Trending Assets

Top investors this month

Trending Assets

Top investors this month

April Roth IRA Portfolio Summary

Portfolio Value

March '23 Month End: $9,873.87

April '23 Month End: $10,499.16

Value Difference: +$625.29

Performance: +3.2% (excluding contributions)

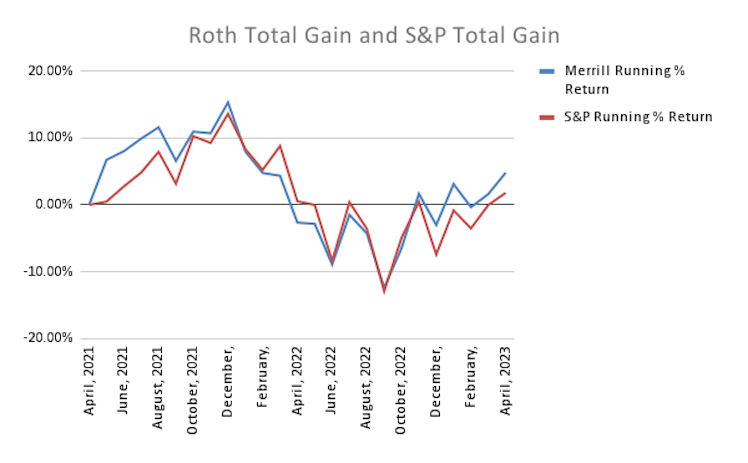

Portfolio vs S&P

March '23 S&P Month End: $4,109.31

March '23 S&P Month End: $4,167.87

S&P % Difference: +5.4%

% Difference Portfolio vs S&P: -2.2% (excluding contributions)

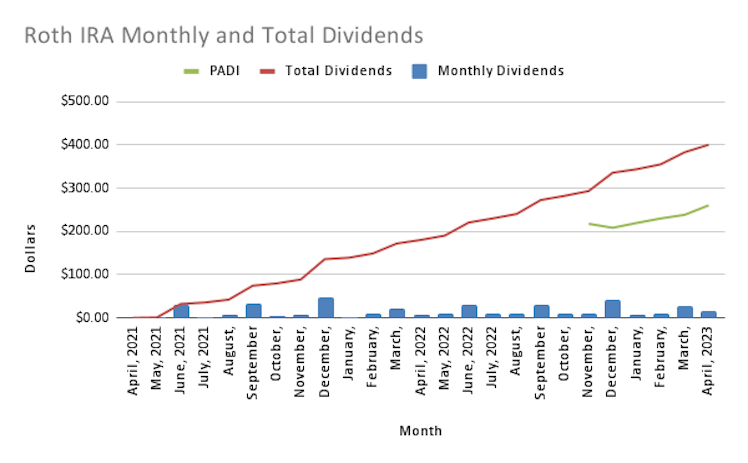

Dividends

April '23: $17.37

April '22: $8.29

% Difference: +110%

PADI: $238.59 to $260.49 (+9.2%)

Contributions

$310

Transactions

Buys

4/4

$KMB - 0.0705 share via dividend reinvestment

4/5

$KMB - 1 share at $134.16

4/10

$EMB - 0.0181 shares via dividend reinvestment

$HASI - 0.044 shares via dividend reinvestment

$LQD - 0.0124 shares via dividend reinvestment

$KMB - 2 shares at $135.59

4/17

$KMB - 1 share at $137.77

4/21

$OZK - 0.0369 shares via dividend reinvestment

Sells

4/3

$VTI - 1 share at $203.91

Summary & Commentary

I completed my quarterly rebalance which resulted in the sale of 1 share of $VTI. This should be my last sell for a while as I am now closer to my target weight in $VTI. My next potential positions to trim are $VNQ and $VIG, but I am hoping to balance those positions with additional contributions before my target holding period hits for these positions in January of 2024.

I have continued and increased my bi-weekly contributions with a recent raise at work. This has allowed me to continue to add to my highest rated positions, primarily $KMB. I am very close to my target weighting in $KMB. Moving forward, I will probably be alternating between buying $KMB and $HSY, depending on which holding is more underweight.

As my portfolio value increases, my bi-weekly contributions are becoming a smaller and smaller portion of my portfolio. This is resulting in a longer time to reach 2% cash position, which is my trigger point to make another buy. I am considering parking the cash in my portfolio in a money market fund. Fidelity does this automatically, not sure why Merrill Lynch doesn't do the same.

As always, would love to hear your feedback, questions, or input in the comments!

Already have an account?