Trending Assets

Top investors this month

Trending Assets

Top investors this month

Bye NIO 👋🏾

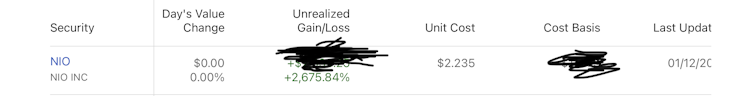

$NIO has been in my portfolio since shortly after the IPO; as a college student, it was my way of buying into the $TSLA hype at a lower cost. After watching my NIO position grow over 2000%, mostly all in the past eight months, I have decided to exit my stake entirely. Here’s why.

- The most important reason: I think my money could grow faster elsewhere.

Following the news of the $NVDA partnership, NIO saw another bump. However, fundamentally how much more do I see NIOs value rising over the next 2-3 years? Would I rather be in another emerging stock like $SQ or a covid devasted company like $AMC (Memo coming soon 😉)? The answer is yes.

- I have 5% of the original position I had in $NIO

My sell strategy was to start selling NIO when it hit $10 that was ~400% return. I continued to sell up to $50 as late as last week.

- I don’t want my portfolio defined by one win.

This may be my ego talking, and I am aware of it, but there are market opportunities everywhere. Maybe not 2000% growth picks, but I don’t believe $NIO has another 2000% run and holding on to grab a screenshot at 3000% is a terrible reason not to sell.

Here’s a screenshot of my remaining position of NIO in my portfolio that I’ll be selling off today.

Already have an account?