Trending Assets

Top investors this month

Trending Assets

Top investors this month

$PLTR - Palantir Earnings Q42022 & FY 2022

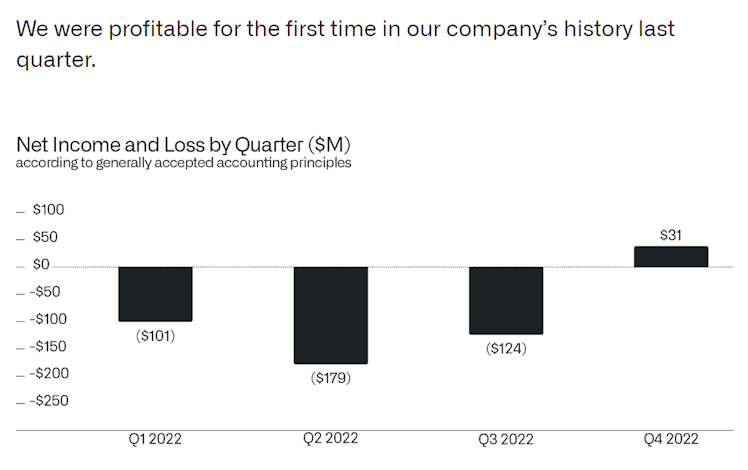

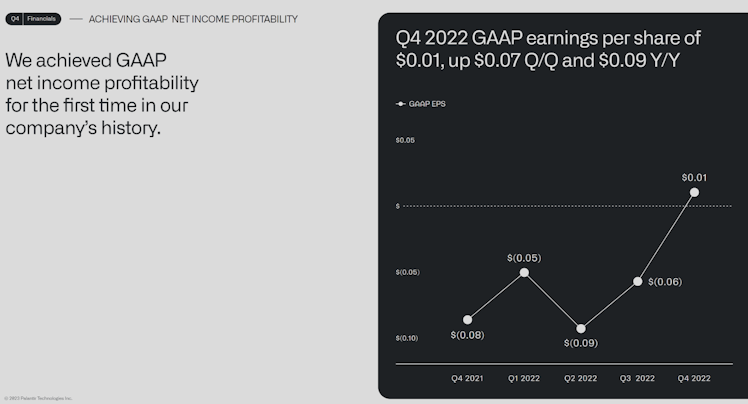

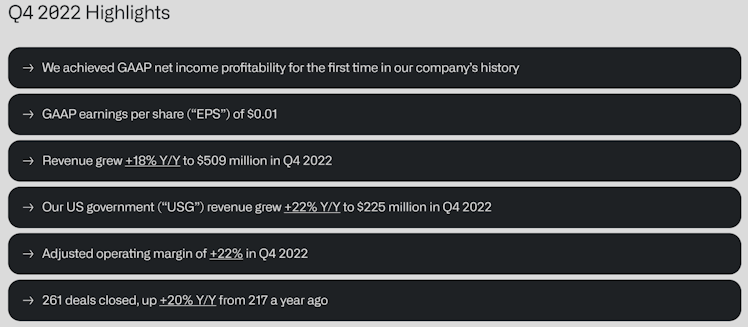

The numbers

Palantir had its first quarter as a profitable business. This is a big deal in the SaaS world, there is only a handful of kickass high-quality SaaS names that are profitable on a GAAP basis. I think they realized last quarter(Q3), when their Government business was experiencing a slowdown, they should pivot to profitability. That makes sense, and I am quite surprised they reached this milestone in two quarters. Tells me a lot about the ability to adapt to rapidly changing conditions and come out on top.

