Trending Assets

Top investors this month

Trending Assets

Top investors this month

Oracle hit a record high, and Q4 financial report expressed AI opportunities

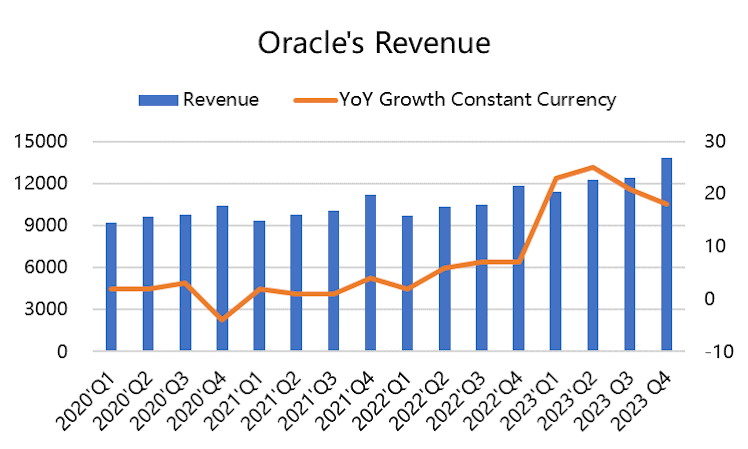

$ORCL The stock price hit a record high after the Q4 financial report after June 12th. Obviously, the recent AI concept has made the company a hot target. The outstanding performance of cloud business has helped the company's revenue and profit both exceed expectations. The development of AI also relies on software services, so it will continue to bring growth to the company, and investors also have great expectations.

In the past 20 days, the company's share price has risen by more than 30%, but on June 12th, it performed very well (+6.0%), and remained optimistic (+3.9%) after the after-hours financial report was released, but there was no double-digit increase.

Q4 Performance Preview

Revenue was 13.84 billion US dollars, an increase of 18% year-on-year at a fixed exchange rate, higher than the market expectation of 13.72 billion US dollars;

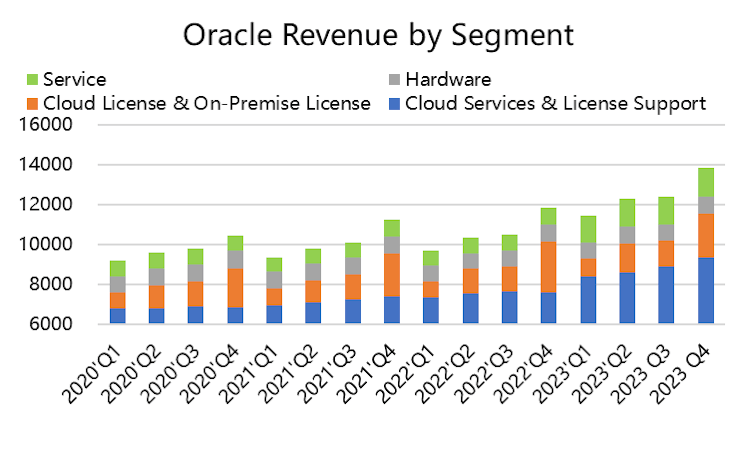

Among them, the revenue from cloud services and licensing support reached 9.37 billion US dollars, a year-on-year increase of 25%, higher than the market expectation of 9.11 billion US dollars; The cloud business revenue of IaaS and PaaS was 4.39 billion US dollars, an increase of 55% at a fixed exchange rate, higher than the market expectation of 4.04 billion US dollars; The revenue of strategic back-office SaaS applications increased by 4%, of which Fusion ERP increased by 17% and NetSuite ERP increased by%; Hardware services reached US $850 million, up 1% year-on-year, which was equal to the market value of US $840 million. Software was US $1.46 billion, higher than the market expectation of US $1.45 billion, with a year-on-year increase of 78%.

