Trending Assets

Top investors this month

Trending Assets

Top investors this month

SNOW Earnings Prediction > $156/sh: Horrible idea but I'm doing it anyways

I'm 95% this prediction will be wrong.. everything is down pre-market and every time any tech company reports, the stock automatically goes down...

SO I HAVE THEM RIGHT WHERE I WANT THEM.

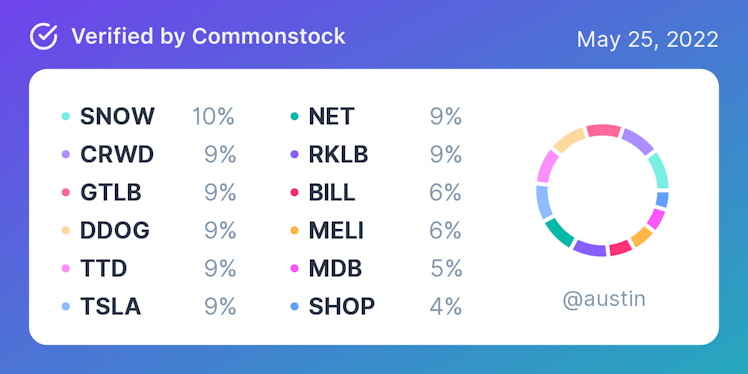

As you can see in my connected portfolio, $SNOW is my largest position. I'll actually be adding to it this morning before they announce earnings after the market closes today.

I fully intend to hold (and probably add to) my position for years so this poll is just for fun.... maybe it will teach a good lesson in how hard earnings reactions are to predict!

Here's why I think $SNOW is coiled and potentially ready for a strong bounce....over the next 8 years

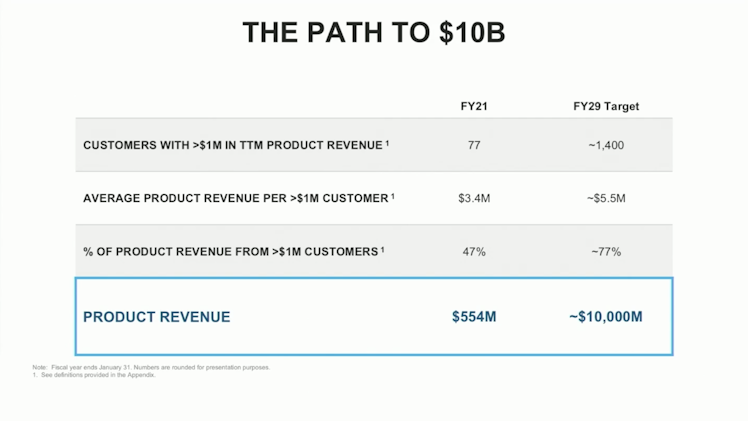

At their Investor Day in 2021, management established FY29 targets $10billion in product revenue and 1,400 customers spending over $1billion

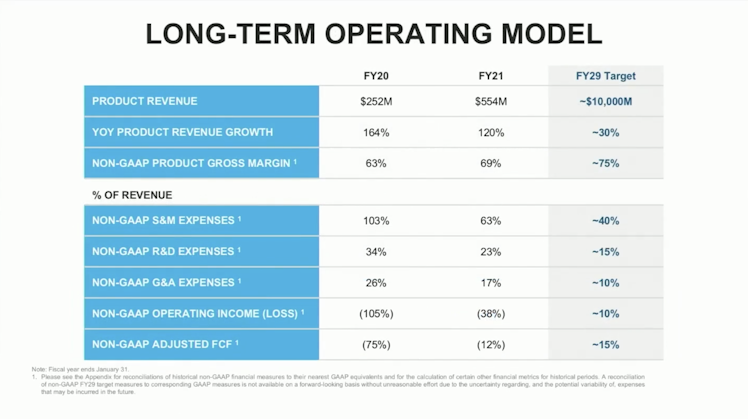

In FY29 management expects to be growing product revenue 30% YoY, with 75% gross margin, 10% operating income, and 15% non-GAAP free cash flow.

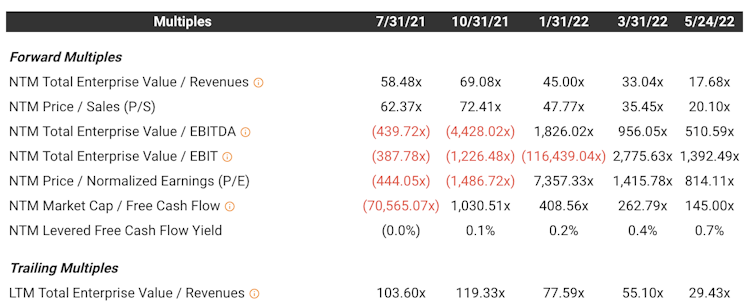

The stock has sold off a ton and next-twelve-months EV/R has come down from 58 in July to 18 now. A lot of people will say "you idiots are never going to make any money investing in unprofitable companies at 18x revenue"

