Trending Assets

Top investors this month

Trending Assets

Top investors this month

The longest streak in history! What's really happening with Tesla? Can the stock continue its upward trend?

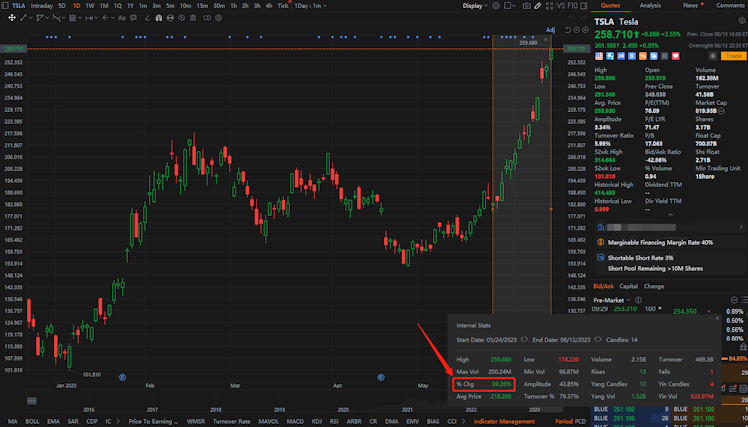

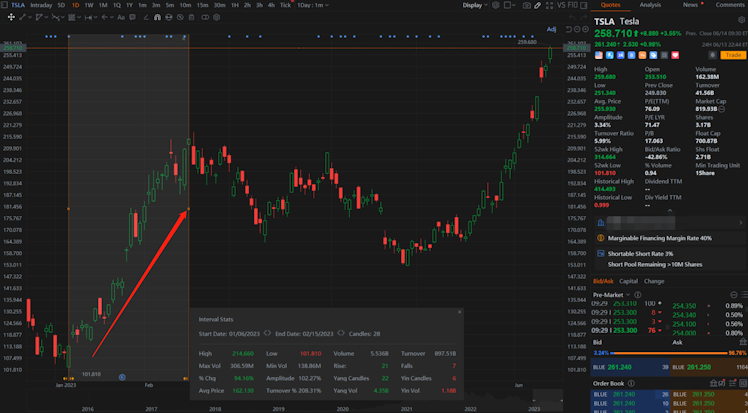

Since May 25, Tesla shares have risen for 13 consecutive days, climbing 38% from $186 to $258. Its market capitalization has once again surpassed $800 billion, a gain of more than 100% this year. From a low of $101 at the beginning of the year, it has grown more than 126 percent so far.

At the beginning of the year, Tesla faced a decline in competitiveness due to a decline in demand for electric vehicles and the lack of new models being introduced. Inventory even reached the highest level since the epidemic. However, through two rounds of global price cuts, Tesla effectively solved the inventory problem and the stock price rebounded from the bottom.

On Jan. 7 of this year, Bill Miller, a well-known U.S. investor, said he had been shorting Tesla recently because of increased competition in the electric car industry. However, after Bill Miller increased his short position in Tesla, Tesla's global price reduction strategy quickly solved the inventory problem and brought the delivery cycle back to normal, and Tesla's share price rebounded.

After Tesla's 11 consecutive days of gains, a journalist retweeted Bill Miller's bearish view of Tesla in January, saying it was up more than 140% since that interview. In response, Tesla CEO Musk commented below with a laughing and crying emoji as the old horse once again mocked the short-seller.

Back in January, the market all felt that Tesla was about to fall below the $100 mark and that was the end of Tesla's high valuation story. However, it turns out that Musk has once again smacked the shorts in the face.

In the past six months, here are the things that have brought Tesla back to kingdom come.

First, Musk decided to drastically reduce the price. On the day he announced a 10% reduction in the global average selling price, Tesla's share price had fallen below the $100 mark, the lowest point of the round of Tesla's decline. The market was deeply skeptical about the effectiveness of this strategy and even worried about its impact on gross margins.

However, it turns out that Tesla has successfully withstood the test of the market, and both sales and share price have successfully bottomed out.