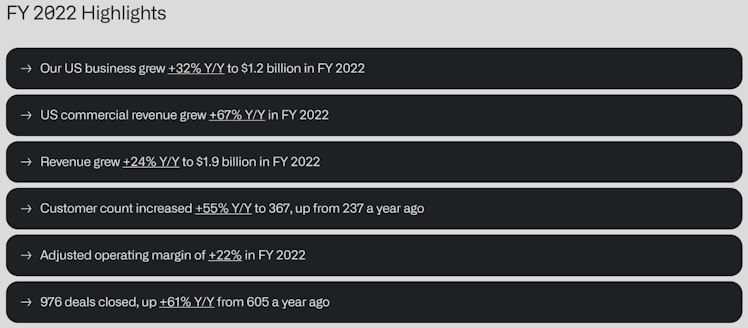

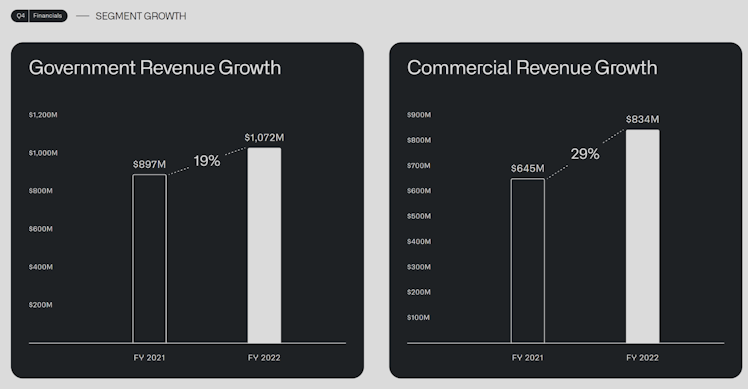

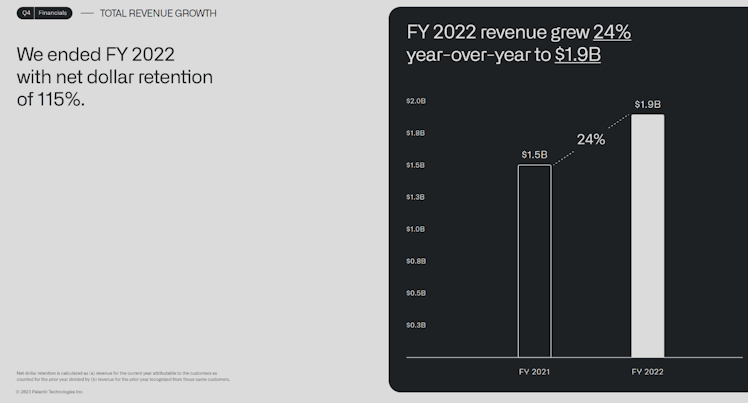

Overall 18% growth is great, especially considering their government business is slowing, but I think it will recover over time to 30%+ growth which has been their long-term growth rate in Government. Also, think about how governments operate(and their inefficiencies); the runway here almost seems endless.

