Trending Assets

Top investors this month

Trending Assets

Top investors this month

Lessons for investors ft. Capital Returns

Recently finished reading Capital Returns and I wanted to bring here some important lessons for investors. Be aware that thoughts are scattered in no particular order.

The psychology of management teams is typically not that different to that of investors.

They may be good operators, but this doesn't mean they are good investors/capital allocators:

Recency bias is common across analysts and investors:

"Both analysts and investors are given to extrapolating current rends. In a cyclical world, they think linearly."

It's common for investors to anchor their future expectations to recent performance.

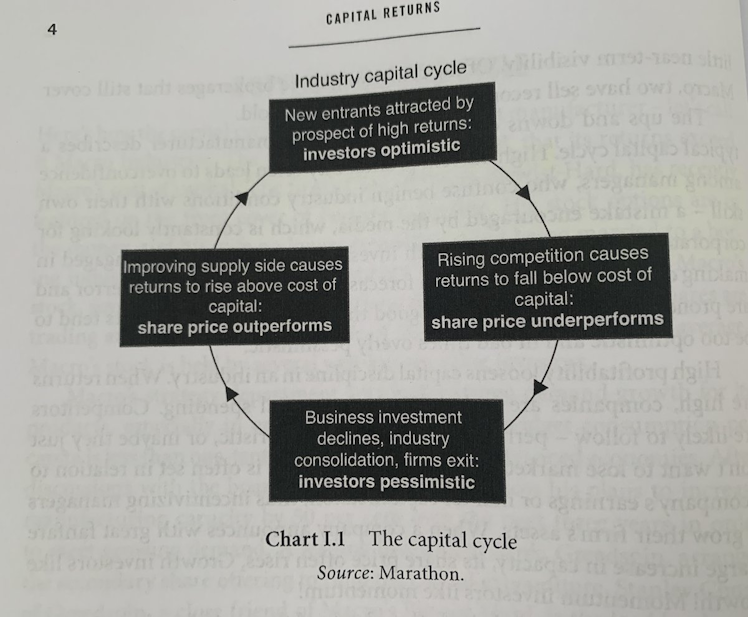

Almost any industry's capital cycle works as follows.

High returns attract new capital and this new capital brings more competition, eroding returns. The cycle repeats over and over.

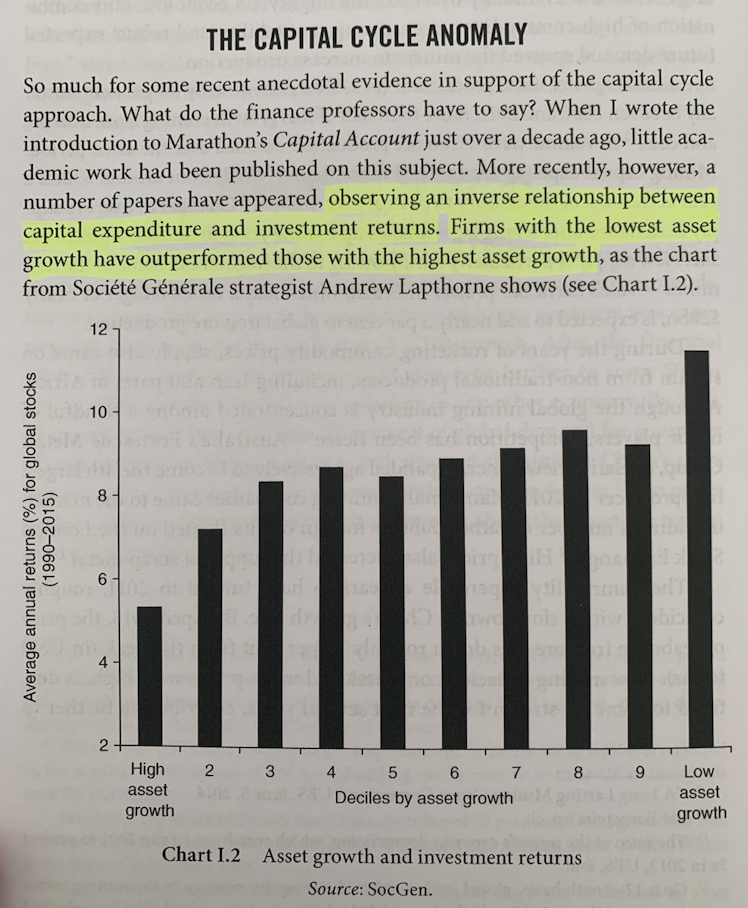

The "asset-growth anomaly" states that those companies which have invested less have produced higher returns.

