Trending Assets

Top investors this month

Trending Assets

Top investors this month

Visa ($V) - Q3 2023 Earnings

Visa is a company we naturally own as part of our SLT Core portfolio and has an average weight of 9% of the portfolio YTD. If you are interested in knowing more about the company you can find our full deep-dive here.

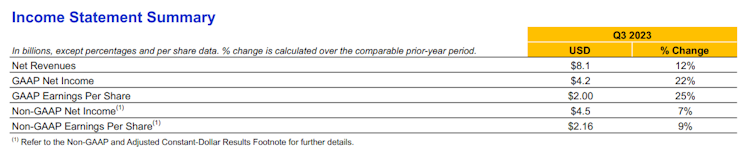

In the fiscal third quarter, the company reported GAAP net income of $4.2bn or $2.00 per share, showing a 22% and 25% increase over the previous year's results, respectively. However, these results included special items. Excluding these special items and related tax impacts, the non-GAAP net income for the quarter was $4.5bn or $2.16 per share, representing increases of 7% and 9% over the previous year's results.

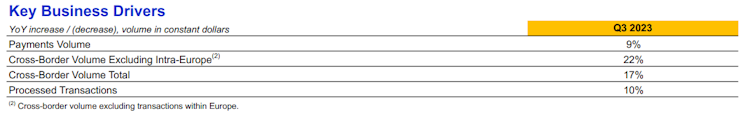

Net revenues (gross revenues minus client incentives) for the quarter were $8.1bn, a 12% increase, driven by growth in payments volume, cross-border volume, and processed transactions. Payments volume for the quarter increased by 10% compared to the previous year, and cross-border volume (excluding transactions within Europe) grew by 22%.