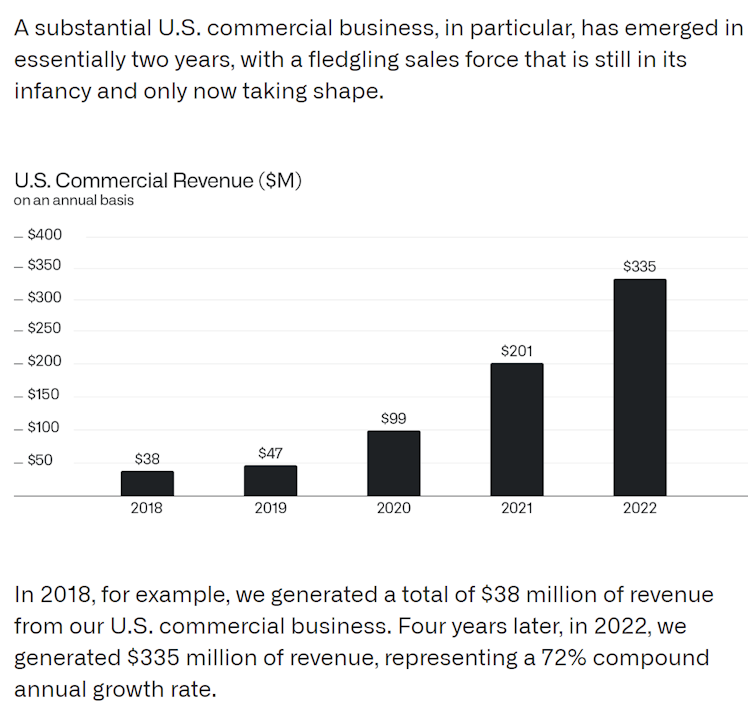

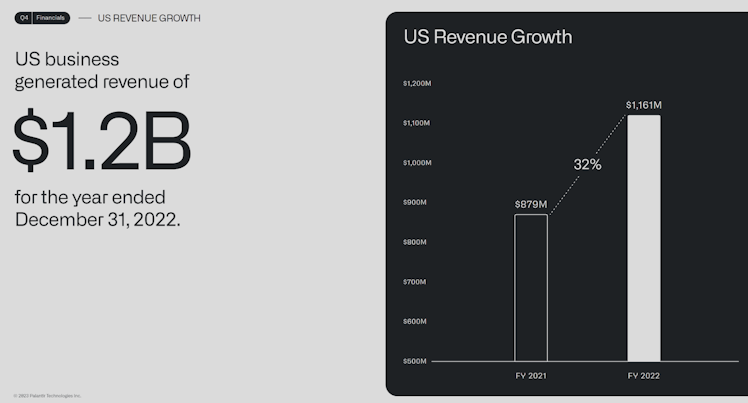

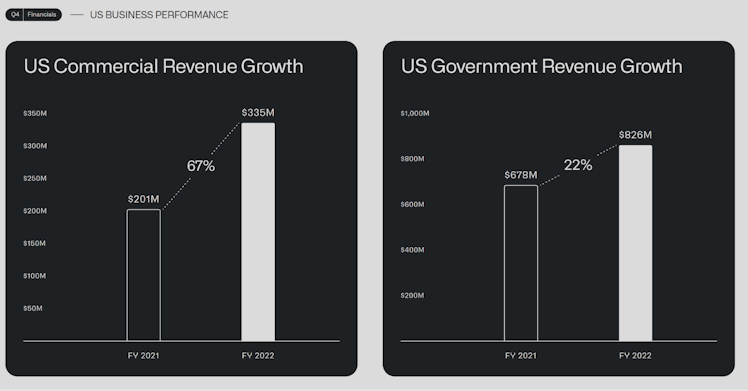

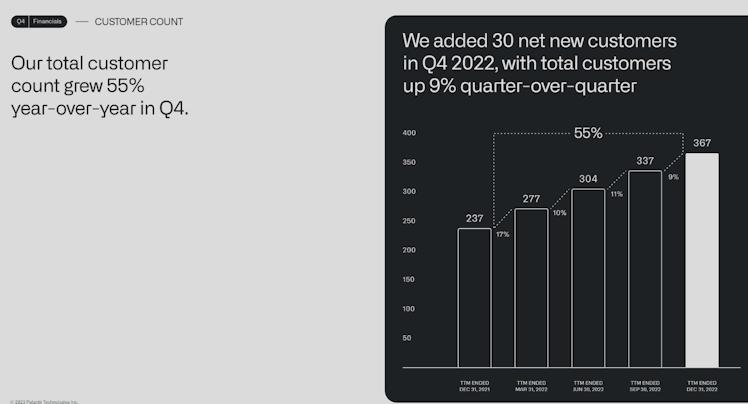

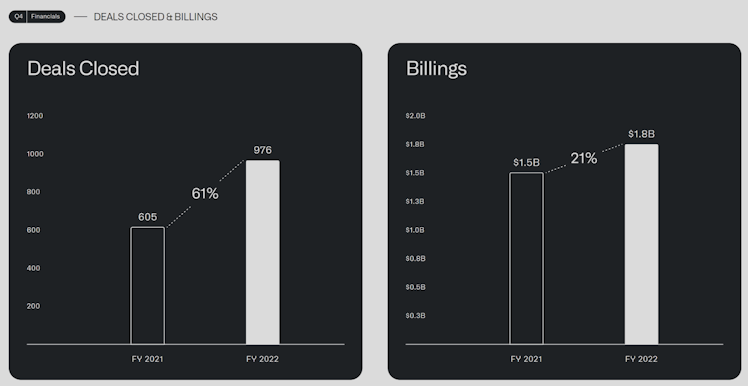

An objective look at their yearly numbers tells us their US business(Government+Commercial) is growing at 32%, and the US commercial business, at 67%, is growing crazy in hypergrowth mode(at a time when most US software businesses are expecting major cuts and slowdown). Also, the number of deals closed and customers signing up is also in hypergrowth. Any Sane growth investor will love these numbers and get on the train if they can overcome their biases and stay clear of the bearish FUD(Fear, Uncertainty, and Doubt) and talking heads who have barely put any work into understanding the durability and quality of Palantir. And to all these folks, if you live in US/UK and have had the COVID vaccine, also, if you have someone you know who was hospitalized during COVID and needed a ventilator, Palantir enabled this for you. They were the only ones capable of doing this for you and will keep doing it, despite the hate that you lay on them. Also, if you think Ukraine was a gateway for world war 3, Palantir is enabling Ukraine from space to mud to fight the Russians, just ponder and ruminate this highly impactful and pro bono ( Ukraine is not paying ) initiative Palantir has taken. More here - https://www.washingtonpost.com/opinions/2022/12/19/palantir-algorithm-data-ukraine-war/