Especially in this year's U.S. IRA electric vehicle subsidy policy, Tesla can also enjoy a $7,500 tax credit after the price cut, which makes Tesla in the already low competitive pressure of the North American market, but also the existence of no rival.

In the Chinese market, Tesla has entered the price range of brands such as Xiaopeng and Askworld after the price cut, forcing these brands to follow the price cut as well. But the price cut did not bring them sales rise, but led to a decline in revenue and gross profit.

The rise in sales to clear inventory is just the first reason for the stock price rebound, but it can't be separated from the fact that Tesla has been on the right path to get things right.

Under the continuous iteration of AI this year, the market is increasingly convinced of the development of AI technology. Tesla's number one fan, Sister Woody, believes that the biggest opportunity for AI lies in software, and Tesla is the most important AI concept stock. Once again, Sister Woody is wildly predicting that FSD will drive Tesla's stock price to $2000 in 2027, which is equal to about $7 trillion.

After the recent Tesla surge, Musk's statements are active again. A Twitter user asked Musk if Tesla would one day surpass the combined market capitalization of Apple and Saudi Aramco. And Musk said that there is still a lot of work to do in between, but it is possible. Currently, the combined market capitalization of Apple and Saudi Aramco is nearly $6 trillion.

Of course, Musk has more than enough of these words. But it is undeniable that the current market is increasingly looking forward to Tesla's FSD story, because we all know that the software side of the profits are much higher than the profits of individual car sales.

At the beginning of the year, Tesla was criticized by the market for the lack of new model launches and the decline in competitiveness. However, since the price reduction strategy succeeded in stimulating market demand, Tesla is also actively addressing the issue of new models.

Tesla plans to put into production a major revision of the Model 3 within this year. and for now, the Model 3 will no longer use Ningde Times batteries in North America in order to comply with the U.S. government's IRA tax credit, plus the subsidies already in place in most parts of the U.S. The price is even lower.

For example, after enjoying all the subsidies in California, the price of Model 3 can be reduced to $25,000, about 180,000 RMB, which is a thousand dollars cheaper compared to buying a Camry in California, which is a very big impact on traditional fuel cars.

The revised Model 3 will be put into production in Shanghai factory and Texas factory in September this year, and it is expected that 23Q4 can start booking, and it is expected that 24Q1 can start delivery. The new model's manufacturing costs are nearly 50% lower than the current Model 3, which means there is more room for downward pricing adjustments.

According to Electrek, Tesla plans to produce 375,000 Cybertrucks per year, an amount that far exceeds Wall Street's expectations, with analysts previously expecting production of less than 100,000 in 2024 and about 240,000 by 2027.

Musk also said recently that he thinks the Cybertruck could produce between about 250,000 and 500,000 units a year. Tesla said it expects to be able to make deliveries of the CyberTruck by the end of the third quarter of this year.

On June 9, the White House said electric vehicle charging stations that offer Tesla charging interfaces are eligible to share in billions of dollars in U.S. federal subsidies as long as they also support CCS interfaces. The White House's goal is to drive the deployment of hundreds of thousands of charging stations, and sees this as an integral part of the push for electric vehicle adoption.

Ford and General Motors have each announced that they will adopt Tesla's charging standard, the North American Charging Standard NACS, which means that the U.S. government hopes to subsidize the switch to Tesla's NACS charging interface for car companies that use CCS charging interfaces, since the entire North American CCS charging piles combined do not use as many NACS piles as Tesla alone, which accounts for 60 percent of North American fast charging piles. 60%.

Tesla will be able to generate additional revenue from Ford and GM EV owners, and the charging network will be more fully utilized.

Conclusion

Over the past six months, Tesla has done four things to boost its stock price.

A big global price cut has spurred market demand, a steady increase in capacity and lower costs at the Texas plant, the upcoming launch of the new and revised Model 3, an expected increase in CyberTruck capacity, and the opening of charging pads to GM and Ford. With the combination of these factors, Tesla's stock price has more than doubled this year, leading the Nasdaq tech stocks.

It is interesting to note that North American sales remain strong under the rate hike cycle. How much will this contribute to Tesla if the end of the rate hike cycle is followed by lower-priced model launches and FSD advances?

Already have an account?