Trending Assets

Top investors this month

Trending Assets

Top investors this month

Capital Returns part 2: Growth and Value

Last week, I uploaded a post on some topics discussed in the book Capital Returns. You can read that post here.

This week, I did the second part, which you can find below. Hope you enjoy it and if you do be sure to leave an upvote and a comment with your thoughts!

--------------------------------------------------------------------------------------------

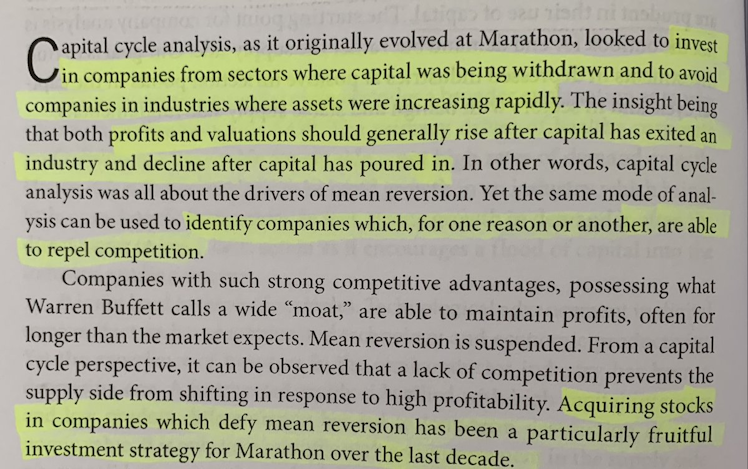

The theory of the Capital Cycle states that returns mean revert once capital and competition flood into an industry.

However, some elite companies are able to repel competition for very long periods, delaying mean reversion longer than the market expects

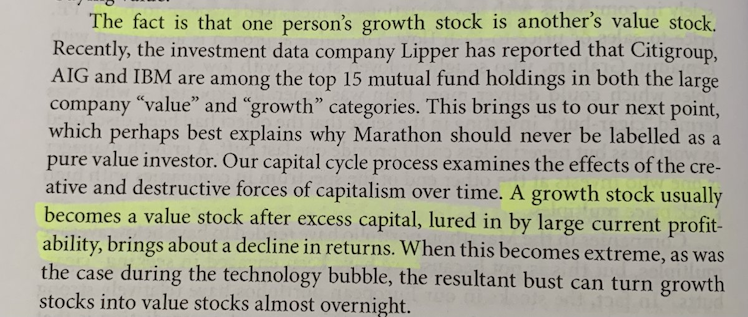

Growth eventually becomes value after an industry is flooded with capital

"One person's growth stock is another's value stock."

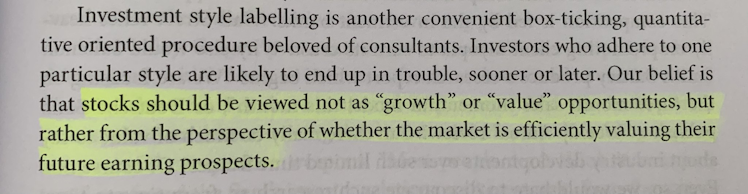

This is a known fact, but stocks should not be grouped as growth or value. If the market is inefficient valuing their future growth prospects, there's always value, irrespective of growth.

Long term investors have less competition than short term "investors" because they tend to ask the right questions and focus on what's important. There's a lot of data out there, but not all is really relevant for the LT

Asking the right questions helps tune out the noise.

Short term data points have fierce competition, as Wall Street relies on short termism to make money

Industries where there is an agent between the seller and the end customer can be profitable for investors, as the seller can bribe the agent to exploit consumer ignorance

"Customers will often pay more when agents are involved."

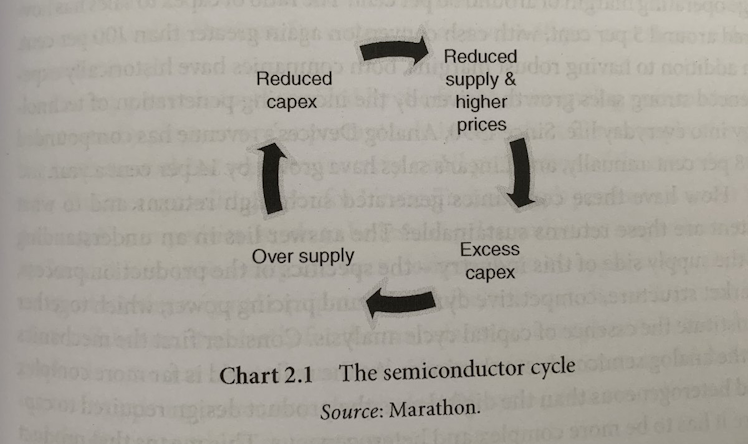

Historically, semiconductors have been very exposed to capital cycles.

I highly doubt it will be different this time, but I wrote an article not long ago talking about why $ASML might be protected. You can find it here.

Despite semiconductor cycles, the analog industry has managed to provide less-volatile returns, aided by low capital intensity. $TXN $ADI

One of the reasons for outperformance is the strong moat enjoyed by analog companies.

First, the talent pool is constrained and rather static, making it difficult for a new entrant to compete in R&D

The analog industry is diversified across end markets and products typically make up a small portion of the customer's budget.

This last part, joint with the high barriers of entry, gives the companies pricing power as competition is based on quality, not price

When prices make a small part of a customer's total costs, there's pricing power. The product should also be mission critical and switching costs must be high

"Intrinsic pricing power is created when price is not the most important factor in a customer's purchase decision."

A technological moat can appear to be stronger than it really is, so it must be combined with other competitive advantages.

Take for example $ASML, the moat is not only tech but also the complexity of the supply chain and its exclusivity agreements with critical suppliers

Despite mean reversion risk, higher rates of return are typically safer than lower rates

ST investors should not worry too much about high returns, as other things (macro, news...) will move the stock over their holding period.

LT investors should care quite a bit, though. Over the LT, macro and news matter less for high quality companies and returns take over

The problem in focusing on P/E ratios is that all earnings are seen as equal, when in reality earnings are worth more when ROIC and FCF conversion are higher

Pick one:

- P/E = 15, FCF conversion = 90%, ROIC = 25%

- P/E = 15, FCF conversion = 60%, ROIC = 15%

Indispensable products in unglamorous activities might be a good fishing pond for two reasons:

- Customers don't typically focus on price

- Unglamorous means that capital is more likely to be absent, reducing competition

Some examples of industries with the above characteristics

- Analog semis

- Payroll processing companies

- CAD / CAM

- Flavor and fragrance companies

- Specialty chemical

- Laboratory supplies

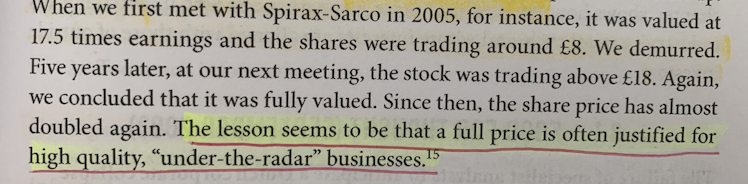

Leaders in the above industries tend to appear to be "fully-priced", but this is rarely the case as the market tends to estimate a faster mean reversion.

Hope you enjoyed the post!

Seeking Alpha

ASML: Don't Worry About A Bust

Many investors are worried about an imminent semiconductor bust and how this might affect companies in the industry. See why ASML is one of these companies.

Already have an account?