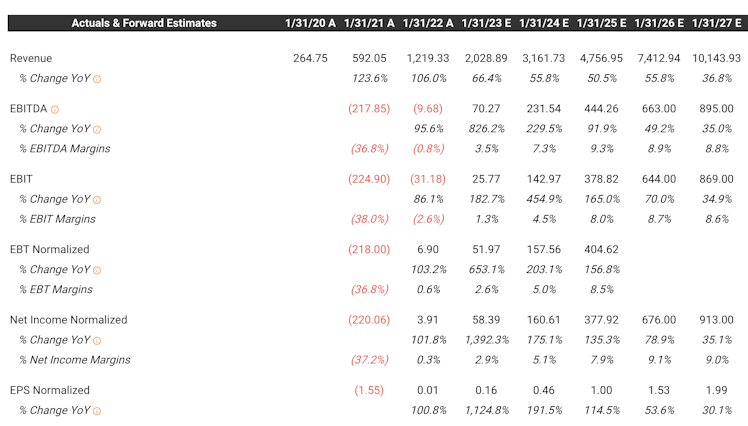

But in FY27, analysts expect $10.14B in revenue, with $913.0 million in net income, and EPS of $1.99

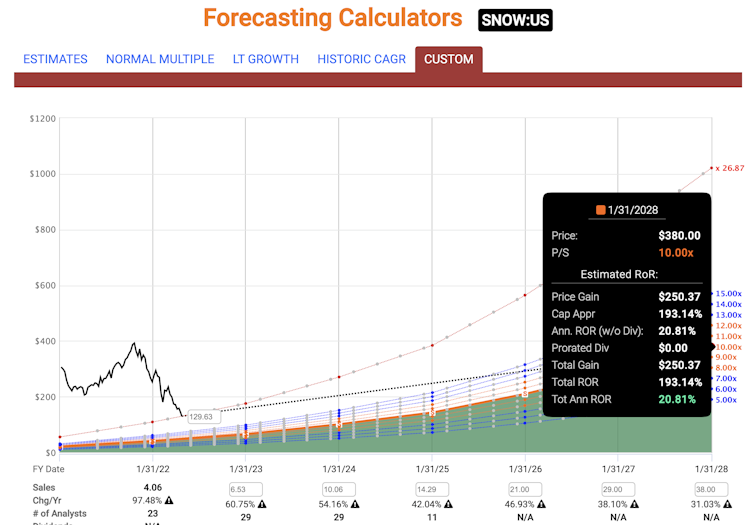

Here's a graph showing what the return could be through FY 28 if Snowflake hits analyst expectations for revenue (I think these estimates could prove to be very conservative) and has a blended P/S ratio of 10.0 down from 27 today...

Shares would be $380.0 which is a 193% total return an a 21% annualized return.

The question then becomes will they execute? There's obviously no way to predict what happens through FY28, but we do know Fran Slootman and his executive team are proven exceptional operators.

They were excellent at Servicenow $NOW and already have $SNOW tracking above their ambitious 2021 Investor Day targets.

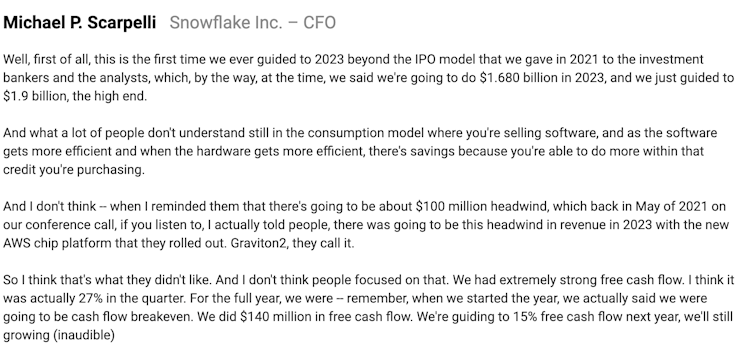

Here's a quote from CFO Mike Scarpelli at the JMP Securities Tech Conference on March 7, 2022 that shows how they're already exceeding expectations.

At the 2021 investor day they were targeting $1.68 billion in revenue in 2023. After last quarter they have adjusted that to $1.9 billion, 13% higher than their initial target. They also ended FY21 with a Q4 Adjusted free cash flow margin of 27% and full-year Adj. FCF margin of 12%... well ahead of their previous target which was break-even.

So the company is out performing management and analyst expectations. We've seen strength from the public cloud providers and $SNOW's multiple has come down drastically.

For my personal portfolio, all of this equates to my highest-conviction position with a 3+ year holding period. I will monitor execution along the way, but I think we COULD see a nice jump after earnings with the strong caveat that the entire market is currently in meltdown mode so who knows.

Already have an account?