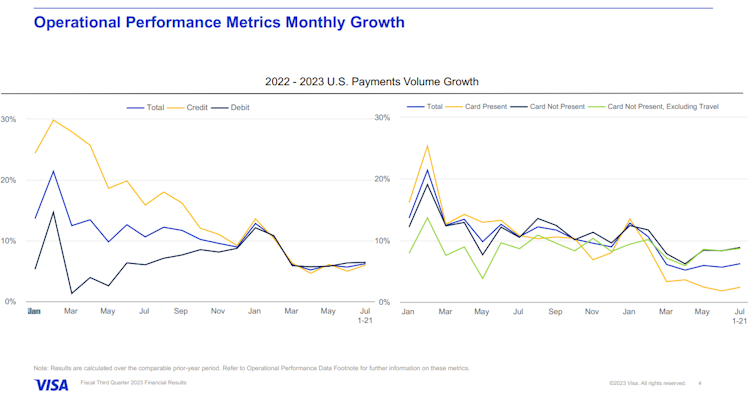

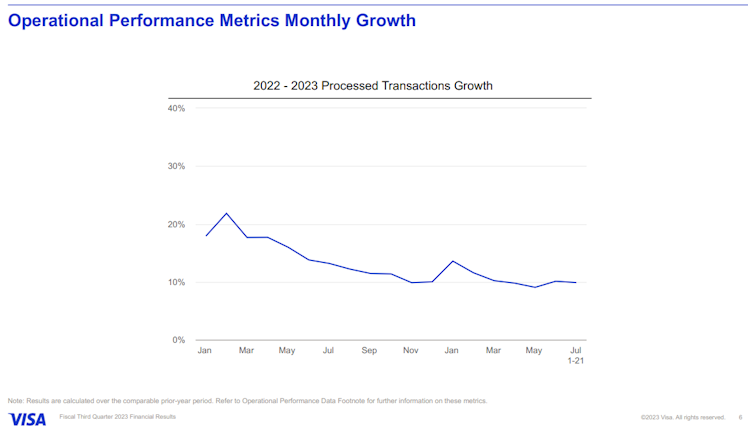

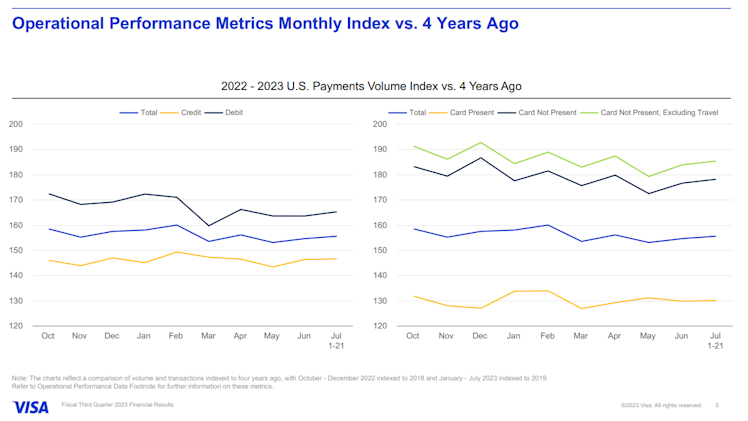

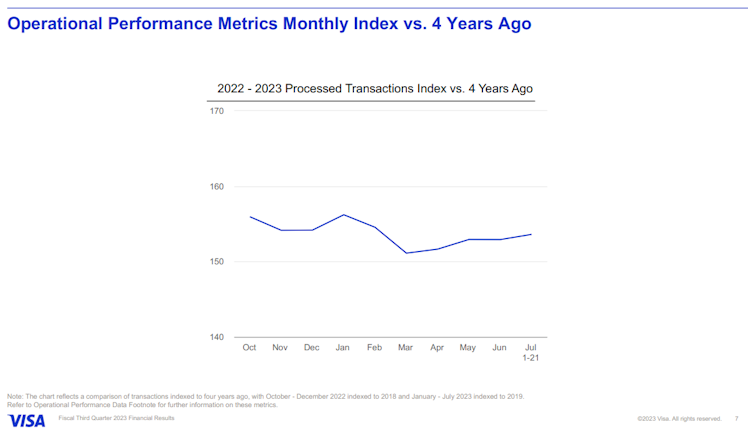

Key metrics such as payment volume and processed transactions continued to rise year over year at an interesting high single-digit / low double-digit rates. However when looking at month over month metrics since the beginning of the year, the operational performance metrics month growth seems to have significantly dropped and is did not go unnoticed by Wall Street.

Even if key metrics growth is obviously slowing since 2022, it is worth remembering that 2022 growth was mainly fueled by global reopening of businesses after Covid-19, naturally boosting key metrics growth for V.

On the other hand, if we put in perspective the growth rate and compare it with pre-pandemic levels as V did, we understand better why management keeps classifying the company's growth as stable and steady.

V's CFO commented "Transactions growth has remained steady at pre-COVID levels of 8%. Average ticket size is down 2%, largely due to declining fuel prices and the general moderation of inflation across multiple categories. Relative to 2019, U.S. payments volume was up 54%".

V has a total of 4.2bn cards out there, a 7% increase year over year and cross-border transactions grew more than 20% (cross-border travel-related spend, excluding intra-Europe, grew 34% year over year). V's CEO commented "On the cross-border front, the travel recovery trend has been steady and generally in line with our expectations so far for fiscal year '23. The cross-border travel index to 2019, excluding intra-Europe, has been improving at a rate of five to six points each quarter."

Fiscal third quarter service revenues were $3.7bn, a 15% increase over the prior year, and are recognized based on payments volume in the previous quarter. Data processing revenues rose 15% to $4.1bn, and international transaction revenues grew 14% to $2.9bn.

