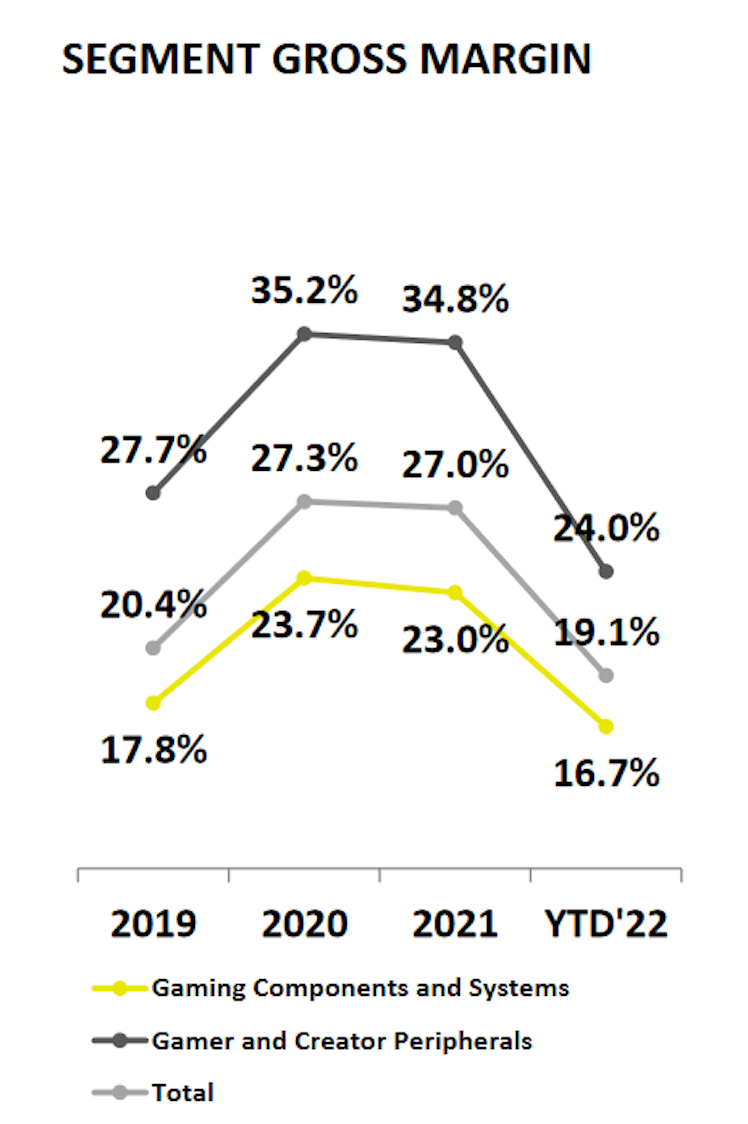

Margins have gotten killed although notably around the same level as pre-pandemic.

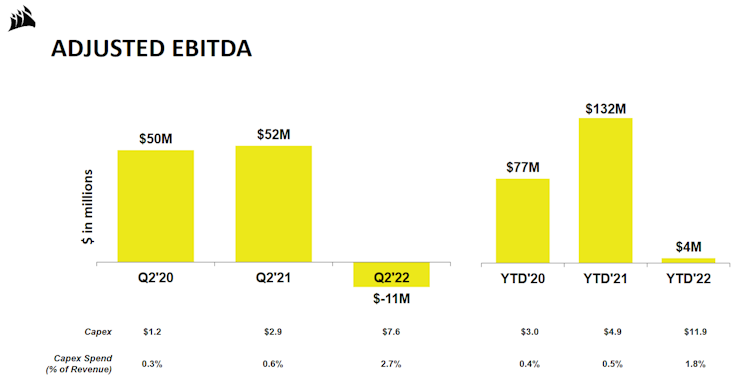

ADJ-EBITDA went negative. Still positive YTD but very concerning.

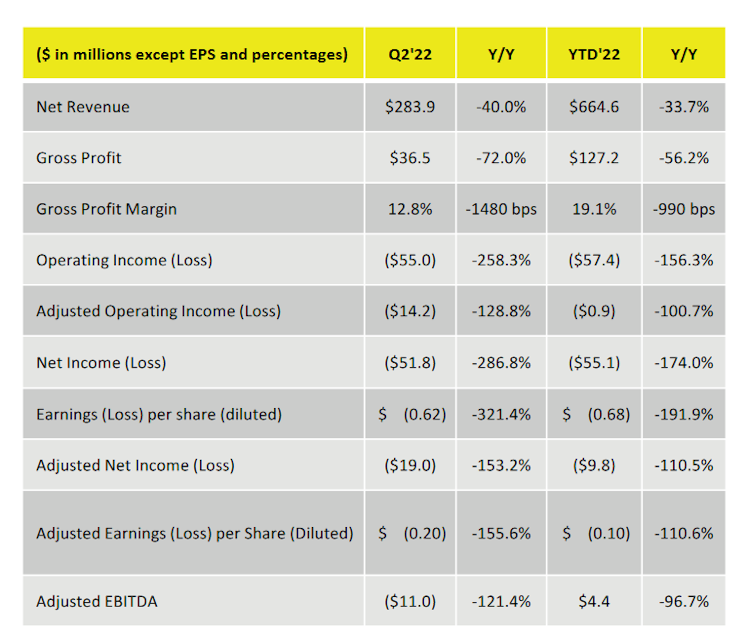

And in general, every measurable stat $CRSR has is down Y/Y. From Revenue to Profit to Net Income which is also negative this quarter.

One of the big problems mentioned is sales in Europe being negatively affected. The claim is the war in Ukraine is slowing spending in both Russia and basically the rest of Europe. Also as inflation climbs a lot higher throughout the entirety of Europe I believe sales will still be bad for a while.

While I think the slowdown was expected these earnings are still quite bad. I continue to hold that Corsair is making meaningful progress in the various areas they operate. Especially given the strong showing from Elgato I believe that the brand will lead Corsair to higher revenue and profit over the long term.

Finally, it appears there is a rumor in Turtle Beach land of activist investors pressuring the company into selling itself. If Corsair we're to step up I, as a shareholder would find this to be quite good news. Adding another high-quality brand to the fold would be incredibly beneficial for both parties.

And one final little tidbit I found in their 10Q filing was this.

When talking about the GPU market a spelling error occurs and instead Corsair mentions a different kind of market entirely. A bit of humor from a rather disappointing earnings.

Already have an account?