The rationale is that most companies typically increase investments when the stock is doing well, so they later underperform (ie., management is pro-cyclical)

Asset expansion during good times typically comes from managers with lower ownership stakes, as their incentives are typically tied to company size.

However, managers with large ownership stakes typically take the opposite route:

Many professional investors avoid being contra-cyclical because this might deviate their short term performance from that of indexes, which is not ideal to increase AUM. Individual investors are free from this "risk":

Mostly every company is subject to the capital cycle and diminishing returns due to competition, but some companies manage to avoid it.

These typically offer good investment opportunity because the market typically undervalues the time that returns can stay above the mean:

Demand is much more difficult to forecast than supply, but stocks typically fail to estimate supply shocks:

The primary driver of profitability is a favorable supply side, not high rates of demand growth. High demand with no cap on supply leads to diminishing returns.

Barriers of entry become important to understand supply dynamics going forward:

Due to the capital cycle's impact on any business and the fact that capital employed drives a large portion of any business' performance over the LT, selecting the right management team should be given the importance it deserves:

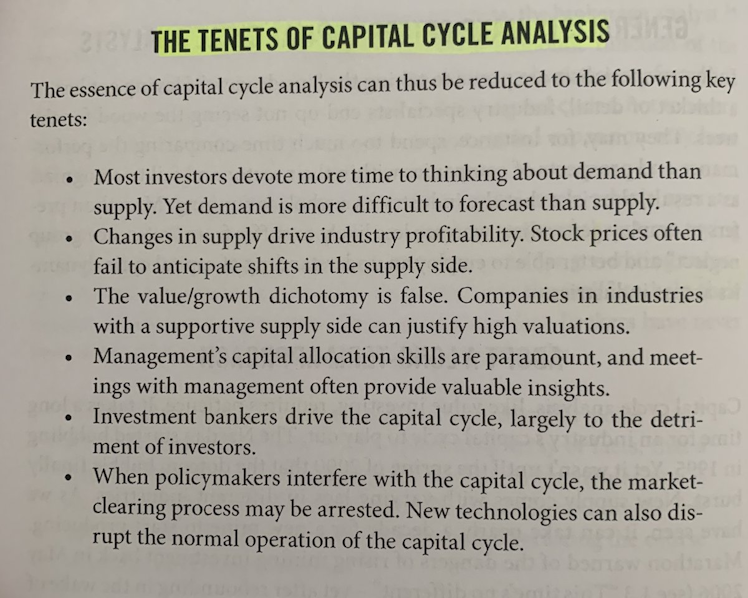

Below you can find a summary of the tenets of capital cycle analysis:

Sustainability should be a focus point for any long term investor. Only if a company survives all the economic cycles, will an investor be capable of reaping the returns it has to offer:

