Trending Assets

Top investors this month

Trending Assets

Top investors this month

9th June 2022 - Trading Journal

Today's trading journal is brought to you by IBKR. I use them as my main brokerage for both investing and trading. As a European investor I have tried several different platforms and I can safely say they have the most comprehensive platform available to any EU based investor. In terms of platform power, safety and products (Stocks, Options, Futures etc.) You can check out the platform here.

Situational awareness:

Note: No trades were made yesterday 8th June 2022.

Still optimistic going into today. Market still in a tight formation with plenty of setups looking decent. CPI Numbers tomorrow will likely move the market one way or another.

Pre Market Work:

Reviewed some charts this morning. Nothing too taxing. Added $OLPX to my focus list with a nice setup on a recent IPO. In Stan Weinstein's book he describes recent IPO's being different in terms of analysis. Overhead resistance is not as important. I like the accumulation here as pointed out and the volume dry up the past few days.

I also had an interesting discussion with @europeandgi today about one of his holdings, $XOM. The stock has advanced quite a lot and we were discussing whether it would be a good idea to sell some calls against the position as a form of hedge. The stock is right at the cusp of All Time Highs. Despite being somewhat extended (Up almost 240% from Oct 2020) it is showing phenomenal RS (Relative Strength). I crudely drew what I would like to see it do to be very bullish. Essentially what I drew is a VCP Pattern (Volatility Contraction Pattern) coined Minervini but a pattern of supply vs demand that has been visible in stocks going back 100 years. It is quite noticeable in the highlighted area from 2021.

Long story short, to me, the stock is still very bullish technically and with some healthy consolidation could easily push much higher. Figuring out tops perfectly is impossible but one can use the weight of evidence to ride their winners as long as they can.

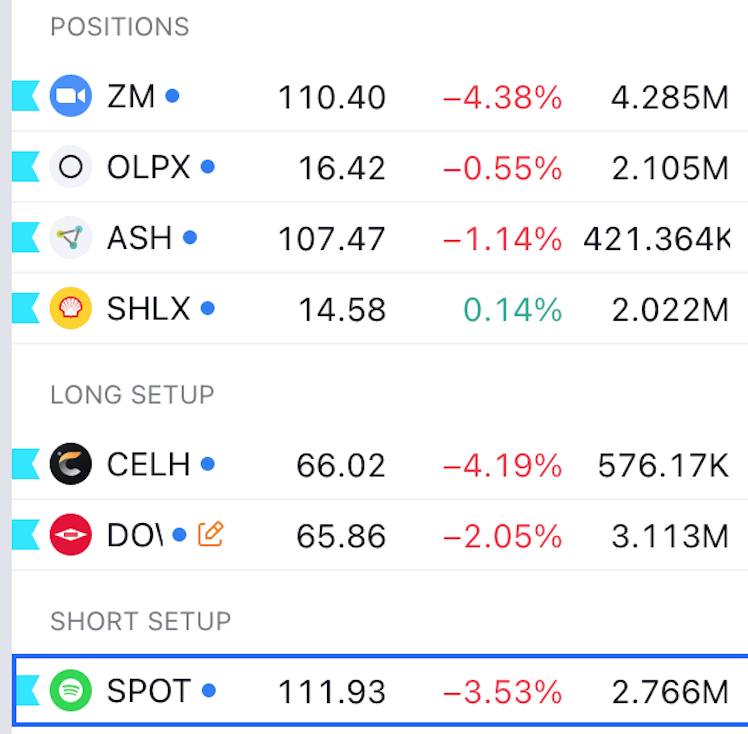

Lastly I identified $SPOT as a nice looking short setup if the market turns sour. I would consider getting short on a break below around $110. With a target of $90.

------------

Trading Day:

I bought $OLPX about an hour into the market today. After a soft open I saw it advancing. I have posted the Hourly chart below for some context on where I bought. Unfortunately we pulled back but it remained relatively strong until late in the day when everything really pulled back. My stop is at $13.80 so there is still plenty of space for it to gyrate.

End of day Thoughts:

The market dumped into the close. I have moved to caution. My positions held up relatively well but if the market is on not on my side then my positions will go nowhere. Tomorrow the CPI print will likely decide a direction. If we continue to dump tomorrow I will cut my positions and go back to cash.

I will be reviewing my trades somewhat. I think I might be jumping in that bit too early at the moment in terms of entry. Trying to gain that extra few cents when I should probably be waiting for more proof that the breakout isn't failing. I don't want to read too much into it considering conditions and only a few trades as sample size but it's something I am aware of.

Notes & Open Trades:

- $SHLX - 5% Stock Position - Entry $14.39 - Stop: $13.80

- $ASH - 5% Stock Position - Entry $111.20 - Stop: $104

- $OLPX - 5% Stock Position - Entry $16.80 - Stop $15.80

- $ZM - August 19th $150/$170 Bull Call Spread - Cost $1.49 per contract

Please note I operate my risk with options that I can lose 100% of the premium. This is the safest way to trade them in my opinion. Even if I cut at 50% once I am setup to lose 100% within my risk threshold then I will stay ahead of my required R:R.

www.interactivebrokers.ie

Home | Interactive Brokers Ireland

Leading online trading solutions for traders, investors and advisors, with direct global access to stocks, options, futures, currencies, bonds and funds. Transparent, low commissions and financing rates and support for best execution.

Already have an account?