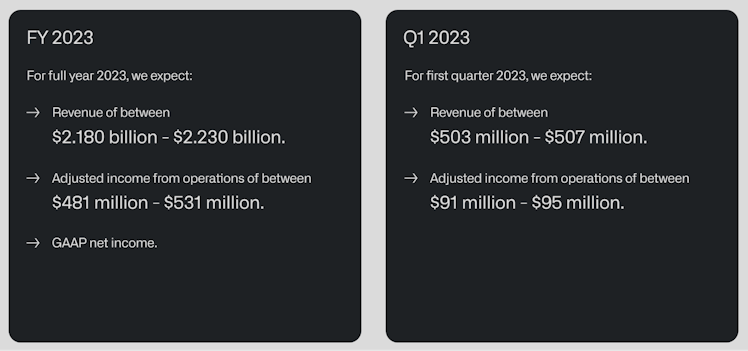

Their guidance is radical, projecting GAAP profitability for FY2023 and GAAP net income. Ask yourself, How many SaaS businesses are doing this?

The Quality

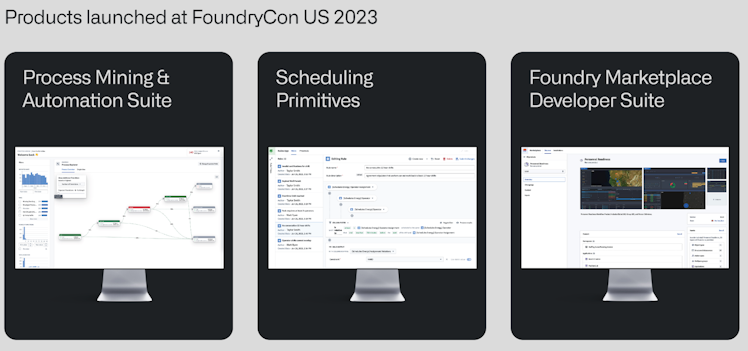

As always, Palantir has its foot planted into the pedal for delivering high-quality products. Love the marketplace where all Palantir users/companies can share their work, and others can benefit. This is another layer of defensibility for Palantir to add another network effect on top of their Foundry platform. Also, the Process mining and automation suite is literally magic. See Shyam explain these new products here - Ontology: Your Business As Code | CTO Shyam Sankar

Alex Karp’s thoughts on Palantir’s differentiation v/s consumer AI

Built for tough times

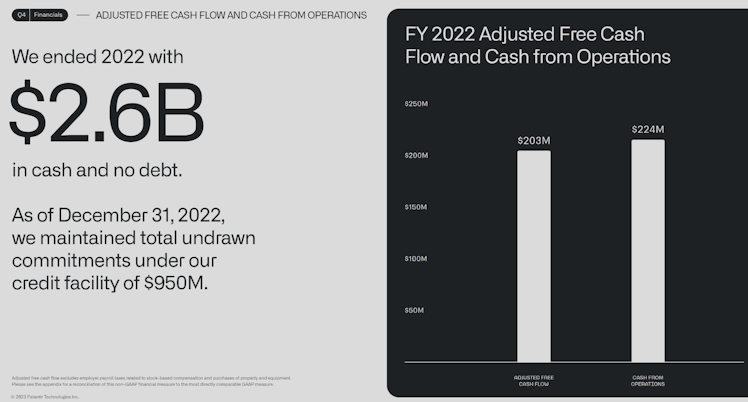

Palantir is built for tough times with $2.6B in cash, a $950 credit facility, and no debt. Think about it, it took them 15 years and $3.5B to build what people are barely starting to use now, and they have another $3.5B(cash + credit) of capacity to change the world of enterprise software forever.

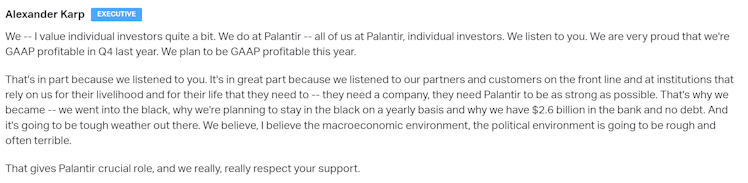

And last but not the least, Palantir cares about their individual investors, unlike every other business that is busy serving their wall street overlords.

$PLTR profitability makes $PLTR stock more accessible to everyone value, growth, and momentum investors.

This means a lot more institutions would want to own it, a lot more analysts will cover it and a lot more people are already looking into $PLTR due to the price rise.

Buckle up.

Sources:

Already have an account?