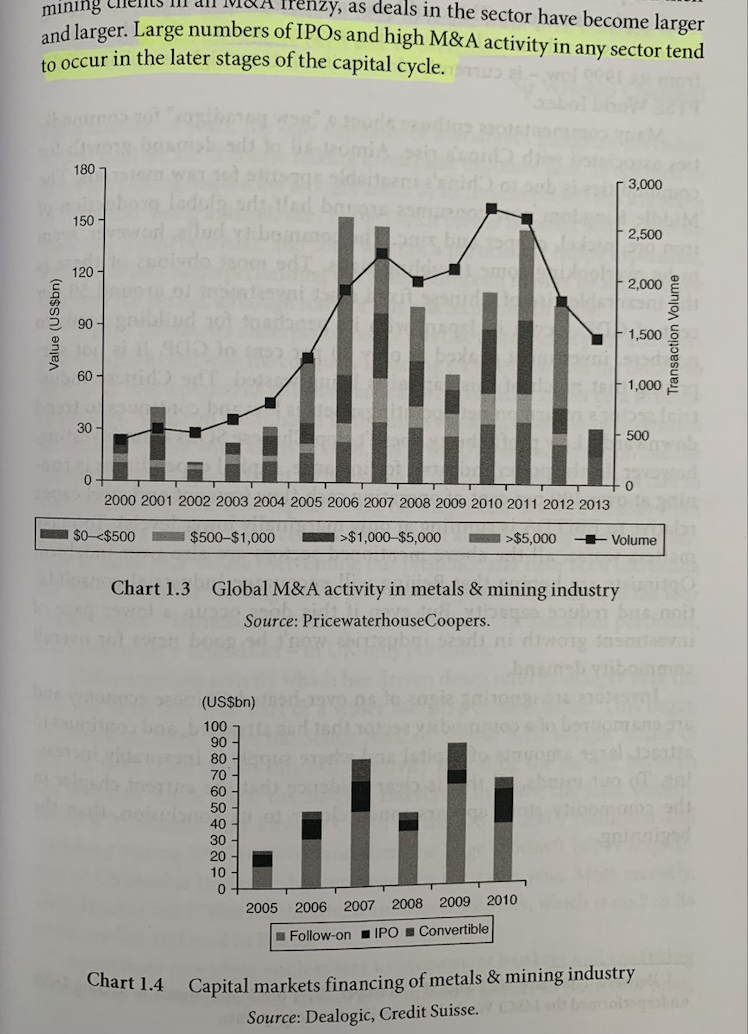

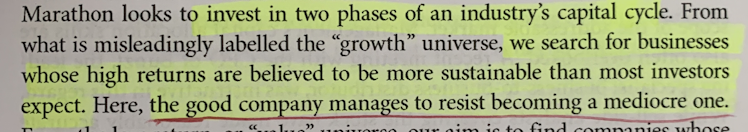

Due to the general pro-cyclicality of management, large numbers of IPOs and high M&A activity typically come in the later stages of the capital cycle.

(It makes perfect sense in the case of IPOs)

Charts below belong to commodities, but applies to any industry

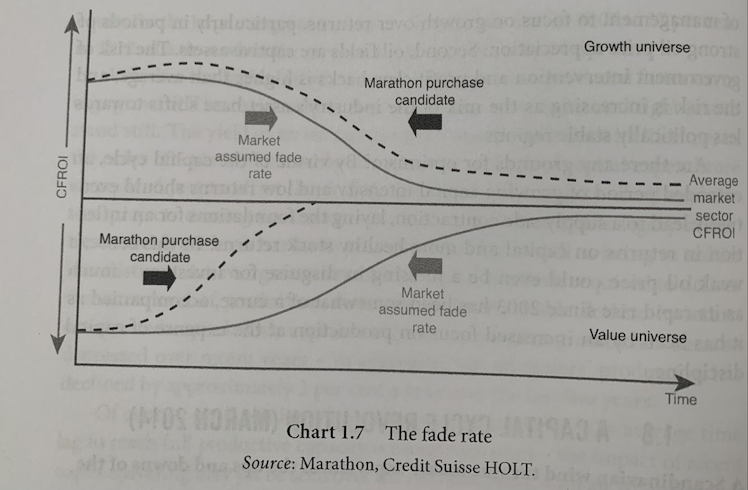

When investing in "growth companies" (ie., those with higher valuations) an investor must study if its high returns are more sustainable than the market expects.

Everyone might perceive a great company to be great, but the key is for how long it will stay great:

The stock market often fails at analyzing superior fade characteristics.

High quality companies almost always appear overvalued in a two step DCF because the growth rate decreases abruptly after year x. These companies tend to prove that their DCFs are overly pessimistic

Many investors typically overlook two other things:

a. Management's capital allocation skills

b. Boring companies

There's a lot more to capital returns, so if you want me to bring another post with more findings, be sure to like this one and leave a comment with your thoughts!

Already have an account?