Gross profit was 10.11 billion US dollars, lower than the market expectation of 10.39 billion US dollars;

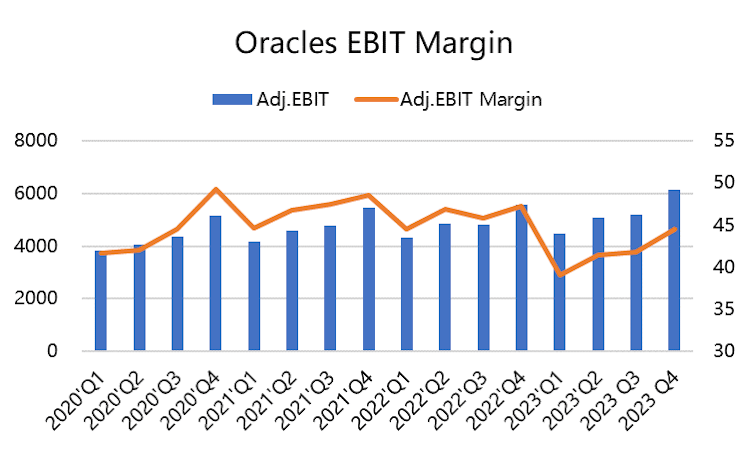

Comparable earnings before interest and tax (EBIT) was US $6.16 billion, higher than the market expectation of US $6.12 billion, and EBIT profit rate was 44.49%.

The adjusted EPS was $1.68, which was higher than the market expectation of $1.53.

The company's free cash flow was $3.73 billion, higher than the market expectation of $2.46 billion.

Investment highlights

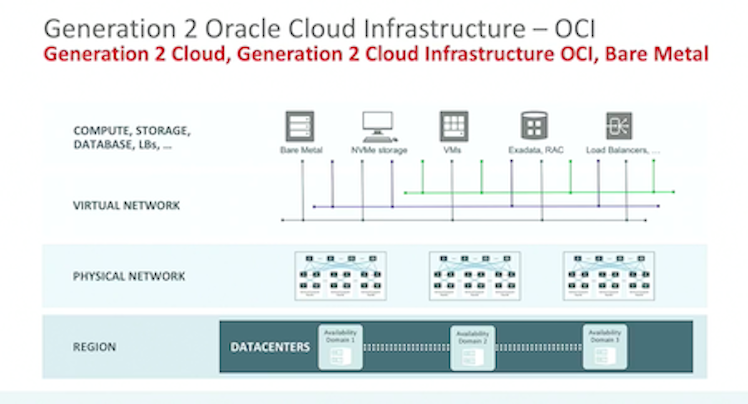

AI gives cloud business considerable opportunities.The company's two strategic cloud businesses are growing, and the cloud application and infrastructure businesses are very obvious. The company also said that Oracle's Gen2 Cloud has the highest performance and lowest cost GPU cluster technology in the world, and Nvidia is also using this cluster. The company is cooperating with Nvidia to build the world's largest high-performance computer.

Oracle Cloud Infrastructure

With the growth of cloud business revenue, the company's profit margin is expected to keep improving.At the same time, the company has been expanding its data center capabilities, and as these new cloud areas continue to fill, the profit margin has also improved. On the other hand, with the continuous integration of the acquired healthcare IT giant Cerner, the company's operating profit has increased to 44%, and will continue to strive to improve Cerner's profitability to Oracle standards and continue to obtain economies of scale from cloud computing.

Cash flow growth is optimistic, but we should also pay attention to the impact of repaying huge net debts (acquisitions) in a high interest rate environment.

Valuation

The company's current 12-month dynamic P/E is 36 times, which is naturally not high compared with SaaS companies, compared with $MSFT $35 times equal.

At the same time, due to the growth expectation, it is expected that the forward-looking P/E in fiscal year 2023 will be about 21 times, which is lower than the average of 31 times in the software industry. At present, the valuation level is relatively neutral.

Already have an account?