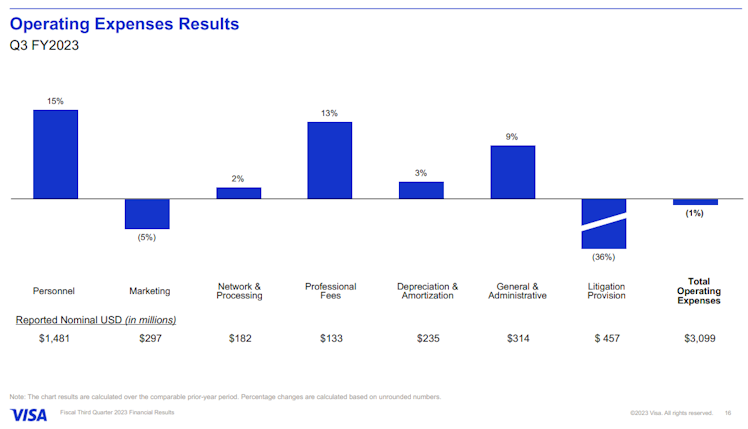

Margins are still high, with operating profit margin and net income margin both above 60 and 50% respectively. Operating expenses decreased by 1% mainly due to special items (litigation provision decrease).

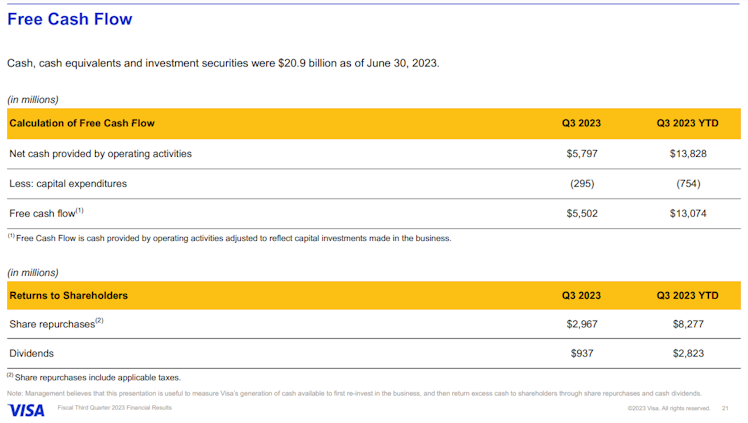

As of June 30, 2023, the company's cash, cash equivalents, and investment securities totaled $20.9 billion. The company is strengthening its balance sheet and became net cash this quarter.

One of our favorite traits about V is the company's ability to generate cash with high level of FCF generation. It is no different in 2023 with more than $13bn in net cash generated by operating activities and only $754mn in CapEx YTD.

When questioned about capital allocation, the company's CFO confirmed that V's capital allocation strategy remains focused on paying dividends, which is based on certain criteria and a percentage range of their EPS (historically 25%). They are currently paying almost $1bn per quarter in dividends.

Buybacks are typically funded from free cash flow, and historically, the company has not borrowed to fund buybacks. Their top priorities are investing in the core business and making sensible acquisitions. They have been actively engaged in both dividends and buybacks, with approximately $8.3bn spent on buybacks so far in the year. Moreover, they have the capacity to do more buybacks if necessary. The company is open to increasing buybacks if they believe the market is undervaluing the stock, and in such a scenario, they may consider borrowing money.

It is worth noting that Ryan McInerney's comments indicated that there is significant potential for growth and expansion in various verticals and value-added services. They emphasize that they are still in the early stages of penetrating these markets, and there is ample room for further development. The CEO mentioned the enormous Total Addressable Market (TAM) in their Acceptance Solutions business, issuing, and B2B sectors. He expressed excitement about the opportunities ahead and the positive feedback received from clients. Overall, they believe there is still a lot of room to grow and various verticals to penetrate in their business.

In conclusion, we are pleased with V's earnings performance and remain happy shareholders. The fiscal Q3 results show significant growth in net income and revenues, even after excluding special items. The company has a strong presence in various sectors, and there is still ample room for further expansion in their value-added services and other verticals. Their ability to generate substantial cash flow and maintain high margins is commendable. Moreover, the company's capital allocation strategy, with a focus on dividends and sensible buybacks, reflects their commitment to enhancing shareholder value. With V's promising growth opportunities and sound financial position, we are optimistic about the company's future prospects.

Already have an account?